First Citizens BancShares Mergers and Acquisitions Presentation Deck

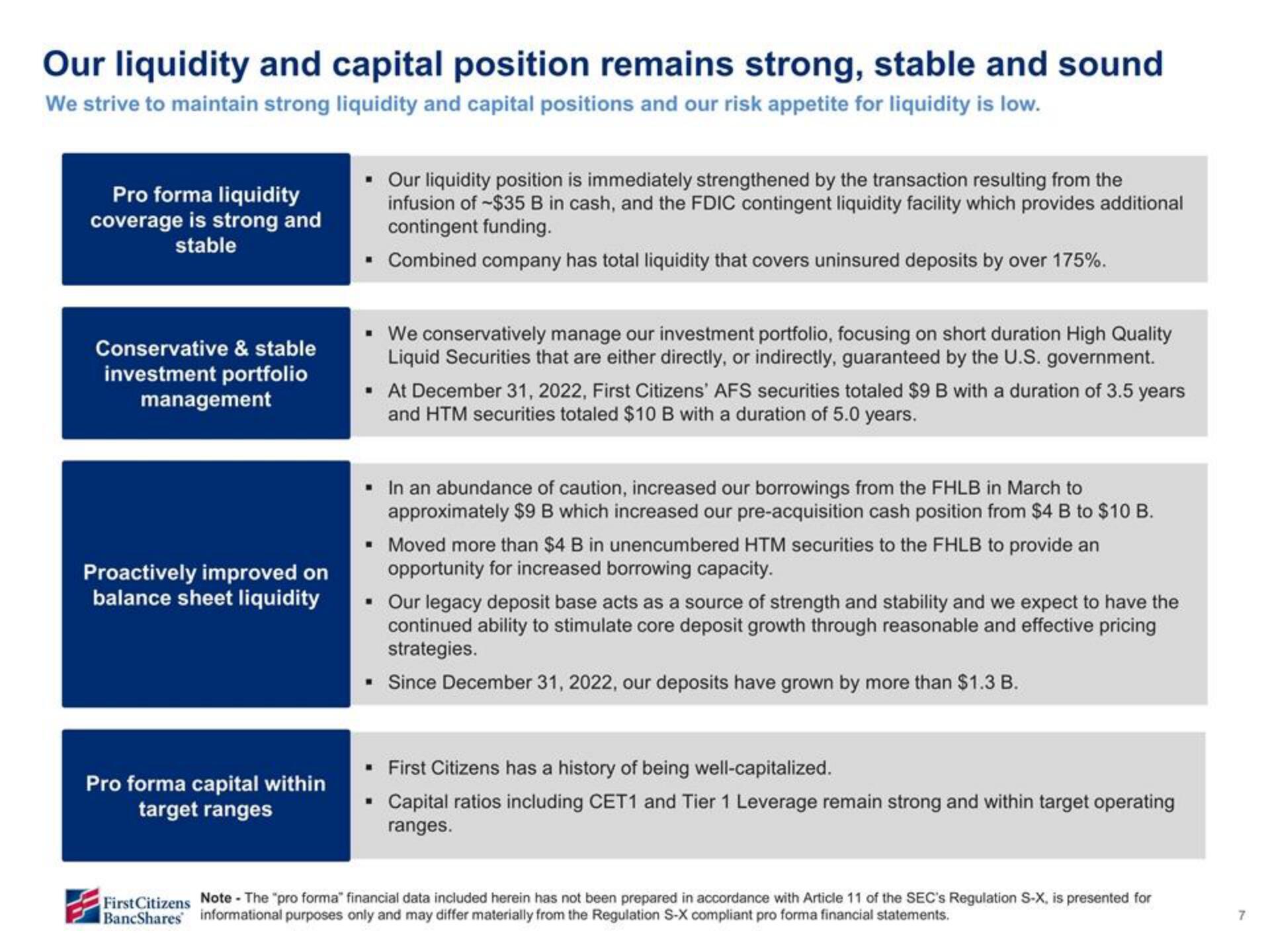

Our liquidity and capital position remains strong, stable and sound

We strive to maintain strong liquidity and capital positions and our risk appetite for liquidity is low.

Pro forma liquidity

coverage is strong and

stable

Conservative & stable

investment portfolio

management

Proactively improved on

balance sheet liquidity

Pro forma capital within

target ranges

▪ Our liquidity position is immediately strengthened by the transaction resulting from the

infusion of -$35 B in cash, and the FDIC contingent liquidity facility which provides additional

contingent funding.

▪ Combined company has total liquidity that covers uninsured deposits by over 175%.

We conservatively manage our investment portfolio, focusing on short duration High Quality

Liquid Securities that are either directly, or indirectly, guaranteed by the U.S. government.

▪ At December 31, 2022, First Citizens' AFS securities totaled $9 B with a duration of 3.5 years

and HTM securities totaled $10 B with a duration of 5.0 years.

▪ In an abundance of caution, increased our borrowings from the FHLB in March to

approximately $9 B which increased our pre-acquisition cash position from $4 B to $10 B.

▪ Moved more than $4 B in unencumbered HTM securities to the FHLB to provide an

opportunity for increased borrowing capacity.

▪ Our legacy deposit base acts as a source of strength and stability and we expect to have the

continued ability to stimulate core deposit growth through reasonable and effective pricing

strategies.

Since December 31, 2022, our deposits have grown by more than $1.3 B.

▪ First Citizens has a history of being well-capitalized.

▪ Capital ratios including CET1 and Tier 1 Leverage remain strong and within target operating

ranges.

First Citizens Note - The "pro forma financial data included herein has not been prepared in accordance with Article 11 of the SEC's Regulation S-X, is presented for

BancShares informational purposes only and may differ materially from the Regulation S-X compliant pro forma financial statements.

7View entire presentation