Silicon Valley Bank Results Presentation Deck

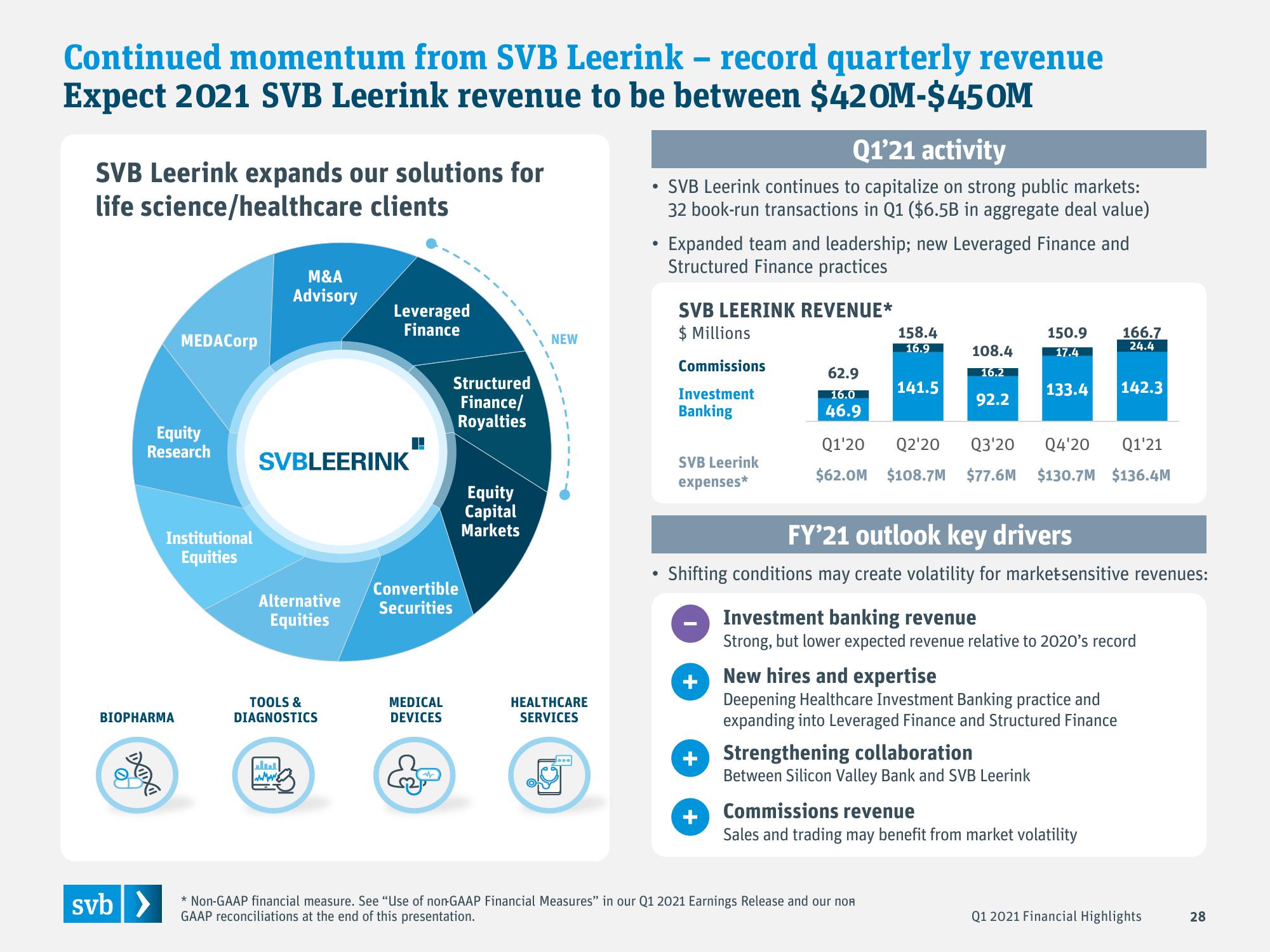

Continued momentum from SVB Leerink - record quarterly revenue

Expect 2021 SVB Leerink revenue to be between $420M-$450M

SVB Leerink expands our solutions for

life science/healthcare clients

DIDI

BIOPHARMA

D

Equity

Research

MEDACorp

svb >

Institutional

Equities

M&A

Advisory

SVBLEERINK

Alternative

Equities

TOOLS &

DIAGNOSTICS

lu

wwwww

Leveraged

Finance

Structured

Finance/

Royalties

Convertible

Securities

MEDICAL

DEVICES

Equity

Capital

Markets

NEW

HEALTHCARE

SERVICES

●

Q1'21 activity

SVB Leerink continues to capitalize on strong public markets:

32 book-run transactions in Q1 ($6.5B in aggregate deal value)

Expanded team and leadership; new Leveraged Finance and

Structured Finance practices

SVB LEERINK REVENUE*

$ Millions

Commissions

Investment

Banking

SVB Leerink

expenses*

+

62.9

16.0

46.9

+

158.4

16.9

141.5

108.4

16.2

92.2

FY'21 outlook key drivers

Shifting conditions may create volatility for market sensitive revenues:

150.9 166.7

24.4

17.4

Q1'20

Q2'20 Q3'20 Q4'20 Q1'21

$62.0M $108.7M $77.6M $130.7M $136.4M

+ Strengthening collaboration

133.4 142.3

* Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q1 2021 Earnings Release and our non

GAAP reconciliations at the end of this presentation.

Investment banking revenue

Strong, but lower expected revenue relative to 2020's record

New hires and expertise

Deepening Healthcare Investment Banking practice and

expanding into Leveraged Finance and Structured Finance

Between Silicon Valley Bank and SVB Leerink

Commissions revenue

Sales and trading may benefit from market volatility

Q1 2021 Financial Highlights

28View entire presentation