First Citizens BancShares Mergers and Acquisitions Presentation Deck

Acquired certain assets and assumed certain liabilities of Silicon Valley

Bridge Bank, N.A. from the FDIC

Acquisition details

▪ We acquired total assets of $110.1 billion with a $16.5 billion discount bid on

assets, consisting of:

o $72.1 billion in loans

o $56.5 billion in deposits

o No investment securities acquired

• Option to purchase all bank branches and corporate locations.

▪ Retaining employees in the acquired revenue-producing businesses and those

necessary to manage operations to support those businesses.

▪

FDIC received a value appreciation instrument from First Citizens BancShares, Inc.

valued at up to $500 million (payable in cash) and exercisable until April 14th, 2023.

Downside protections

• Transaction structured to limit liquidity and credit risks to First Citizens:

o Asset discount and loss share agreement with the FDIC provides downside

protection against credit risk.

o Five-year loss share agreement stipulates that the FDIC will reimburse First

Citizens for 50% of losses on commercial loans in excess of $5 billion.

o Entered into a liquidity facility with the FDIC to provide additional contingent

funding if needed.

Integration

▪ All regulatory approvals received and transaction has closed.

. All branches now operating as a division of First Citizens Bank.

All depositors will continue to have access to their funds.

First Citizens

BancShares

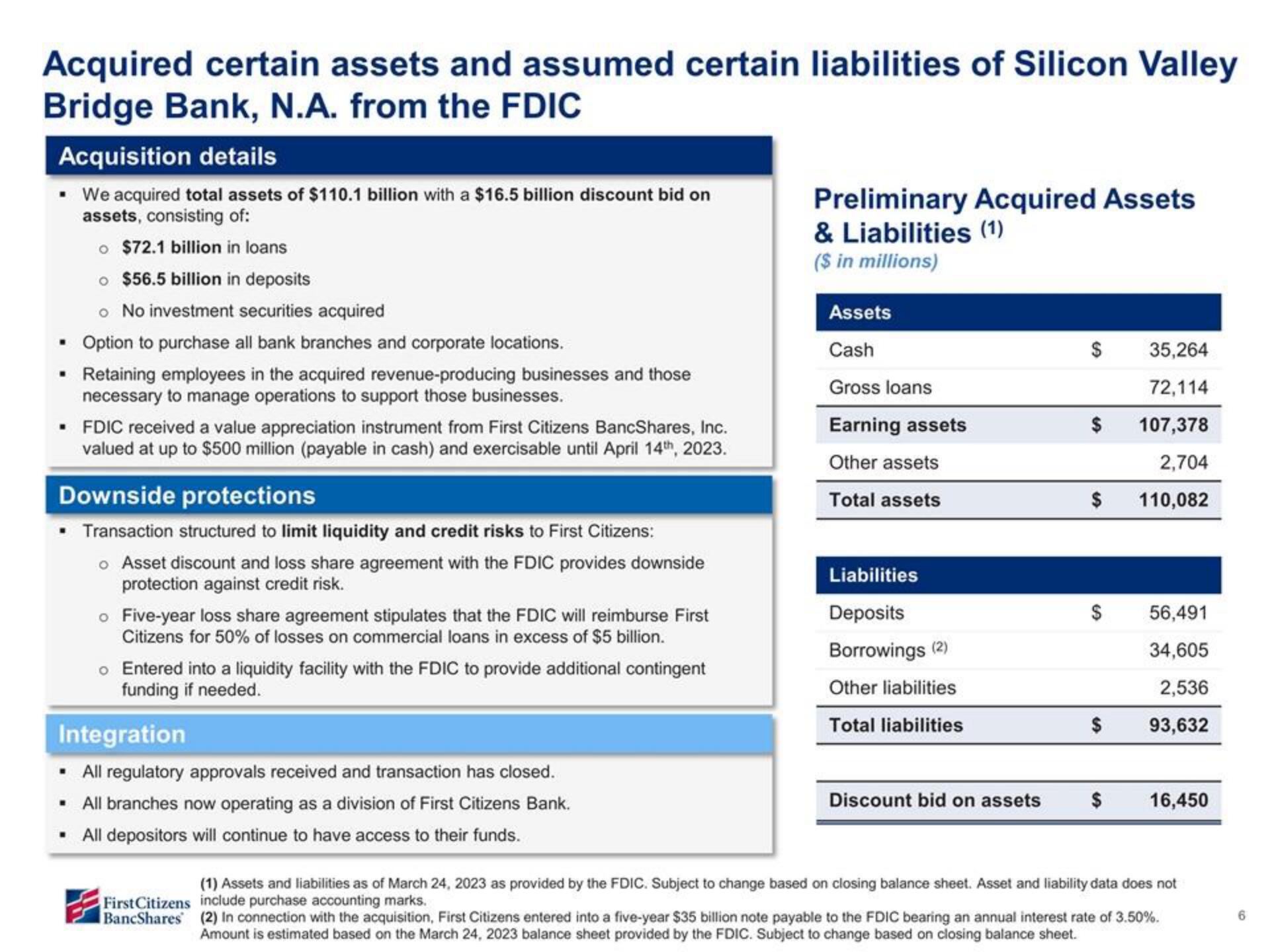

Preliminary Acquired Assets

& Liabilities (1)

($ in millions)

Assets

Cash

Gross loans

Earning assets

Other assets

Total assets

Liabilities

Deposits

Borrowings (2)

Other liabilities

Total liabilities

$

$

$

$

$

Discount bid on assets $

35,264

72,114

107,378

2,704

110,082

56,491

34,605

2,536

93,632

16,450

(1) Assets and liabilities as of March 24, 2023 as provided by the FDIC. Subject to change based on closing balance sheet. Asset and liability data does not

include purchase accounting marks.

(2) In connection with the acquisition, First Citizens entered into a five-year $35 billion note payable to the FDIC bearing an annual interest rate of 3.50%.

Amount is estimated based on the March 24, 2023 balance sheet provided by the FDIC. Subject to change based on closing balance sheet.View entire presentation