Silicon Valley Bank Results Presentation Deck

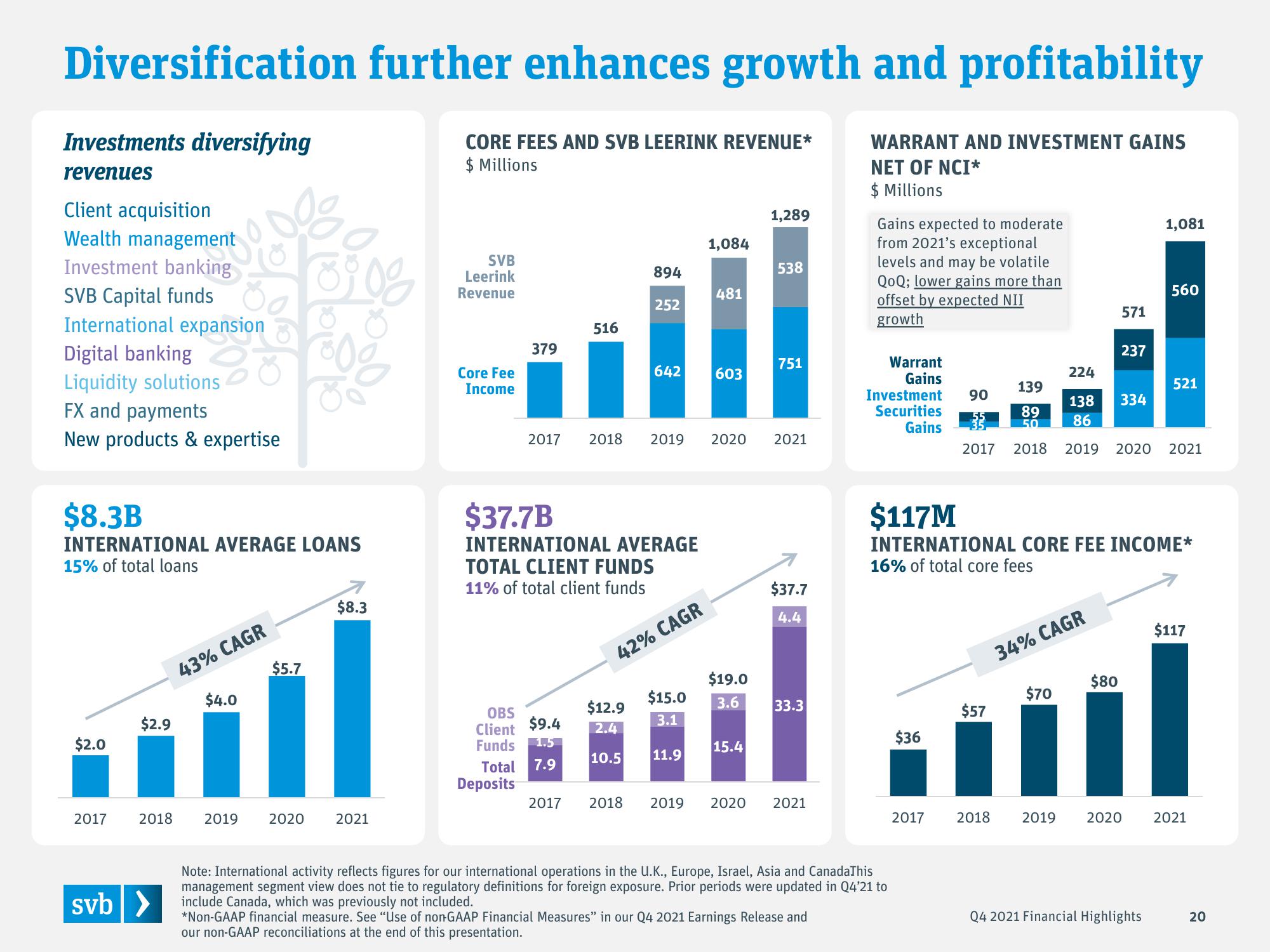

Diversification further enhances growth and profitability

CORE FEES AND SVB LEERINK REVENUE*

$ Millions

WARRANT AND INVESTMENT GAINS

NET OF NCI*

$ Millions

Investments diversifying

revenues

Client acquisition

Wealth management

Investment banking

SVB Capital funds

International expansion

Digital banking

Liquidity solutions

FX and payments

New products & expertise

$8.3B

INTERNATIONAL AVERAGE LOANS

15% of total loans

$2.0

$2.9

2017 2018

svb >

43% CAGR

$4.0

$5.7

8900

2019 2020

$8.3

2021

SVB

Leerink

Revenue

Core Fee

Income

379

2017

OBS

Client

Funds 1.5

$9.4

Deposits

Total 7.9

516

894

$37.7B

INTERNATIONAL AVERAGE

TOTAL CLIENT FUNDS

11% of total client funds

252

$12.9

2.4

642 603

1,084

42% CAGR

$15.0

3.1

481

2018 2019 2020 2021

10.5 11.9

$19.0

3.6

1,289

15.4

538

751

$37.7

4.4

33.3

2017 2018 2019 2020 2021

Gains expected to moderate

from 2021's exceptional

levels and may be volatile

QoQ; lower gains more than

offset by expected NII

growth

Warrant

Gains

Investment 90

Securities

Gains

Note: International activity reflects figures for our international operations in the U.K., Europe, Israel, Asia and CanadaThis

management segment view does not tie to regulatory definitions for foreign exposure. Prior periods were updated in Q4'21 to

include Canada, which was previously not included.

*Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and

our non-GAAP reconciliations at the end of this presentation.

$36

2017

$57

2018

$117M

INTERNATIONAL CORE FEE INCOME*

16% of total core fees

571

224

138 334

34% CAGR

$70

237

139

89

50 86

2017 2018 2019 2020 2021

$80

1,081

560

521

Q4 2021 Financial Highlights

$117

2019 2020 2021

20View entire presentation