Silicon Valley Bank Mergers and Acquisitions Presentation Deck

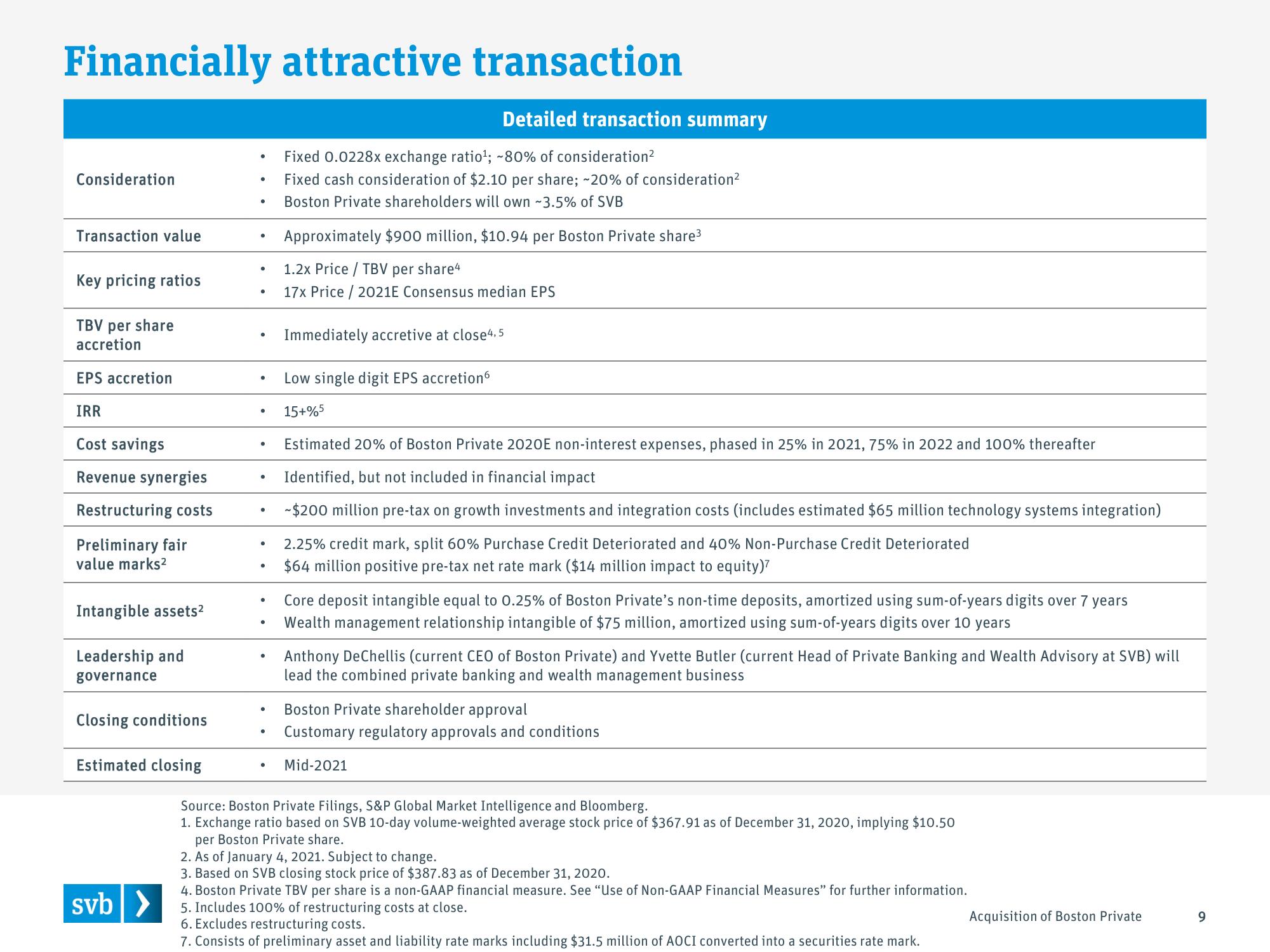

Financially attractive transaction

Consideration

Transaction value

Key pricing ratios

TBV per share

accretion

EPS accretion

IRR

Cost savings

Revenue synergies

Restructuring costs

Preliminary fair

value marks²

Intangible assets²

Leadership and

governance

Closing conditions

Estimated closing

svb>

●

●

●

●

●

●

●

●

●

●

●

●

●

●

Detailed transaction summary

Fixed 0.0228x exchange ratio¹; -80% of consideration²

Fixed cash consideration of $2.10 per share; ~20% of consideration²

Boston Private shareholders will own 3.5% of SVB

Approximately $900 million, $10.94 per Boston Private share³

1.2x Price / TBV per share4

17x Price / 2021E Consensus median EPS

Immediately accretive at close4,5

Low single digit EPS accretion

15+%5

Estimated 20% of Boston Private 2020E non-interest expenses, phased in 25% in 2021, 75% in 2022 and 100% thereafter

Identified, but not included in financial impact

-$200 million pre-tax on growth investments and integration costs (includes estimated $65 million technology systems integration)

2.25% credit mark, split 60% Purchase Credit Deteriorated and 40% Non-Purchase Credit Deteriorated

$64 million positive pre-tax net rate mark ($14 million impact to equity)?

Core deposit intangible equal to 0.25% of Boston Private's non-time deposits, amortized using sum-of-years digits over 7 years

Wealth management relationship intangible of $75 million, amortized using sum-of-years digits over 10 years

Anthony DeChellis (current CEO of Boston Private) and Yvette Butler (current Head of Private Banking and Wealth Advisory at SVB) will

lead the combined private banking and wealth management business

Boston Private shareholder approval

Customary regulatory approvals and conditions

Mid-2021

Source: Boston Private Filings, S&P Global Market Intelligence and Bloomberg.

1. Exchange ratio based on SVB 10-day volume-weighted average stock price of $367.91 as of December 31, 2020, implying $10.50

per Boston Private share.

2. As of January 4, 2021. Subject to change.

3. Based on SVB closing stock price of $387.83 as of December 31, 2020.

4. Boston Private TBV per share is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures" for further information.

5. Includes 100% of restructuring costs at close.

6. Excludes restructuring costs.

7. Consists of preliminary asset and liability rate marks including $31.5 million of AOCI converted into a securities rate mark.

Acquisition of Boston Private

9View entire presentation