Silicon Valley Bank Results Presentation Deck

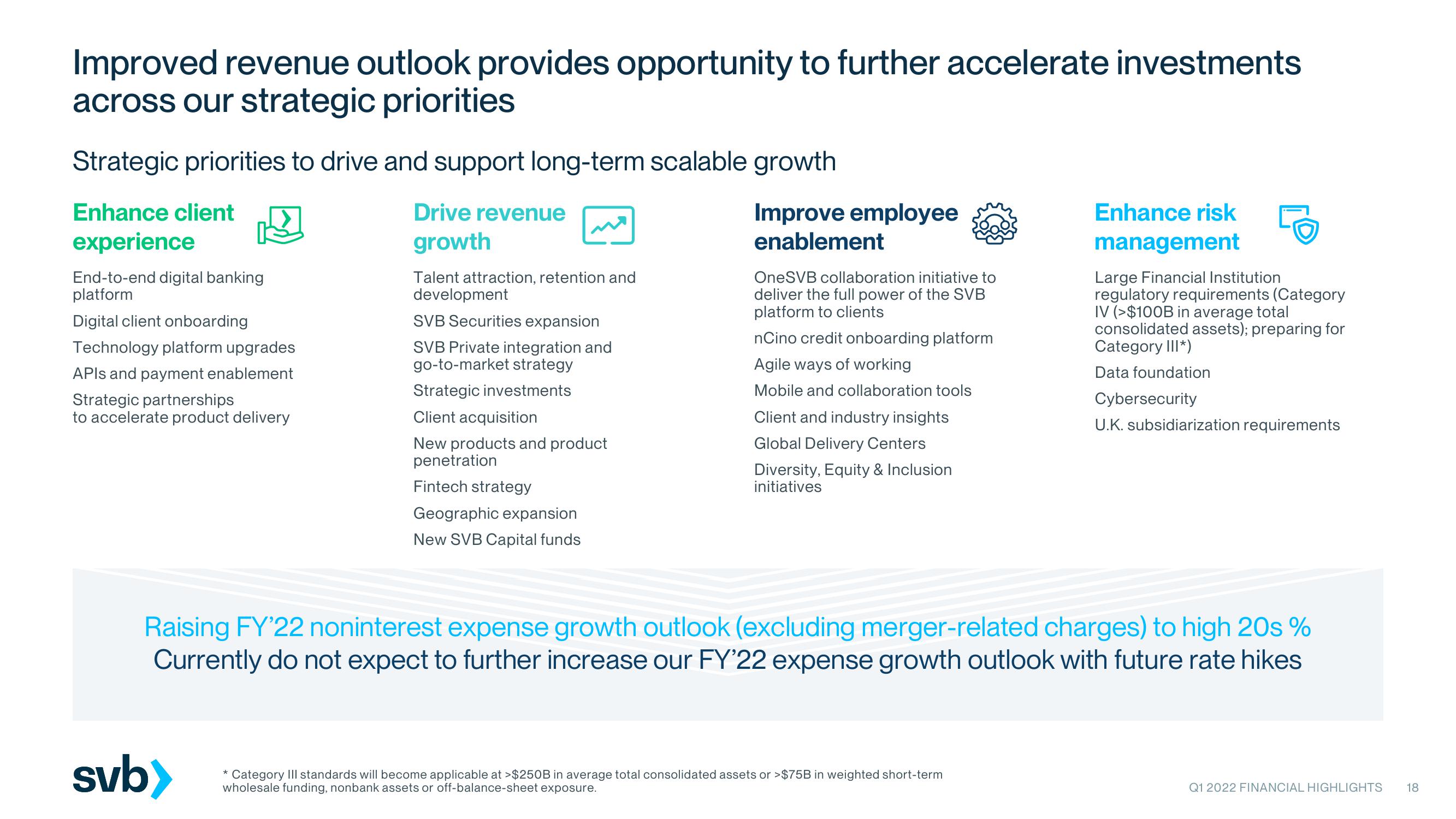

Improved revenue outlook provides opportunity to further accelerate investments

across our strategic priorities

Strategic priorities to drive and support long-term scalable growth

Enhance client

experience

End-to-end digital banking

platform

Digital client onboarding

Technology platform upgrades

APIs and payment enablement

Strategic partnerships

to accelerate product delivery

Drive revenue

growth

svb>

Talent attraction, retention and

development

SVB Securities expansion

SVB Private integration and

go-to-market strategy

Strategic investments

Client acquisition

New products and product

penetration

Fintech strategy

Geographic expansion

New SVB Capital funds

Improve employee

enablement

OneSVB collaboration initiative to

deliver the full power of the SVB

platform to clients

nCino credit onboarding platform

Agile ways of working

Mobile and collaboration tools

Client and industry insights

Global Delivery Centers

Diversity, Equity & Inclusion

initiatives

Raising FY'22 noninterest expense growth outlook (excluding merger-related charges) to high 20s%

Currently do not expect to further increase our FY'22 expense growth outlook with future rate hikes

Enhance risk

management

Large Financial Institution

regulatory requirements (Category

IV (>$100B in average total

consolidated assets); preparing for

Category III*)

Data foundation

Cybersecurity

U.K. subsidiarization requirements

* Category III standards will become applicable at >$250B in average total consolidated assets or >$75B in weighted short-term

wholesale funding, nonbank assets or off-balance-sheet exposure.

Q1 2022 FINANCIAL HIGHLIGHTS 18View entire presentation