Silicon Valley Bank Results Presentation Deck

Glossary

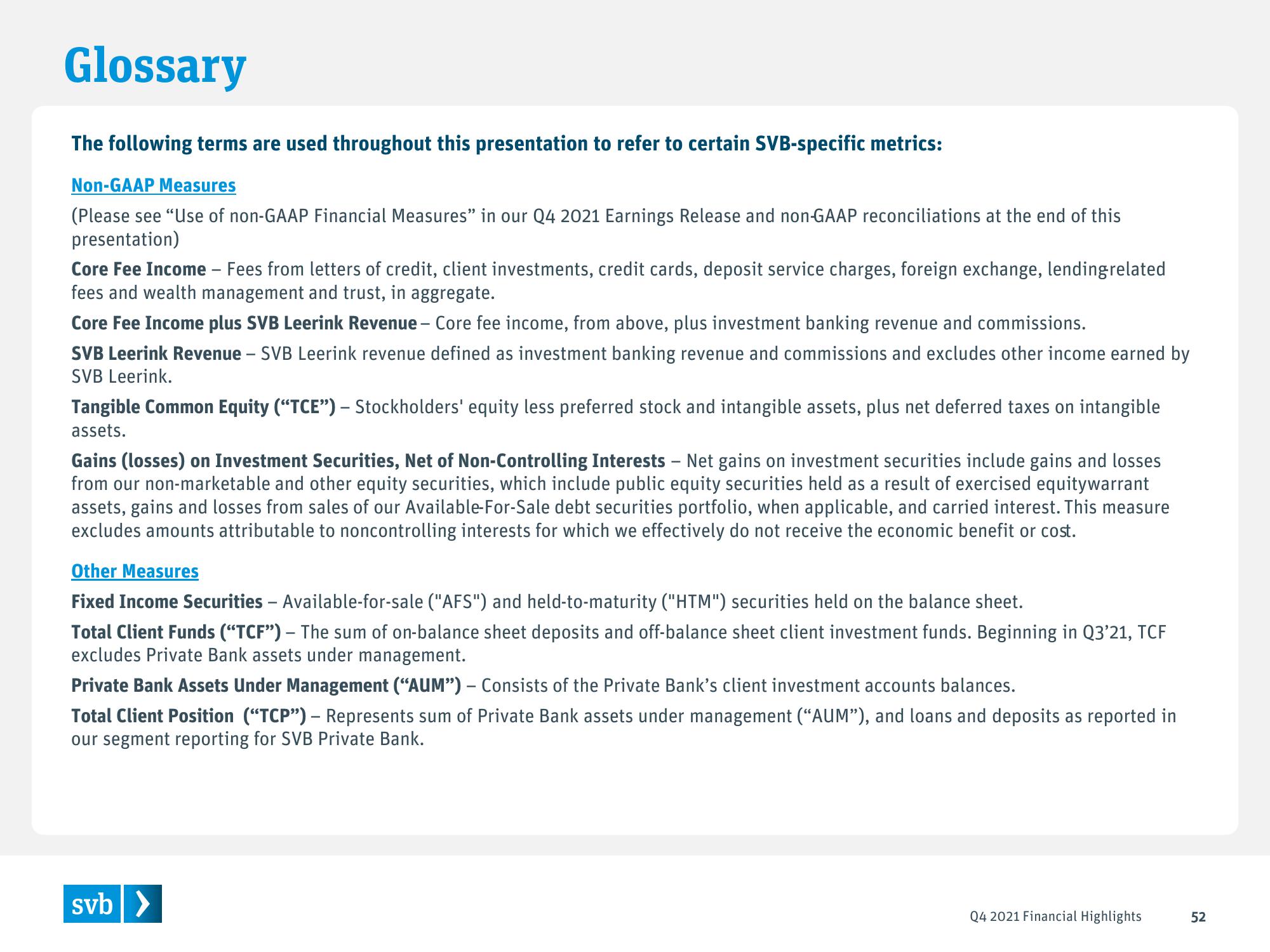

The following terms are used throughout this presentation to refer to certain SVB-specific metrics:

Non-GAAP Measures

(Please see "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and non-GAAP reconciliations at the end of this

presentation)

Core Fee Income - Fees from letters of credit, client investments, credit cards, deposit service charges, foreign exchange, lending related

fees and wealth management and trust, in aggregate.

Core Fee Income plus SVB Leerink Revenue - Core fee income, from above, plus investment banking revenue and commissions.

SVB Leerink Revenue - SVB Leerink revenue defined as investment banking revenue and commissions and excludes other income earned by

SVB Leerink.

Tangible Common Equity ("TCE") - Stockholders' equity less preferred stock and intangible assets, plus net deferred taxes on intangible

assets.

Gains (losses) on Investment Securities, Net of Non-Controlling Interests - Net gains on investment securities include gains and losses

from our non-marketable and other equity securities, which include public equity securities held as a result of exercised equitywarrant

assets, gains and losses from sales of our Available-For-Sale debt securities portfolio, when applicable, and carried interest. This measure

excludes amounts attributable to noncontrolling interests for which we effectively do not receive the economic benefit or cost.

Other Measures

Fixed Income Securities - Available-for-sale ("AFS") and held-to-maturity ("HTM") securities held on the balance sheet.

Total Client Funds ("TCF") - The sum of on-balance sheet deposits and off-balance sheet client investment funds. Beginning in Q3'21, TCF

excludes Private Bank assets under management.

Private Bank Assets Under Management ("AUM") - Consists of the Private Bank's client investment accounts balances.

Total Client Position ("TCP") - Represents sum of Private Bank assets under management ("AUM"), and loans and deposits as reported in

our segment reporting for SVB Private Bank.

svb >

Q4 2021 Financial Highlights

52View entire presentation