Silicon Valley Bank Results Presentation Deck

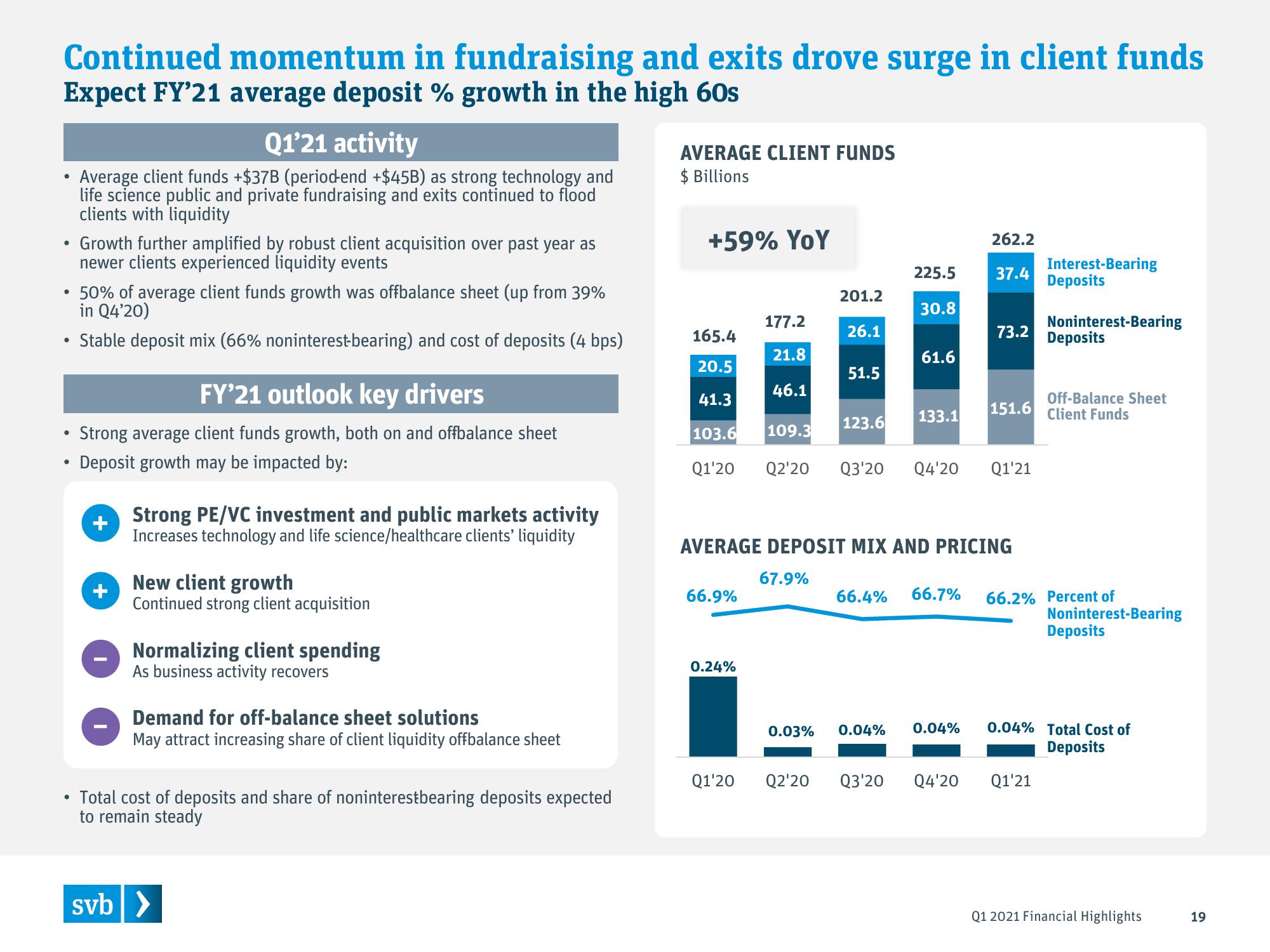

Continued momentum in fundraising and exits drove surge in client funds

Expect FY'21 average deposit % growth in the high 60s

●

●

●

●

●

●

Q1'21 activity

Average client funds +$37B (periodend +$45B) as strong technology and

life science public and private fundraising and exits continued to flood

clients with liquidity

Growth further amplified by robust client acquisition over past year as

newer clients experienced liquidity events

50% of average client funds growth was offbalance sheet (up from 39%

in Q4'20)

Stable deposit mix (66% noninterest-bearing) and cost of deposits (4 bps)

FY'21 outlook key drivers

Strong average client funds growth, both on and offbalance sheet

Deposit growth may be impacted by:

+

+

Strong PE/VC investment and public markets activity

Increases technology and life science/healthcare clients' liquidity

New client growth

Continued strong client acquisition

Normalizing client spending

As business activity recovers

Demand for off-balance sheet solutions

May attract increasing share of client liquidity offbalance sheet

Total cost of deposits and share of noninterestbearing deposits expected

to remain steady

svb >

AVERAGE CLIENT FUNDS

$ Billions

+59% YoY

165.4

20.5

41.3

103.6

Q1'20

66.9%

0.24%

177.2

21.8

Q1'20

46.1

109.3

201.2

26.1

51.5

123.6

225.5

30.8

61.6

0.03% 0.04%

133.1

Q2'20 Q3'20 Q4'20

AVERAGE DEPOSIT MIX AND PRICING

67.9%

66.4% 66.7%

262.2

37.4

0.04%

73.2

151.6

Q1'21

Interest-Bearing

Deposits

Noninterest-Bearing

Deposits

Q2'20 Q3'20 Q4'20 Q1'21

Off-Balance Sheet

Client Funds

66.2% Percent of

Noninterest-Bearing

Deposits

0.04% Total Cost of

Deposits

Q1 2021 Financial Highlights

19View entire presentation