Apollo Global Management Investor Presentation Deck

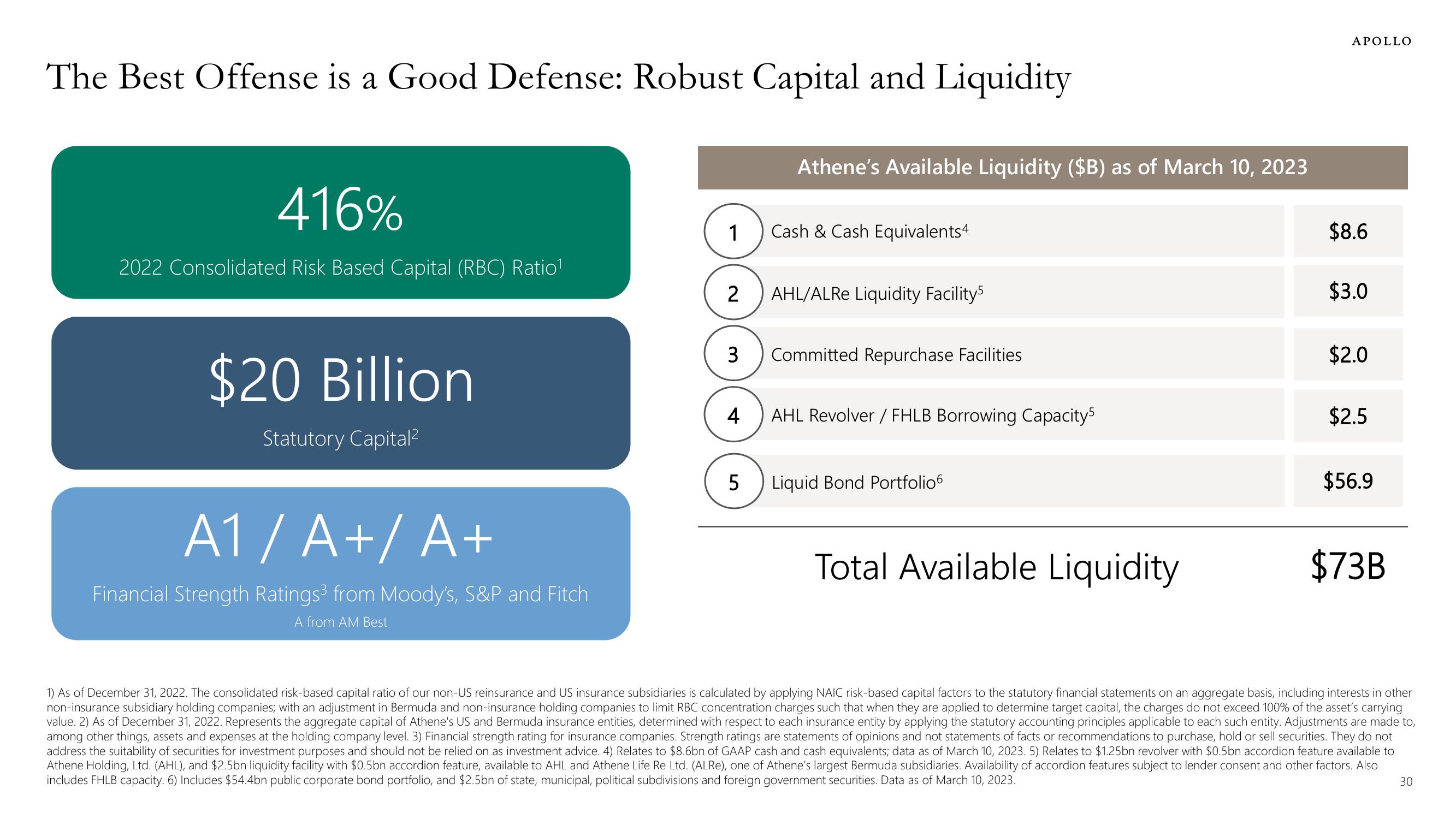

The Best Offense is a Good Defense: Robust Capital and Liquidity

416%

2022 Consolidated Risk Based Capital (RBC) Ratio¹

$20 Billion

Statutory Capital²

A1/A+/A+

Financial Strength Ratings³ from Moody's, S&P and Fitch

A from AM Best

1

2

3

4

5

Athene's Available Liquidity ($B) as of March 10, 2023

Cash & Cash Equivalents4

AHL/ALRe Liquidity Facility5

Committed Repurchase Facilities

AHL Revolver / FHLB Borrowing Capacity5

Liquid Bond Portfolio6

Total Available Liquidity

APOLLO

$8.6

$3.0

$2.0

$2.5

$56.9

$73B

1) As of December 31, 2022. The consolidated risk-based capital ratio of our non-US reinsurance and US insurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, including interests in other

non-insurance subsidiary holding companies; with an adjustment in Bermuda and non-insurance holding companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset's carrying

value. 2) As of December 31, 2022. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to,

among other things, assets and expenses at the holding company level. 3) Financial strength rating for insurance companies. Strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not

address the suitability of securities for investment purposes and should not be relied on as investment advice. 4) Relates to $8.6bn of GAAP cash and cash equivalents; data as of March 10, 2023. 5) Relates to $1.25bn revolver with $0.5bn accordion feature available to

Athene Holding, Ltd. (AHL), and $2.5bn liquidity facility with $0.5bn accordion feature, available to AHL and Athene Life Re Ltd. (ALRe), one of Athene's largest Bermuda subsidiaries. Availability of accordion features subject to lender consent and other factors. Also

includes FHLB capacity. 6) Includes $54.4bn public corporate bond portfolio, and $2.5bn of state, municipal, political subdivisions and foreign government securities. Data as of March 10, 2023.

30View entire presentation