Silicon Valley Bank Results Presentation Deck

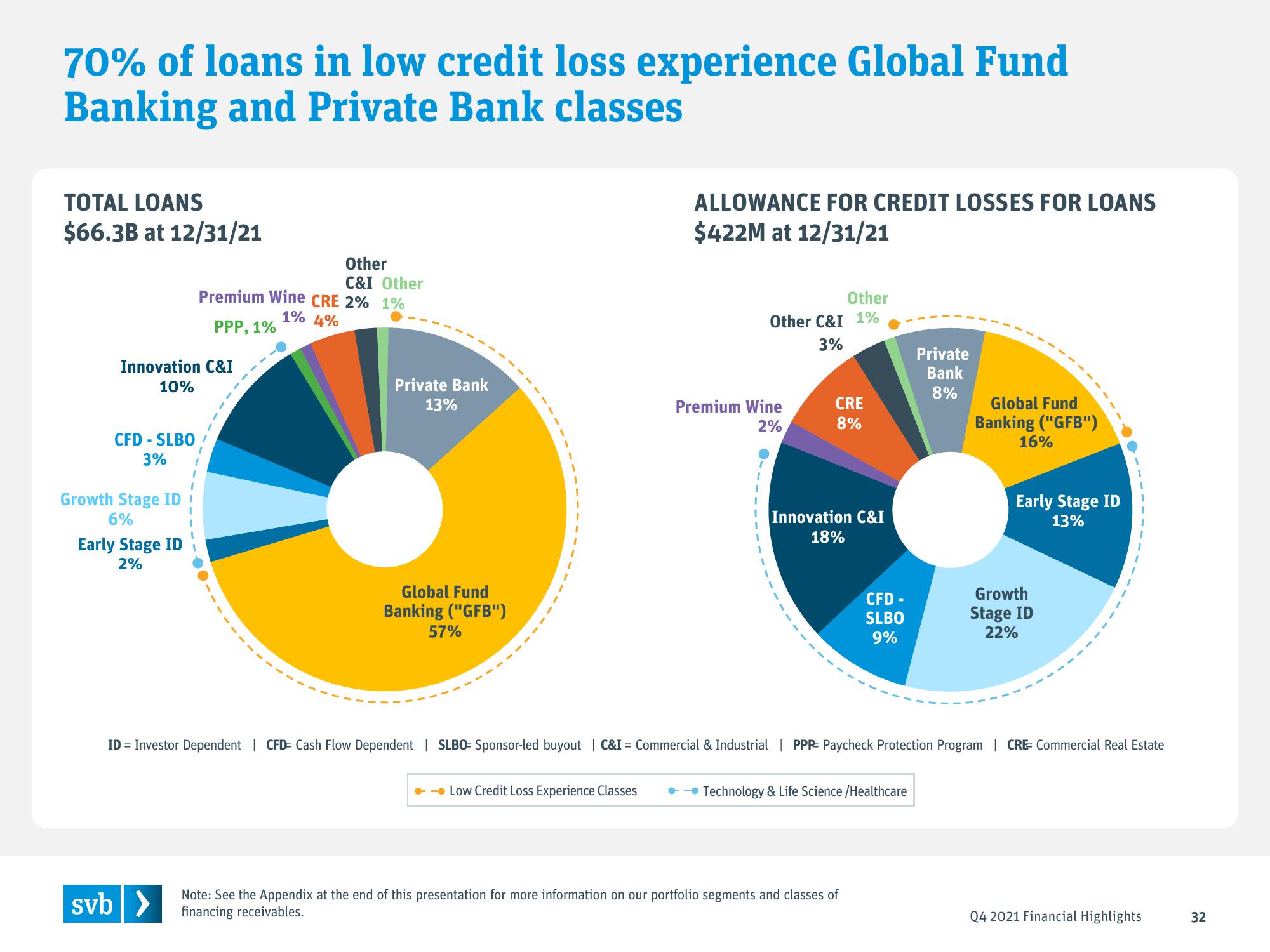

70% of loans in low credit loss experience Global Fund

Banking and Private Bank classes

TOTAL LOANS

$66.3B at 12/31/21

Innovation C&I

10%

CFD - SLBO

3%

Growth Stage ID !

6%

Early Stage ID

2%

Other

C&I Other

Premium Wine CRE 2% 1%

1% 4%

PPP, 1%

1

svb >

Private Bank

13%

Global Fund

Banking ("GFB")

57%

ALLOWANCE FOR CREDIT LOSSES FOR LOANS

$422M at 12/31/21

Low Credit Loss Experience Classes

Other C&I 1%

3%

Premium Wine

2%

Other

CRE

8%

Innovation C&I

18%

CFD -

SLBO

9%

Note: See the Appendix at the end of this presentation for more information on our portfolio segments and classes of

financing receivables.

Technology & Life Science /Healthcare

Private

Bank

8%

ID = Investor Dependent | CFD= Cash Flow Dependent | SLBO= Sponsor-led buyout | C&I= Commercial & Industrial | PPP Paycheck Protection Program | CRE- Commercial Real Estate

Global Fund

Banking ("GFB")

16%

Early Stage ID

13%

Growth

Stage ID

22%

Q4 2021 Financial Highlights

32View entire presentation