Apollo Global Management Investor Presentation Deck

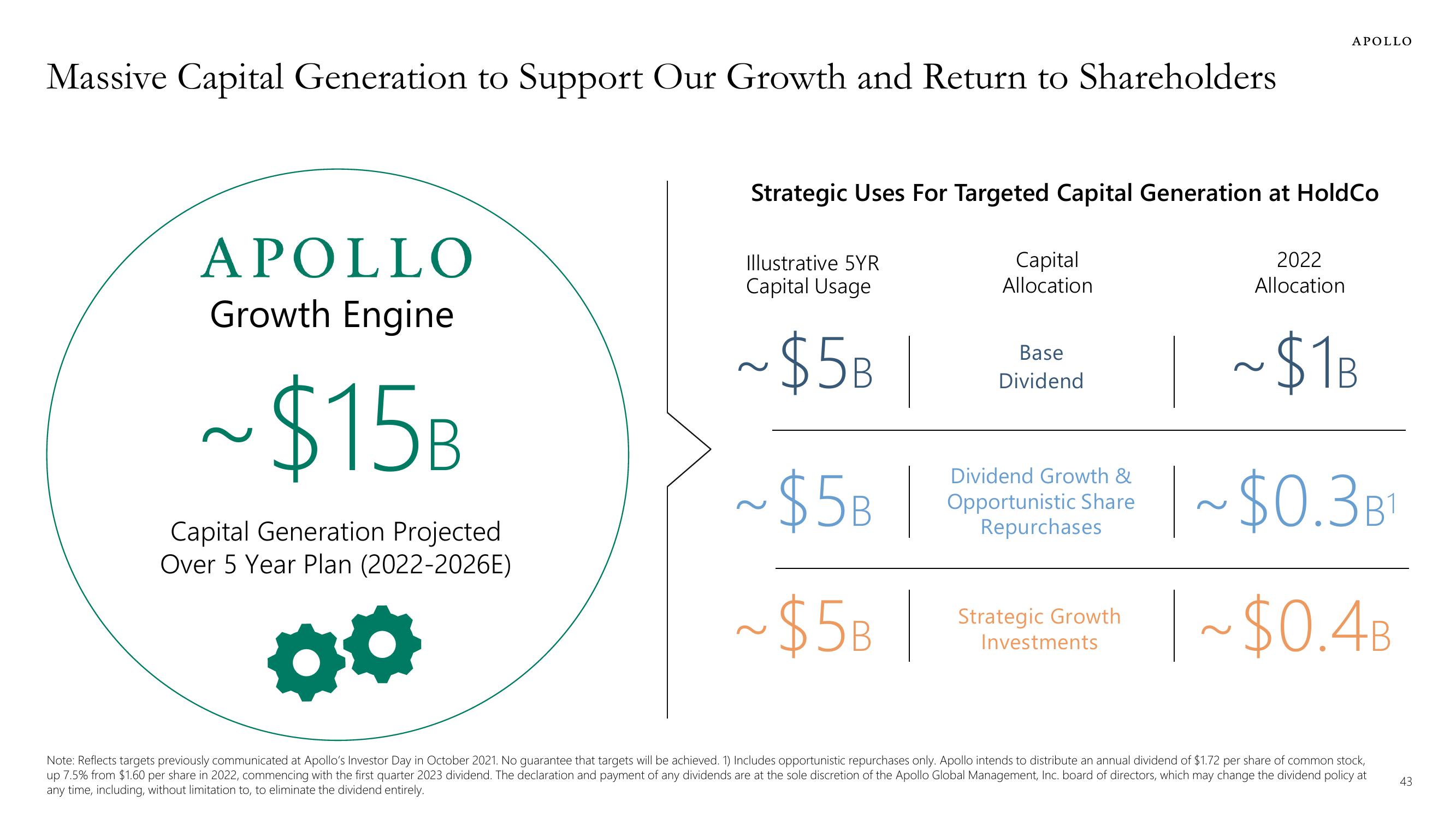

Massive Capital Generation to Support Our Growth and Return to Shareholders

APOLLO

Growth Engine

~$15B

Capital Generation Projected

Over 5 Year Plan (2022-2026E)

**

Strategic Uses For Targeted Capital Generation at HoldCo

Illustrative 5YR

Capital Usage

~$5B

~$5B

~$5B

Capital

Allocation

Base

Dividend

Dividend Growth &

Opportunistic Share

Repurchases

APOLLO

Strategic Growth

Investments

2022

Allocation

~$1B

~$0.3B

~$0.4B

Note: Reflects targets previously communicated at Apollo's Investor Day in October 2021. No guarantee that targets will be achieved. 1) Includes opportunistic repurchases only. Apollo intends to distribute an annual dividend of $1.72 per share of common stock,

up 7.5% from $1.60 per share in 2022, commencing with the first quarter 2023 dividend. The declaration and payment of any dividends are at the sole discretion of the Apollo Global Management, Inc. board of directors, which may change the dividend policy at

any time, including, without limitation to, to eliminate the dividend entirely.

43View entire presentation