Apollo Global Management Investor Presentation Deck

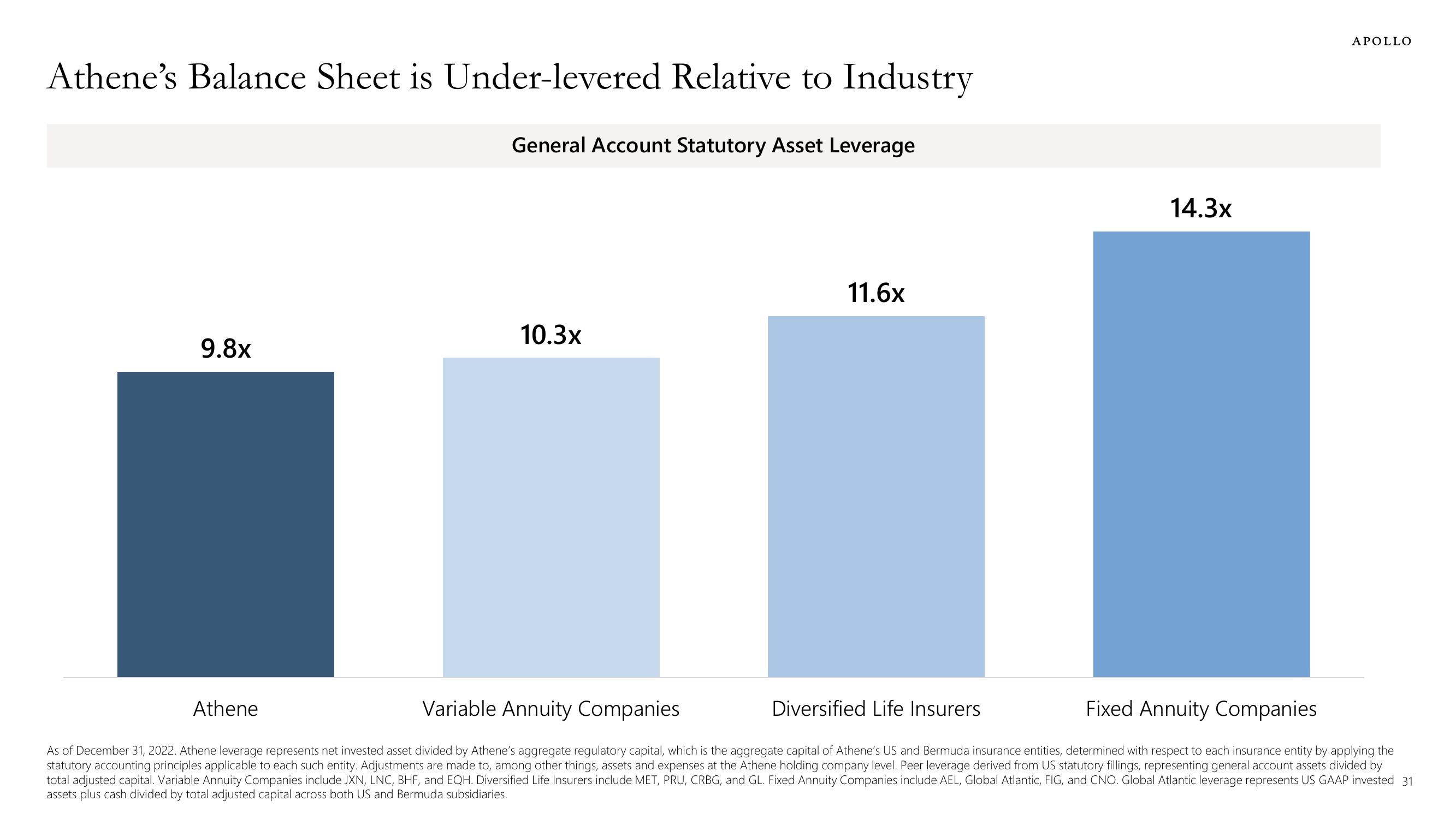

Athene's Balance Sheet is Under-levered Relative to Industry

9.8x

General Account Statutory Asset Leverage

Athene

10.3x

11.6x

14.3x

APOLLO

Variable Annuity Companies

Diversified Life Insurers

Fixed Annuity Companies

As of December 31, 2022. Athene leverage represents net invested asset divided by Athene's aggregate regulatory capital, which is the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the

statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the Athene holding company level. Peer leverage derived from US statutory fillings, representing general account assets divided by

total adjusted capital. Variable Annuity Companies include JXN, LNC, BHF, and EQH. Diversified Life Insurers include MET, PRU, CRBG, and GL. Fixed Annuity Companies include AEL, Global Atlantic, FIG, and CNO. Global Atlantic leverage represents US GAAP invested 31

assets plus cash divided by total adjusted capital across both US and Bermuda subsidiaries.View entire presentation