Silicon Valley Bank Results Presentation Deck

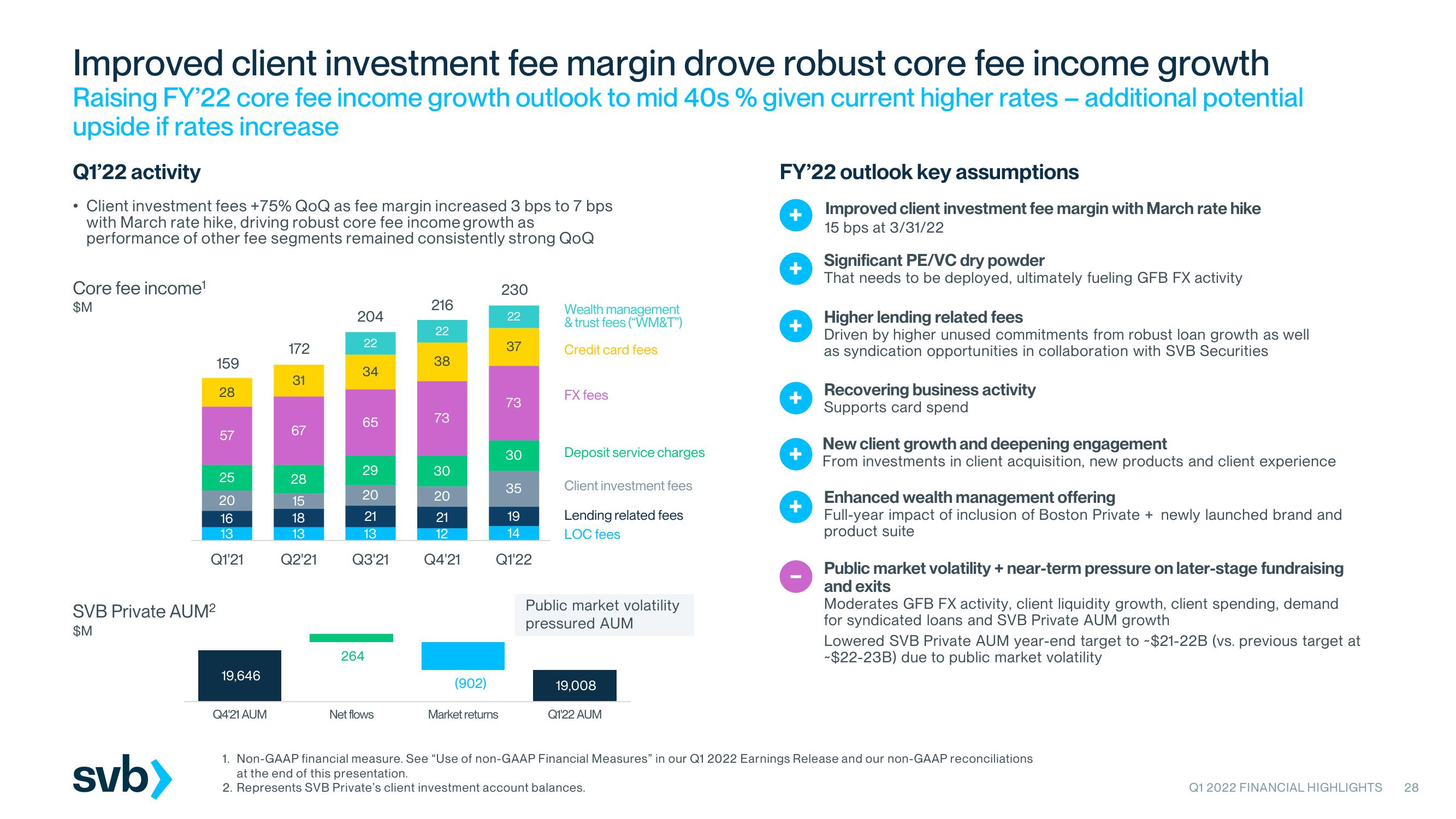

Improved client investment fee margin drove robust core fee income growth

Raising FY'22 core fee income growth outlook to mid 40s % given current higher rates - additional potential

upside if rates increase

Q1'22 activity

Client investment fees +75% QOQ as fee margin increased 3 bps to 7 bps

with March rate hike, driving robust core fee income growth as

performance of other fee segments remained consistently strong QoQ

●

Core fee income¹

$M

SVB Private AUM²

$M

svb>

159

28

57

25

20

16

13

Q1'21

19,646

Q4'21 AUM

172

31

67

28

15

18

13

Q2¹21

204

22

34

65

29

20

21

13

Q3'21

264

Net flows

216

22

38

73

30

20

21

12

Q4'21

(902)

230

Market returns

22

37

73

30

35

19

14

Q1'22

Wealth management

& trust fees ("WM&T")

Credit card fees

FX fees

Deposit service charges

Client investment fees

Lending related fees

LOC fees

Public market volatility

pressured AUM

19,008

Q1'22 AUM

FY'22 outlook key assumptions

+

Improved client investment fee margin with March rate hike

15 bps at 3/31/22

Significant PE/VC dry powder

That needs to be deployed, ultimately fueling GFB FX activity

Higher lending related fees

Driven by higher unused commitments from robust loan growth as well

as syndication opportunities in collaboration with SVB Securities

Recovering business activity

Supports card spend

New client growth and deepening engagement

From investments in client acquisition, new products and client experience

Enhanced wealth management offering

Full-year impact of inclusion of Boston Private + newly launched brand and

product suite

Public market volatility + near-term pressure on later-stage fundraising

and exits

Moderates GFB FX activity, client liquidity growth, client spending, demand

for syndicated loans and SVB Private AUM growth

Lowered SVB Private AUM year-end target to ~$21-22B (vs. previous target at

-$22-23B) due to public market volatility

1. Non-GAAP financial measure. See “Use of non-GAAP Financial Measures" in our Q1 2022 Earnings Release and our non-GAAP reconciliations

at the end of this presentation.

2. Represents SVB Private's client investment account balances.

Q1 2022 FINANCIAL HIGHLIGHTS

28View entire presentation