FL Entertaiment SPAC

PIPE overview

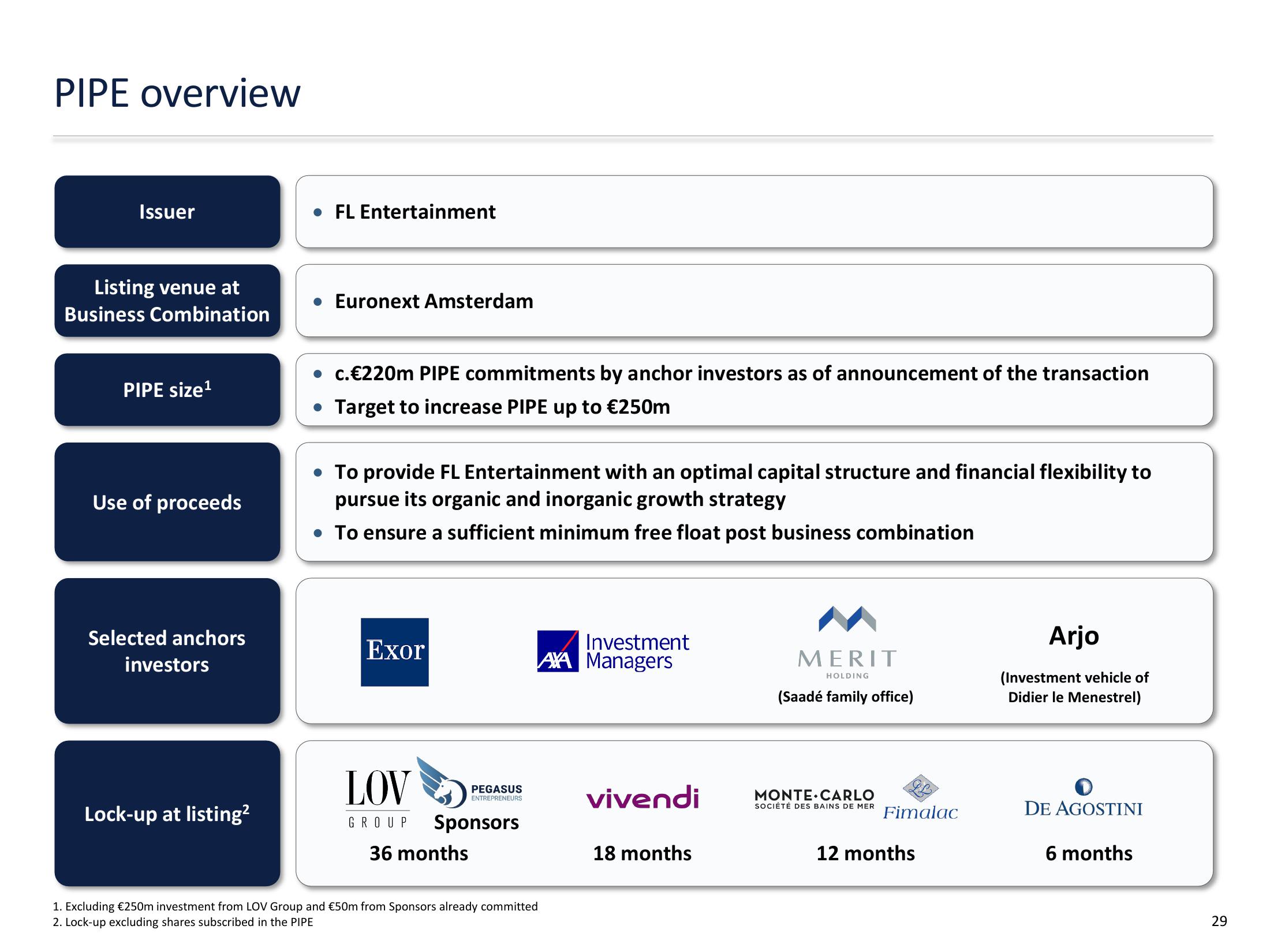

Issuer

Listing venue at

Business Combination

PIPE size¹

Use of proceeds

Selected anchors

investors

Lock-up at listing²

• FL Entertainment

Euronext Amsterdam

c. €220m PIPE commitments by anchor investors as of announcement of the transaction

• Target to increase PIPE up to €250m

To provide FL Entertainment with an optimal capital structure and financial flexibility to

pursue its organic and inorganic growth strategy

• To ensure a sufficient minimum free float post business combination

Exor

LOV

GROUP Sponsors

36 months

PEGASUS

ENTREPRENEURS

Investment

AXA Managers

1. Excluding €250m investment from LOV Group and €50m from Sponsors already committed

2. Lock-up excluding shares subscribed in the PIPE

vivendi

18 months

MERIT

HOLDING

(Saadé family office)

MONTE CARLO

SOCIÉTÉ DES BAINS DE MER

Fimalac

12 months

Arjo

(Investment vehicle of

Didier le Menestrel)

DE AGOSTINI

6 months

29View entire presentation