AstraZeneca Results Presentation Deck

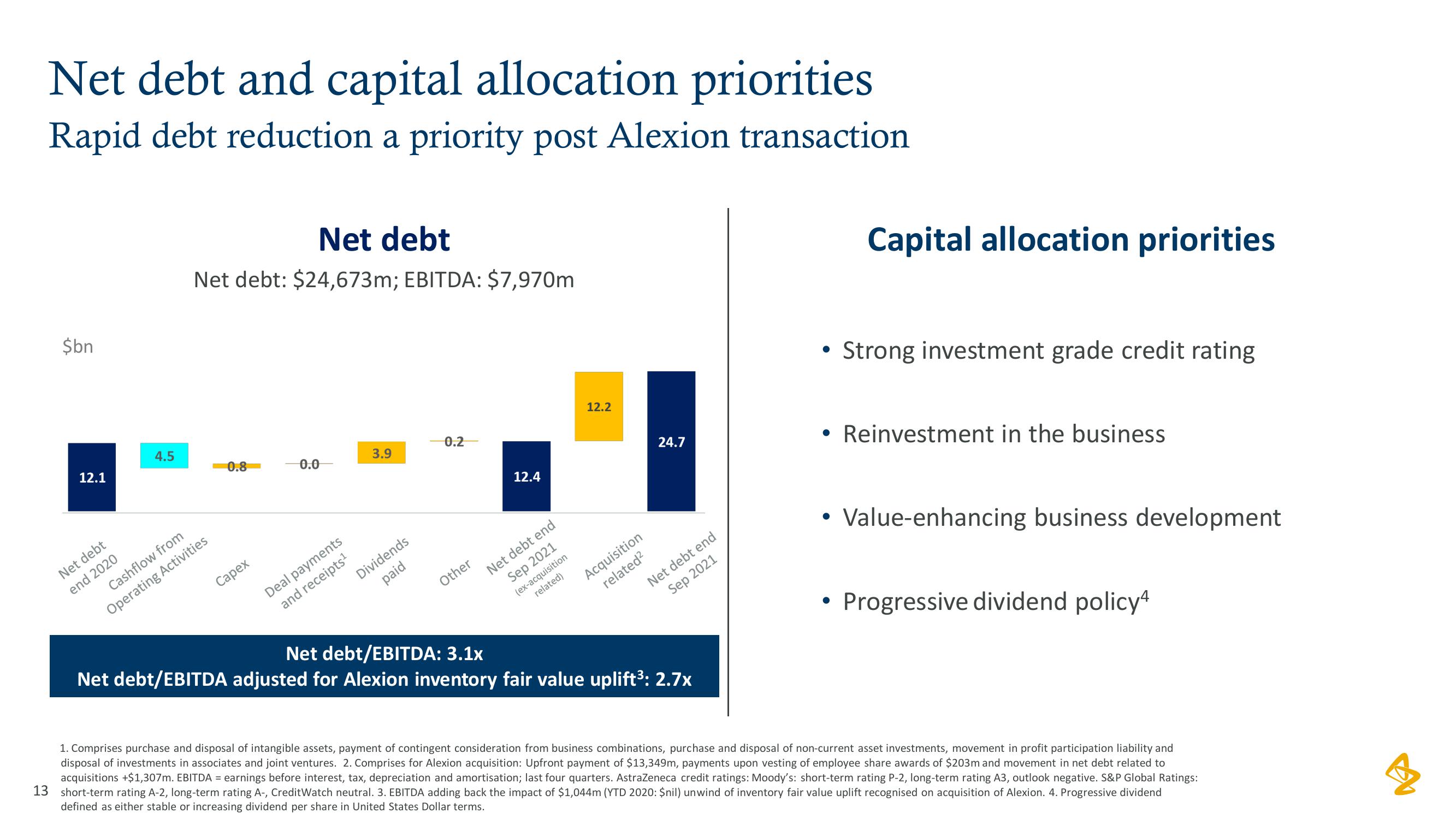

Net debt and capital allocation priorities

Rapid debt reduction a priority post Alexion transaction

$bn

12.1

Net debt

end 2020

4.5

Net debt

Net debt: $24,673m; EBITDA: $7,970m

0.8

Capex

Cashflow from

Operating Activities

0.0

3.9

Dividends

paid

Deal payments

and receipts¹

0.2

Other

12.4

Net debt end

Sep 2021

(ex-acquisition

related)

12.2

Acquisition

related²

24.7

Net debt end

Sep 2021

Net debt/EBITDA: 3.1x

Net debt/EBITDA adjusted for Alexion inventory fair value uplift³: 2.7x

●

Capital allocation priorities

Strong investment grade credit rating

• Reinvestment in the business

●

• Value-enhancing business development

●

• Progressive dividend policy4

1. Comprises purchase and disposal of intangible assets, payment of contingent consideration from business combinations, purchase and disposal of non-current asset investments, movement in profit participation liability and

disposal of investments in associates and joint ventures. 2. Comprises for Alexion acquisition: Upfront payment of $13,349m, payments upon vesting of employee share awards of $203m and movement in net debt related to

acquisitions +$1,307m. EBITDA = earnings before interest, tax, depreciation and amortisation; last four quarters. AstraZeneca credit ratings: Moody's: short-term rating P-2, long-term rating A3, outlook negative. S&P Global Ratings:

13 short-term rating A-2, long-term rating A-, CreditWatch neutral. 3. EBITDA adding back the impact of $1,044m (YTD 2020: $nil) unwind of inventory fair value uplift recognised on acquisition of Alexion. 4. Progressive dividend

defined as either stable or increasing dividend per share in United States Dollar terms.

BView entire presentation