Apollo Global Management Investor Presentation Deck

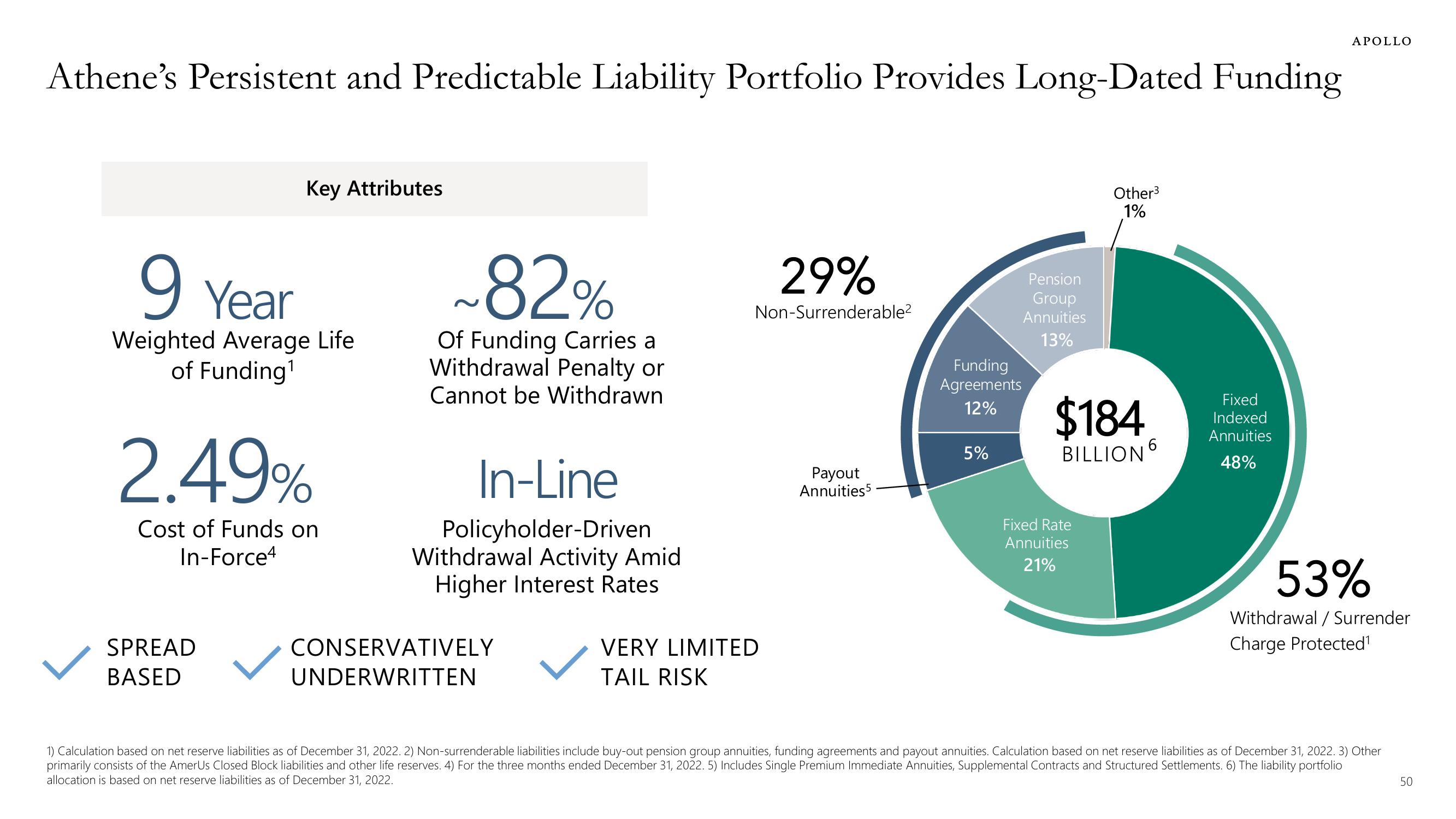

Athene's Persistent and Predictable Liability Portfolio Provides Long-Dated Funding

Key Attributes

9 Year

Weighted Average Life

of Funding¹

2.49%

Cost of Funds on

In-Force4

SPREAD

BASED

~82%

Of Funding Carries a

Withdrawal Penalty or

Cannot be Withdrawn

In-Line

Policyholder-Driven

Withdrawal Activity Amid

Higher Interest Rates

CONSERVATIVELY

UNDERWRITTEN

29%

Non-Surrenderable²

VERY LIMITED

TAIL RISK

Payout

Annuities5

Funding

Agreements

12%

5%

Pension

Group

Annuities

13%

Other³

1%

$184

BILLION 6

Fixed Rate

Annuities

21%

Fixed

Indexed

Annuities

48%

APOLLO

53%

Withdrawal / Surrender

Charge Protected¹

1) Calculation based on net reserve liabilities as of December 31, 2022. 2) Non-surrenderable liabilities include buy-out pension group annuities, funding agreements and payout annuities. Calculation based on net reserve liabilities as of December 31, 2022. 3) Other

primarily consists of the AmerUs Closed Block liabilities and other life reserves. 4) For the three months ended December 31, 2022. 5) Includes Single Premium Immediate Annuities, Supplemental Contracts and Structured Settlements. 6) The liability portfolio

allocation is based on net reserve liabilities as of December 31, 2022.

50View entire presentation