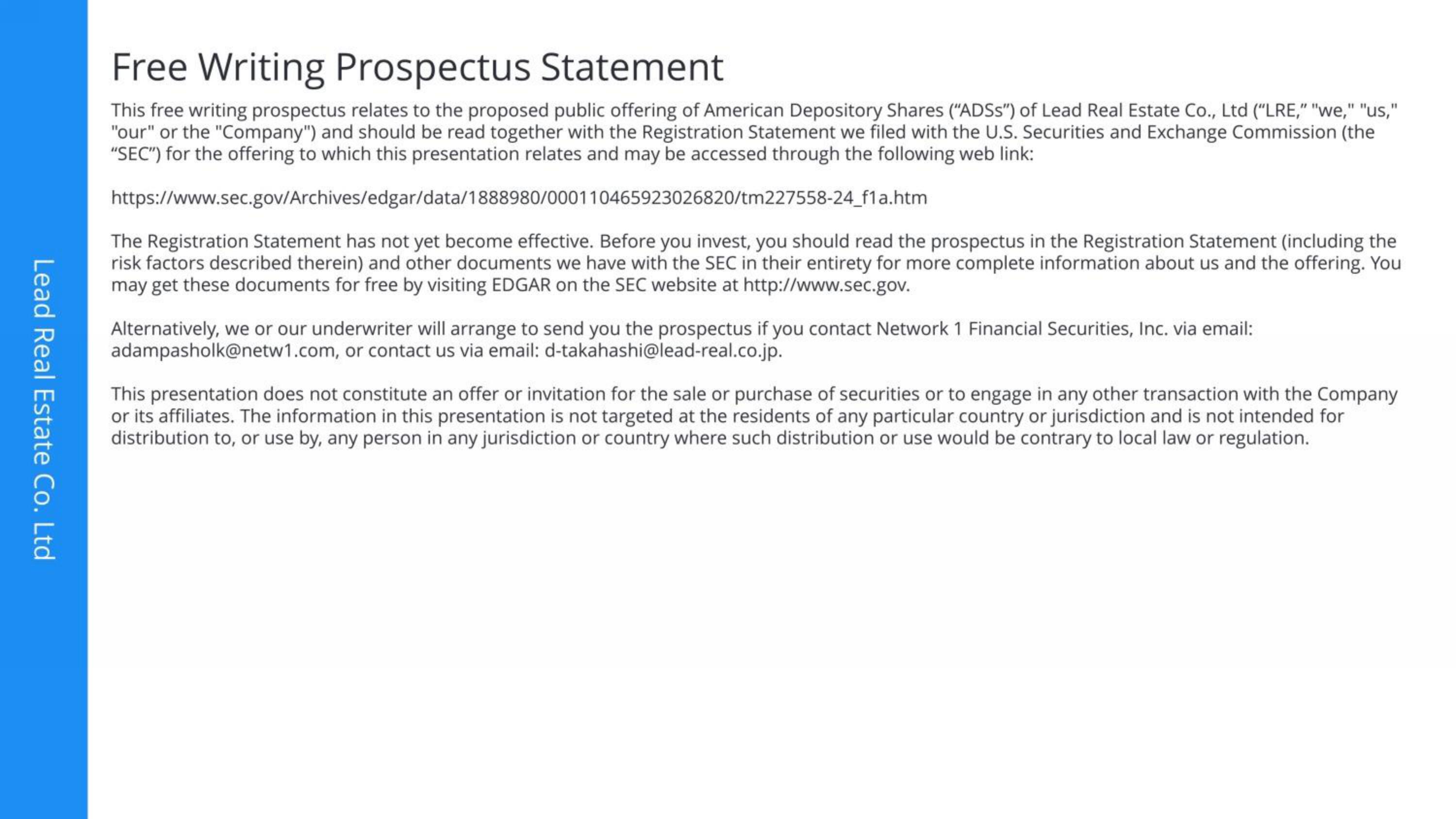

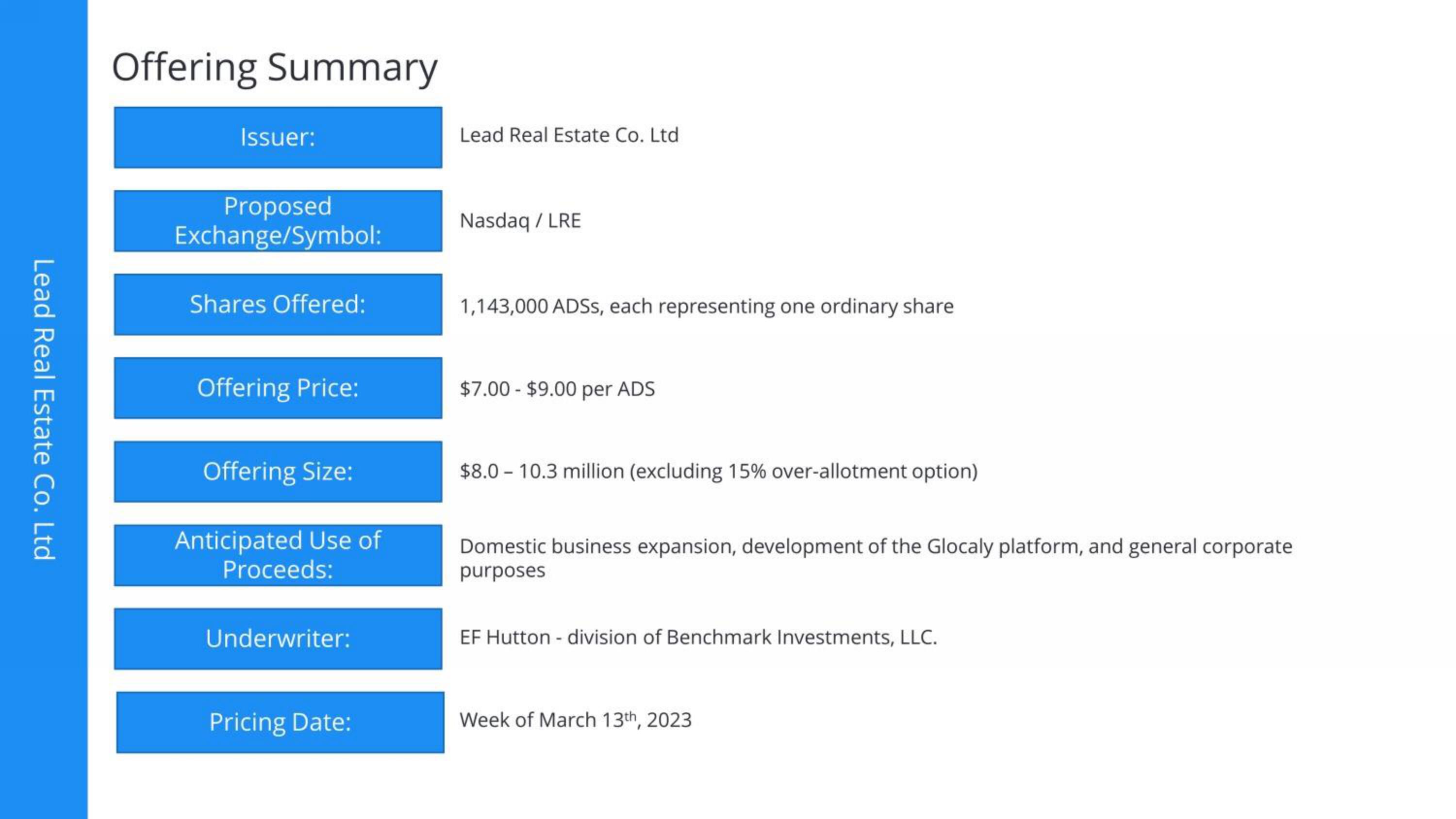

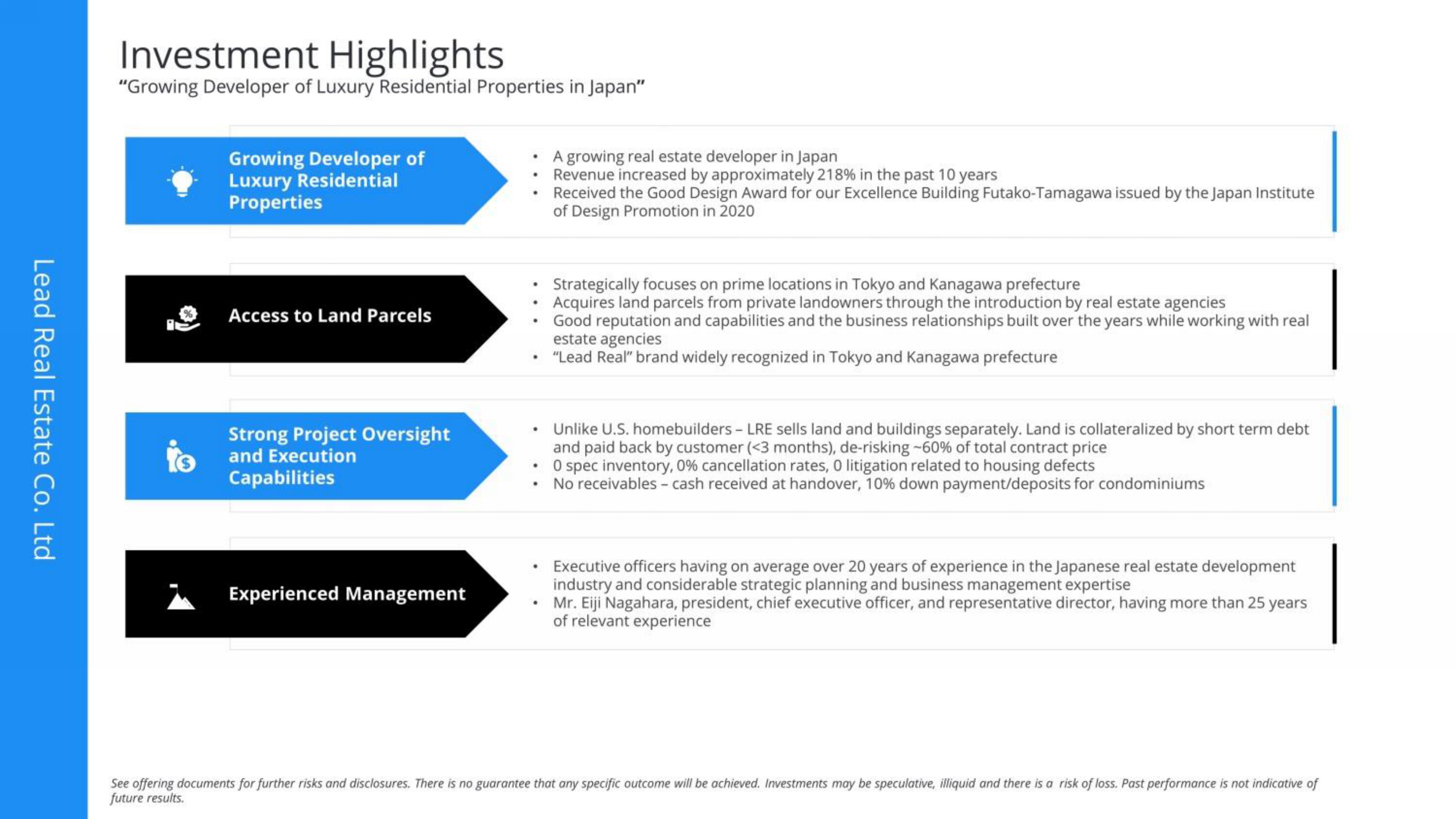

Lead Real Estate Co IPO Presentation Deck

Made public by

Lead Real Estate Co

sourced by PitchSend

Creator

lead-real-estate-co

Category

Real Estate

Published

March 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related