Silicon Valley Bank Results Presentation Deck

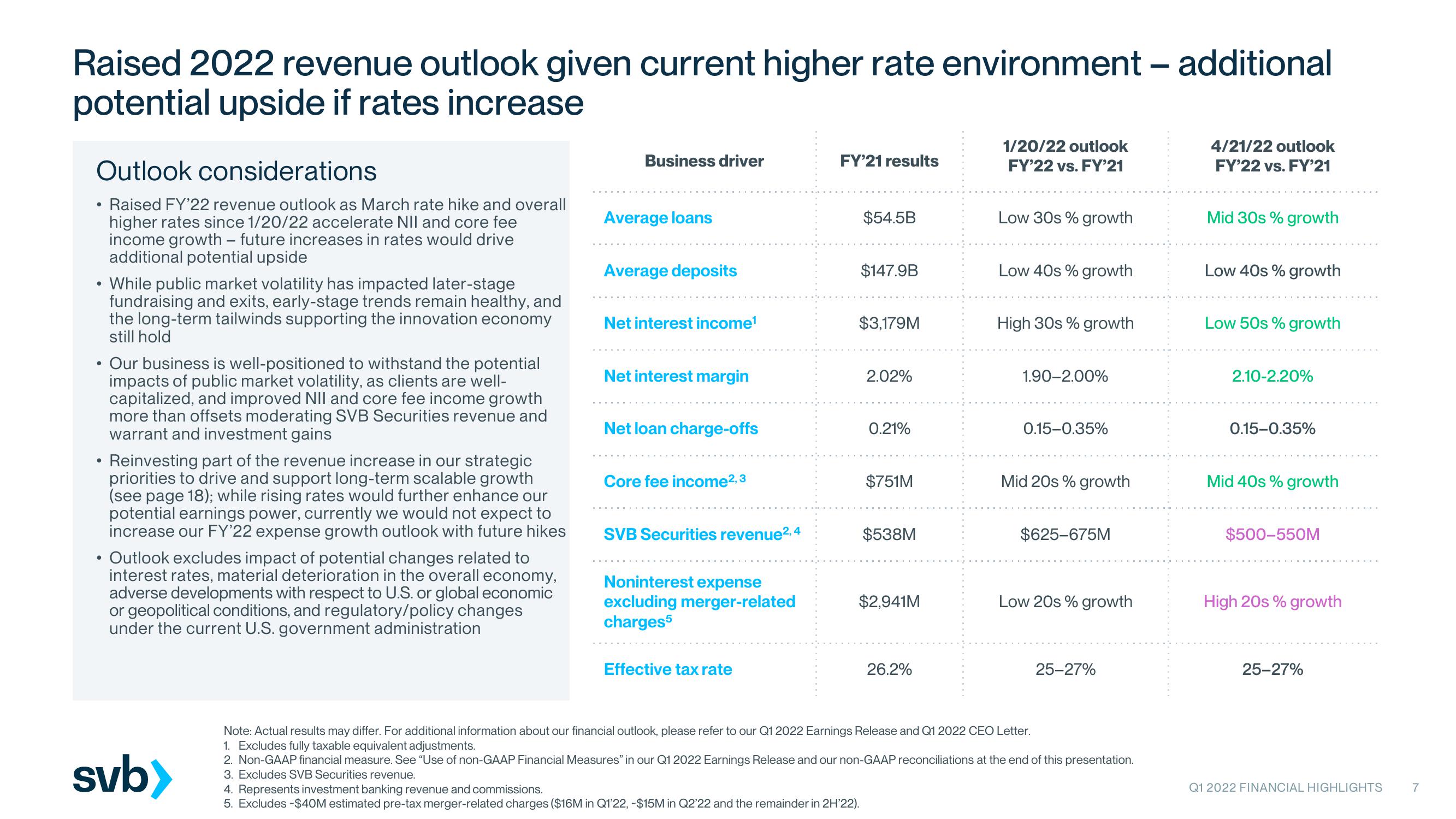

Raised 2022 revenue outlook given current higher rate environment - additional

potential upside if rates increase

Outlook considerations

Raised FY'22 revenue outlook as March rate hike and overall

higher rates since 1/20/22 accelerate NII and core fee

income growth - future increases in rates would drive

additional potential upside

●

•

●

●

While public market volatility has impacted later-stage

fundraising and exits, early-stage trends remain healthy, and

the long-term tailwinds supporting the innovation economy

still hold

Our business is well-positioned to withstand the potential

impacts of public market volatility, as clients are well-

capitalized, and improved NII and core fee income growth

more than offsets moderating SVB Securities revenue and

warrant and investment gains

Reinvesting part of the revenue increase in our strategic

priorities to drive and support long-term scalable growth

(see page 18); while rising rates would further enhance our

potential earnings power, currently we would not expect to

increase our FY'22 expense growth outlook with future hikes

●

• Outlook excludes impact of potential changes related to

interest rates, material deterioration in the overall economy,

adverse developments with respect to U.S. or global economic

or geopolitical conditions, and regulatory/policy changes

under the current U.S. government administration

svb>

Business driver

Average loans

Average deposits

Net interest income¹

Net interest margin

Net loan charge-offs

Core fee income2,3

SVB Securities revenue², 4

Noninterest expense

excluding merger-related

charges5

Effective tax rate

FY'21 results

$54.5B

$147.9B

$3,179M

4. Represents investment banking revenue and commissions.

5. Excludes $40M estimated pre-tax merger-related charges ($16M in Q1'22, -$15M in Q2'22 and the remainder in 2H'22).

2.02%

0.21%

$751M

$538M

$2,941M

26.2%

1/20/22 outlook

FY'22 vs. FY'21

Low 30s % growth

Low 40s % growth

High 30s % growth

1.90-2.00%

0.15-0.35%

Mid 20s % growth

$625-675M

Low 20s % growth

25-27%

Note: Actual results may differ. For additional information about our financial outlook, please refer to our Q1 2022 Earnings Release and Q1 2022 CEO Letter.

1. Excludes fully taxable equivalent adjustments.

2. Non-GAAP financial measure. See “Use of non-GAAP Financial Measures" in our Q1 2022 Earnings Release and our non-GAAP reconciliations at the end of this presentation.

3. Excludes SVB Securities revenue.

4/21/22 outlook

FY'22 vs. FY'21

Mid 30s % growth

Low 40s % growth

Low 50s % growth

2.10-2.20%

0.15-0.35%

Mid 40s % growth

$500-550M

High 20s % growth

25-27%

Q1 2022 FINANCIAL HIGHLIGHTS

7View entire presentation