FL Entertaiment SPAC

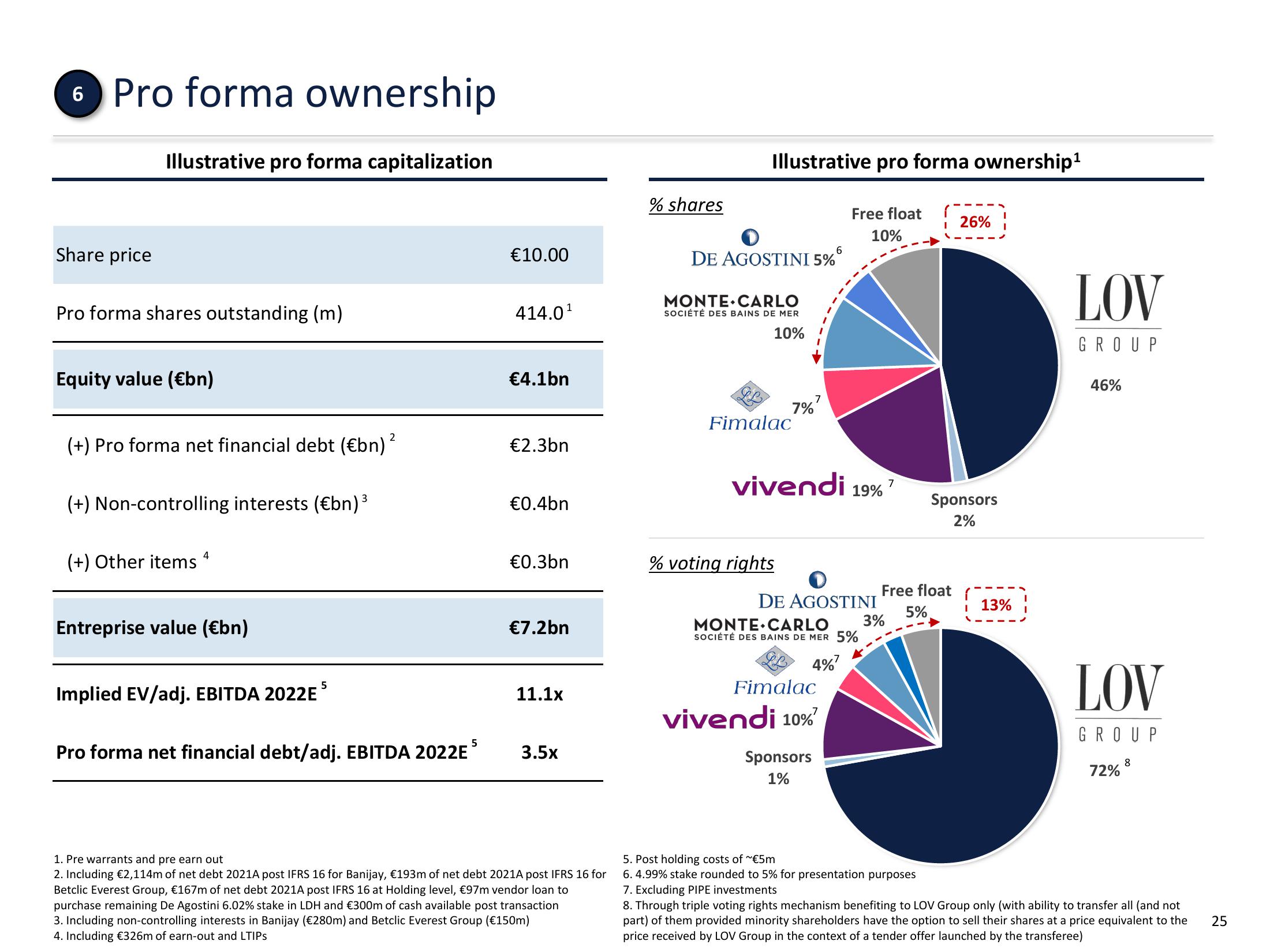

6 Pro forma ownership

Share price

Illustrative pro forma capitalization

Pro forma shares outstanding (m)

Equity value (€bn)

2

(+) Pro forma net financial debt (€bn) ²

3

(+) Non-controlling interests (€bn) ³

(+) Other items

4

Entreprise value (€bn)

Implied EV/adj. EBITDA 2022E5

Pro forma net financial debt/adj. EBITDA 2022E³

€10.00

414.0¹

€4.1bn

€2.3bn

€0.4bn

€0.3bn

€7.2bn

11.1x

3.5x

1. Pre warrants and pre earn out

2. Including €2,114m of net debt 2021A post IFRS 16 for Banijay, €193m of net debt 2021A post IFRS 16 for

Betclic Everest Group, €167m of net debt 2021A post IFRS 16 at Holding level, €97m vendor loan to

purchase remaining De Agostini 6.02% stake in LDH and €300m of cash available post transaction

3. Including non-controlling interests in Banijay (€280m) and Betclic Everest Group (€150m)

4. Including €326m of earn-out and LTIPS

% shares

Illustrative pro forma ownership¹

Free float

10%

O

DE AGOSTINI 5%

MONTE CARLO

SOCIÉTÉ DES BAINS DE MER

10%

Fimalac

% voting rights

7

7%

vivendi 19% 7

I

Fimalac

vivendi 10%

DE AGOSTINI

3%

MONTE CARLO

SOCIÉTÉ DES BAINS DE MER 5%

4%7

Sponsors

1%

i 26%

Sponsors

2%

Free float (

5%

I

13%

LOV

GROUP

46%

LOV

GROUP

72%8

5. Post holding costs of ~€5m

6. 4.99% stake rounded to 5% for presentation purposes

7. Excluding PIPE investments

8. Through triple voting rights mechanism benefiting to LOV Group only (with ability to transfer all (and not

part) of them provided minority shareholders have the option to sell their shares at a price equivalent to the

price received by LOV Group in the context of a tender offer launched by the transferee)

25View entire presentation