Silicon Valley Bank Results Presentation Deck

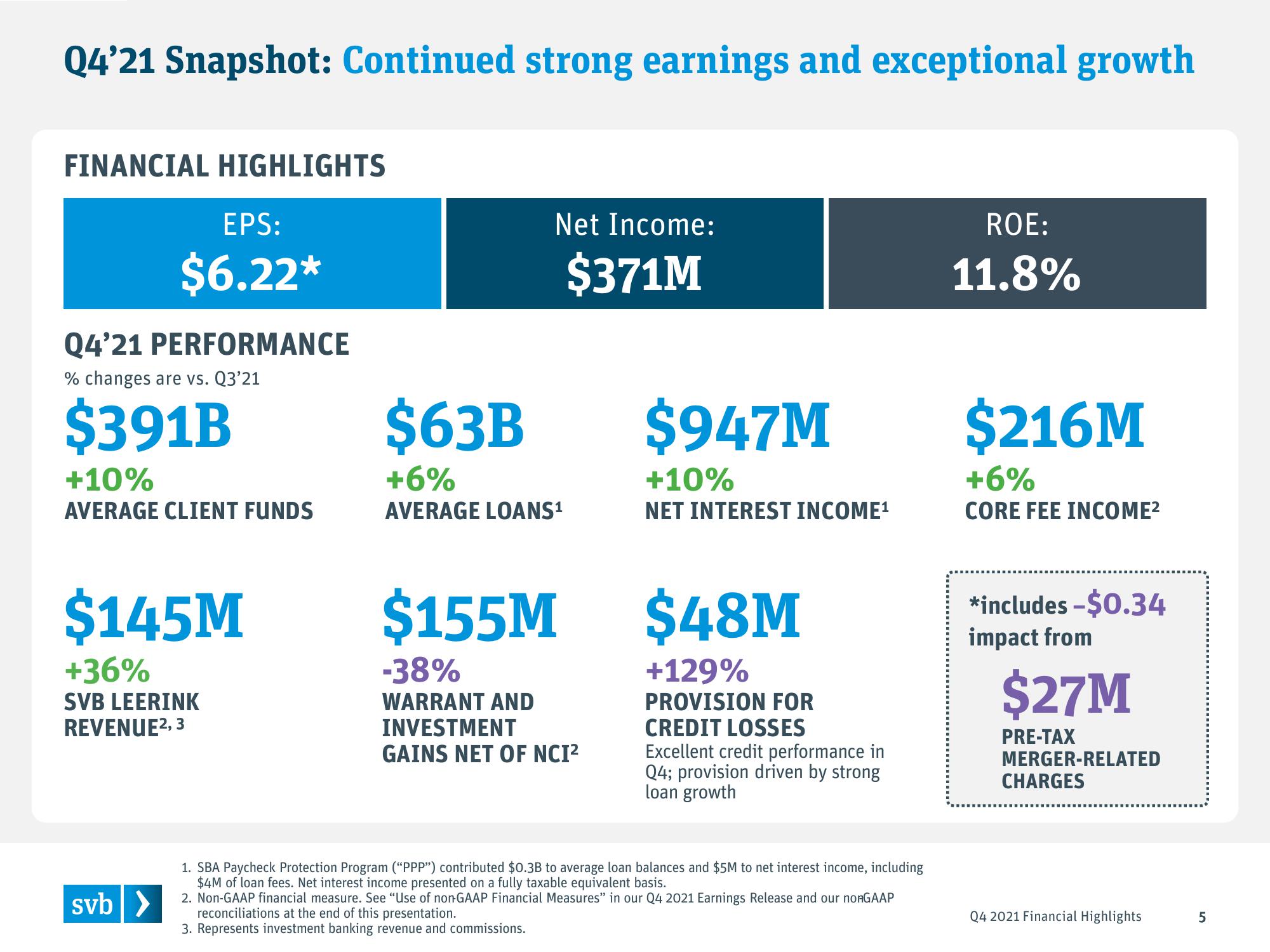

Q4'21 Snapshot: Continued strong earnings and exceptional growth

FINANCIAL HIGHLIGHTS

EPS:

$6.22*

Q4'21 PERFORMANCE

% changes are vs. Q3'21

$391B

+10%

AVERAGE CLIENT FUNDS

$145M

+36%

SVB LEERINK

REVENUE², 3

svb >

Net Income:

$371M

$63B

+6%

AVERAGE LOANS¹

$155M

-38%

WARRANT AND

INVESTMENT

GAINS NET OF NCI²

$947M

+10%

NET INTEREST INCOME¹

$48M

+129%

PROVISION FOR

CREDIT LOSSES

Excellent credit performance in

Q4; provision driven by strong

loan growth

1. SBA Paycheck Protection Program ("PPP") contributed $0.3B to average loan balances and $5M to net interest income, including

$4M of loan fees. Net interest income presented on a fully taxable equivalent basis.

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and our noRGAAP

reconciliations at the end of this presentation.

3. Represents investment banking revenue and commissions.

ROE:

11.8%

$216M

+6%

CORE FEE INCOME²

*includes -$0.34

impact from

$27M

PRE-TAX

MERGER-RELATED

CHARGES

Q4 2021 Financial Highlights

5View entire presentation