Silicon Valley Bank Results Presentation Deck

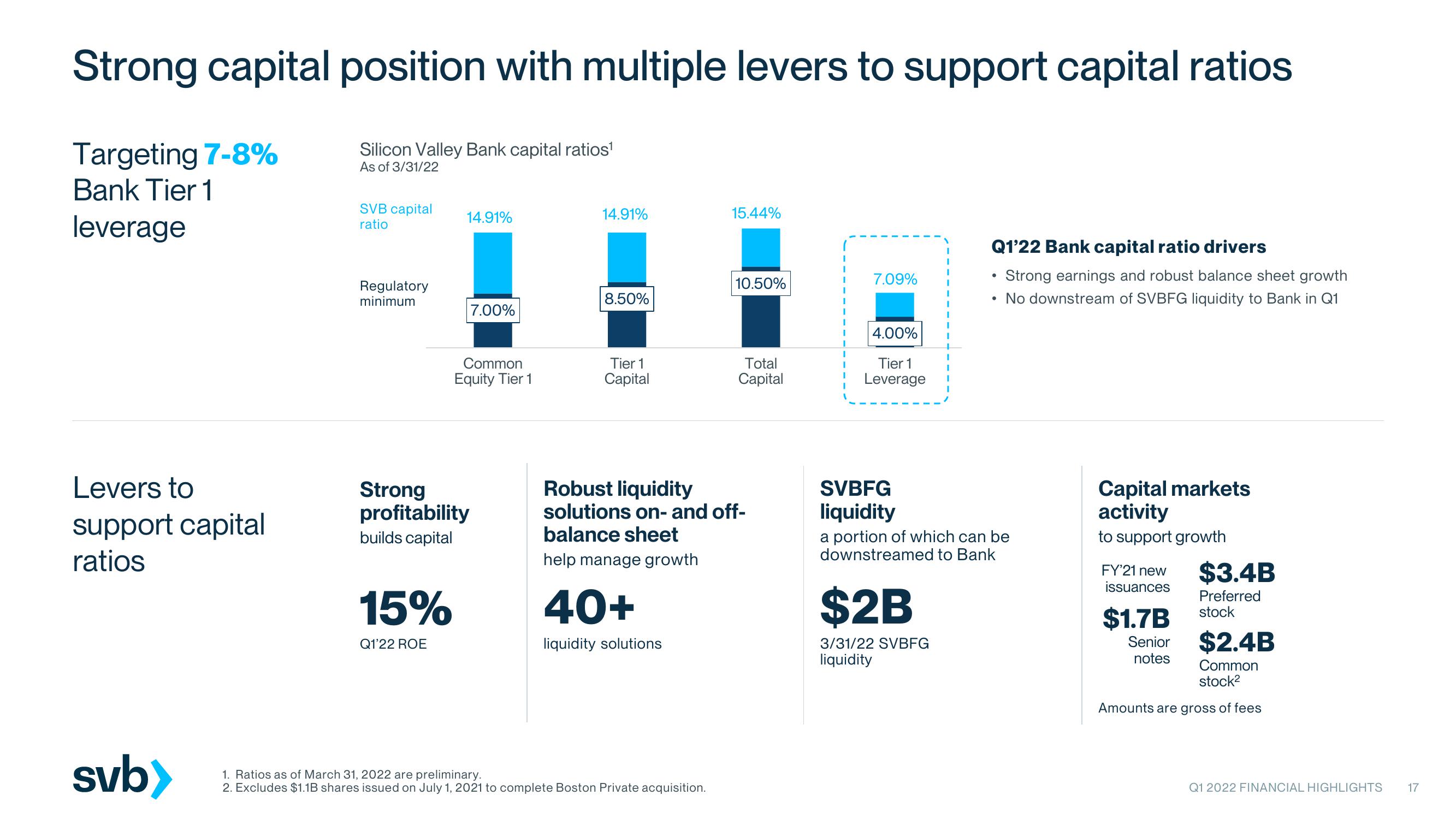

Strong capital position with multiple levers to support capital ratios

Targeting 7-8%

Bank Tier 1

leverage

Levers to

support capital

ratios

svb>

Silicon Valley Bank capital ratios¹

As of 3/31/22

SVB capital

ratio

Regulatory

minimum

14.91%

15%

Q1'22 ROE

Strong

profitability

builds capital

7.00%

Common

Equity Tier 1

14.91%

8.50%

Tier 1

Capital

40+

liquidity solutions

15.44%

1. Ratios as of March 31, 2022 are preliminary.

2. Excludes $1.1B shares issued on July 1, 2021 to complete Boston Private acquisition.

10.50%

Robust liquidity

solutions on- and off-

balance sheet

help manage growth

Total

Capital

I

I

I

I

I

7.09%

4.00%

Tier 1

Leverage

SVBFG

liquidity

Q1'22 Bank capital ratio drivers

Strong earnings and robust balance sheet growth

No downstream of SVBFG liquidity to Bank in Q1

$2B

3/31/22 SVBFG

liquidity

●

●

a portion of which can be

downstreamed to Bank

Capital markets

activity

to support growth

FY'21 new

issuances

$1.7B

Senior

notes

$3.4B

Preferred

stock

$2.4B

Common

stock²

Amounts are gross of fees

Q1 2022 FINANCIAL HIGHLIGHTS

17View entire presentation