Apollo Global Management Investor Presentation Deck

Multi-Pronged Approach to the Global Wealth Opportunity

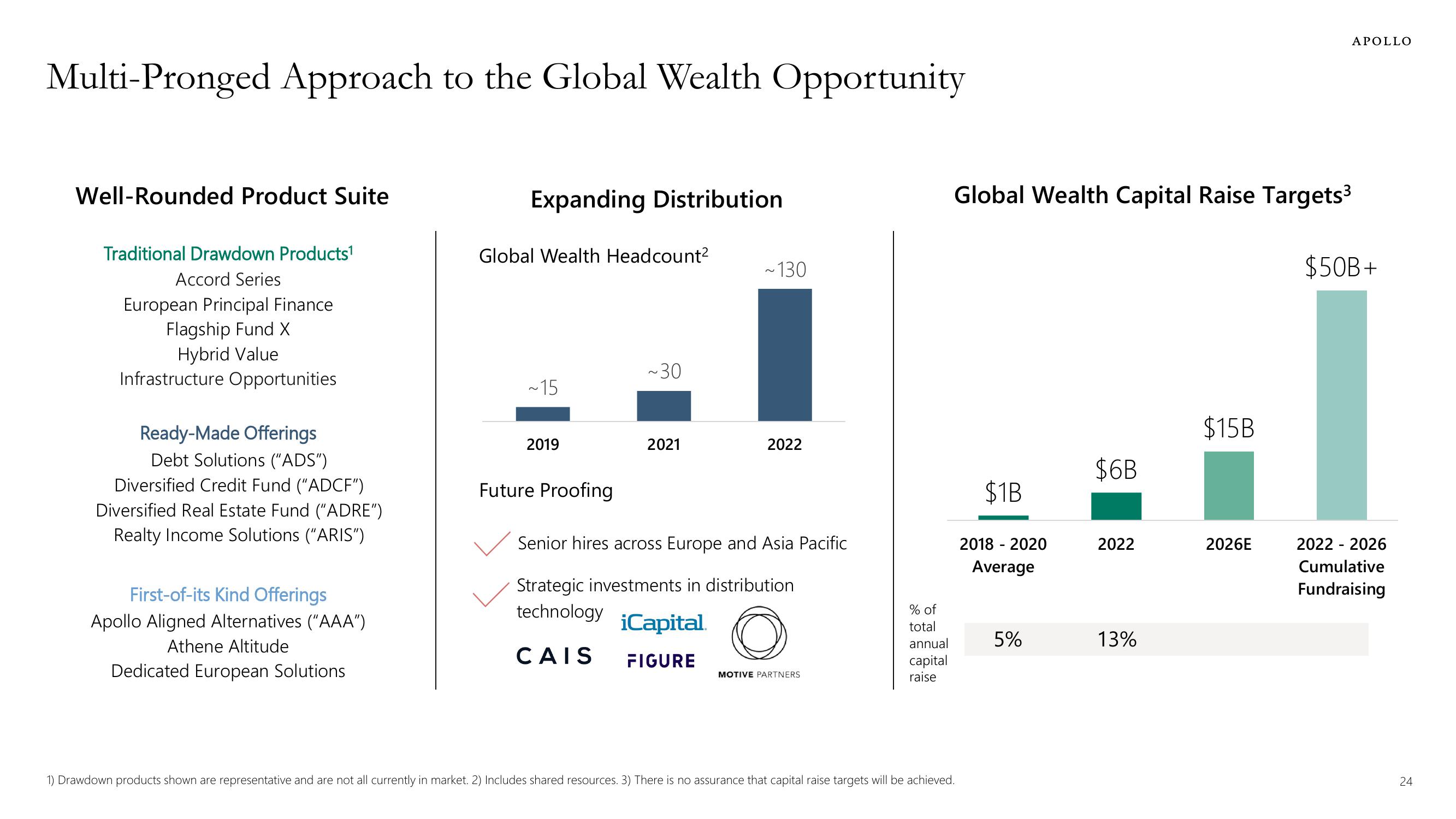

Well-Rounded Product Suite

Traditional Drawdown Products¹

Accord Series

European Principal Finance

Flagship Fund X

Hybrid Value

Infrastructure Opportunities

Ready-Made Offerings

Debt Solutions ("ADS")

Diversified Credit Fund ("ADCF")

Diversified Real Estate Fund ("ADRE")

Realty Income Solutions ("ARIS")

First-of-its Kind Offerings

Apollo Aligned Alternatives ("AAA")

Athene Altitude

Dedicated European Solutions

Expanding Distribution

Global Wealth Headcount²

~15

2019

Future Proofing

~30

2021

~130

iCapital

FIGURE

2022

Senior hires across Europe and Asia Pacific

Strategic investments in distribution

technology

O

CAIS

MOTIVE PARTNERS

% of

total

annual

capital

raise

Global Wealth Capital Raise Targets³

1) Drawdown products shown are representative and are not all currently in market. 2) Includes shared resources. 3) There is no assurance that capital raise targets will be achieved.

$1B

2018 - 2020

Average

5%

$6B

2022

13%

$15B

APOLLO

2026E

$50B+

2022 - 2026

Cumulative

Fundraising

24View entire presentation