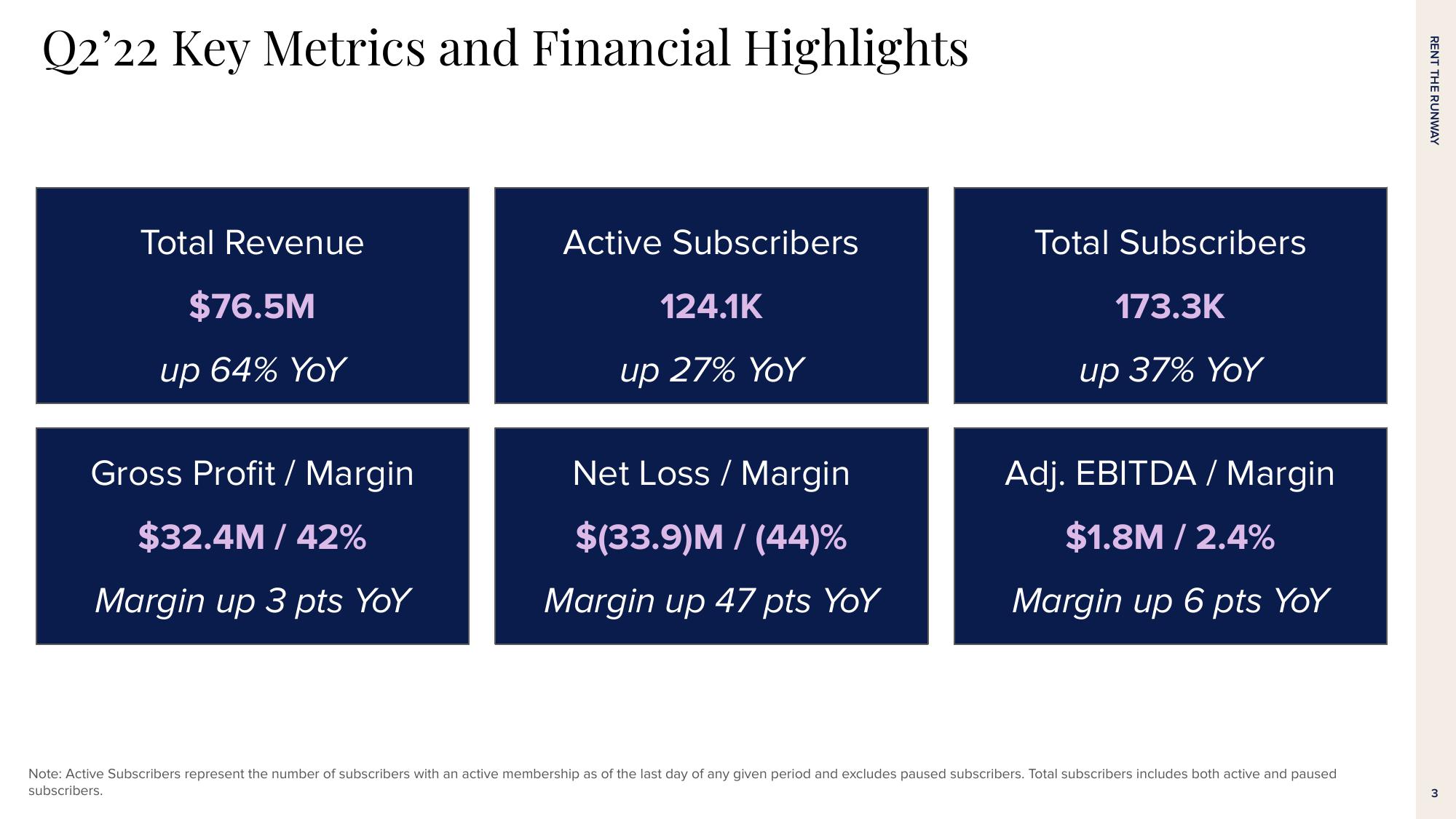

Rent The Runway Results Presentation Deck

Made public by

Rent The Runway

sourced by PitchSend

Creator

rent-the-runway

Category

Consumer

Published

September 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related