Apollo Global Management Investor Presentation Deck

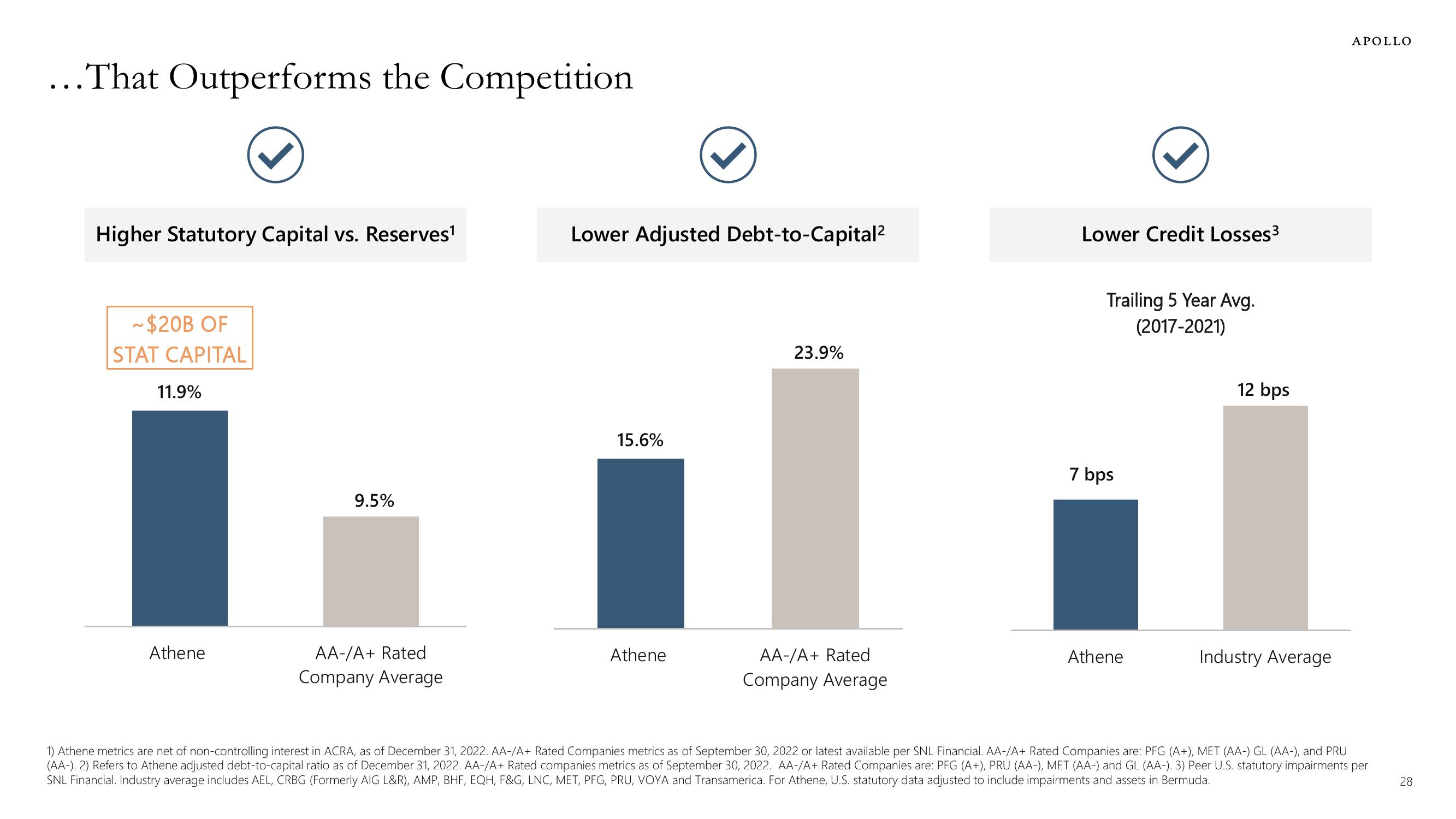

...That Outperforms the Competition

Higher Statutory Capital vs. Reserves¹

~$20B OF

STAT CAPITAL

11.9%

Athene

9.5%

AA-/A+ Rated

Company Average

Lower Adjusted Debt-to-Capital²

15.6%

Athene

23.9%

AA-/A+ Rated

Company Average

Lower Credit Losses³

Trailing 5 Year Avg.

(2017-2021)

7 bps

Athene

12 bps

Industry Average

APOLLO

1) Athene metrics are net of non-controlling interest in ACRA, as of December 31, 2022. AA-/A+ Rated Companies metrics as of September 30, 2022 or latest available per SNL Financial. AA-/A+ Rated Companies are: PFG (A+), MET (AA-) GL (AA-), and PRU

(AA-). 2) Refers to Athene adjusted debt-to-capital ratio as of December 31, 2022. AA-/A+ Rated companies metrics as of September 30, 2022. AA-/A+ Rated Companies are: PFG (A+), PRU (AA-), MET (AA-) and GL (AA-). 3) Peer U.S. statutory impairments per

SNL Financial. Industry average includes AEL, CRBG (Formerly AIG L&R), AMP, BHF, EQH, F&G, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda.

28View entire presentation