Silicon Valley Bank Results Presentation Deck

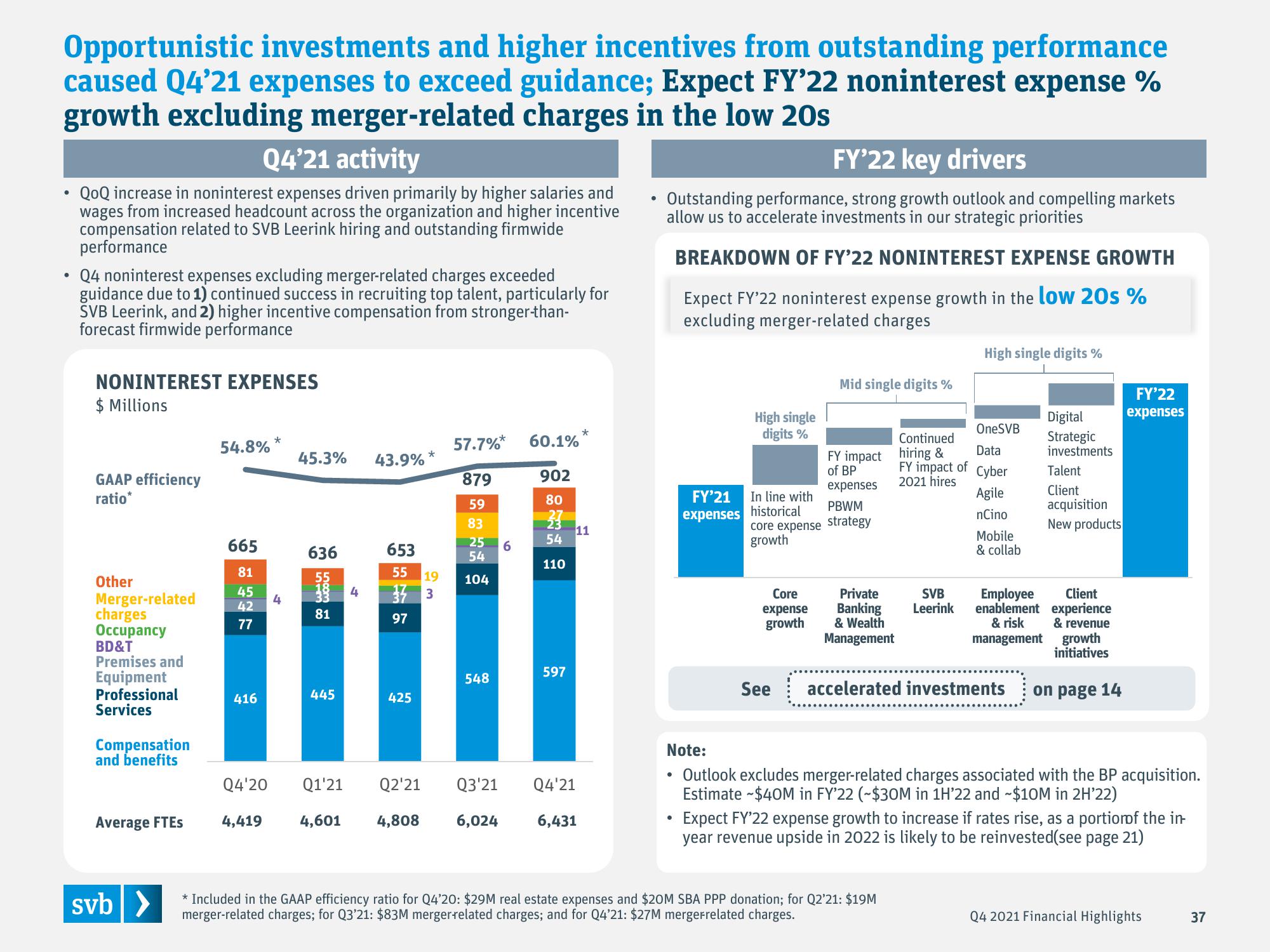

Opportunistic investments and higher incentives from outstanding performance

caused Q4'21 expenses to exceed guidance; Expect FY'22 noninterest expense %

growth excluding merger-related charges in the low 20s

Q4'21 activity

QoQ increase in noninterest expenses driven primarily by higher salaries and

wages from increased headcount across the organization and higher incentive

compensation related to SVB Leerink hiring and outstanding firmwide

performance

Q4 noninterest expenses excluding merger-related charges exceeded

guidance due to 1) continued success in recruiting top talent, particularly for

SVB Leerink, and 2) higher incentive compensation from stronger-than-

forecast firmwide performance

NONINTEREST EXPENSES

$ Millions

GAAP efficiency

ratio*

Other

Merger-related

charges

Occupancy

BD&T

Premises and

Equipment

Professional

Services

Compensation

and benefits

Average FTES

svb >

54.8% *

665

81

45

42

77

416

4

4,419

45.3% 43.9% *

636

55

LOOM

81

445

Q4'20 Q1'21

4

653

55

37 3

97

425

Q2'21

4,601 4,808

57.7%*

879

59

83

25

54

19 104

548

6

60.1%

902

80

23

54

110

597

*

11

Q3'21

Q4'21

6,024 6,431

●

FY'22 key drivers

Outstanding performance, strong growth outlook and compelling markets

allow us to accelerate investments in our strategic priorities

BREAKDOWN OF FY'22 NONINTEREST EXPENSE GROWTH

Expect FY'22 noninterest expense growth in the low 20s%

excluding merger-related charges

FY'21

expenses

●

High single

digits %

Continued

FY impact hiring &

of BP

expenses

PBWM

In line with

historical

core expense strategy

growth

Core

expense

growth

Mid single digits %

See

Private

Banking

& Wealth

Management

High single digits %

SVB

Leerink

OneSVB

Data

FY impact of Cyber

2021 hires

* Included in the GAAP efficiency ratio for Q4'20: $29M real estate expenses and $20M SBA PPP donation; for Q2'21: $19M

merger-related charges; for Q3'21: $83M mergerrelated charges; and for Q4'21: $27M mergerrelated charges.

Agile

nCino

Mobile

& collab

accelerated investments

Digital

Strategic

investments

Talent

Client

acquisition

New products

Client

Employee

enablement experience

& risk

management

& revenue

growth

initiatives

on page 14

Note:

• Outlook excludes merger-related charges associated with the BP acquisition.

Estimate $40M in FY'22 (~$30M in 1H'22 and ~$10M in 2H'22)

FY'22

expenses

Expect FY'22 expense growth to increase if rates rise, as a portion of the in

year revenue upside in 2022 is likely to be reinvested(see page 21)

Q4 2021 Financial Highlights

37View entire presentation