Silicon Valley Bank Results Presentation Deck

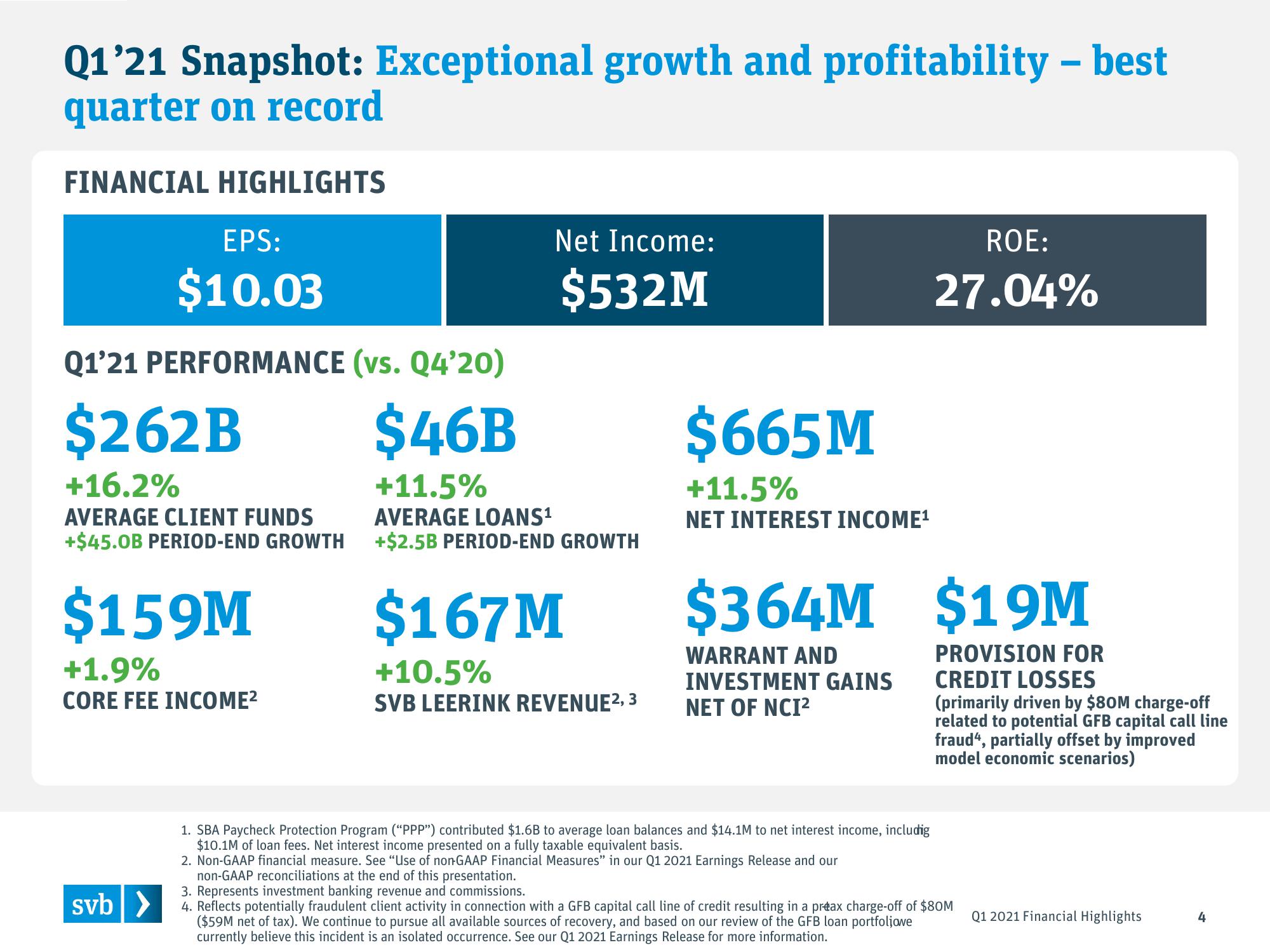

Q1'21 Snapshot: Exceptional growth and profitability - best

quarter on record

FINANCIAL HIGHLIGHTS

EPS:

$10.03

Q1'21 PERFORMANCE (vs. Q4'20)

$46B

+11.5%

AVERAGE LOANS¹

+$2.5B PERIOD-END GROWTH

$262B

+16.2%

AVERAGE CLIENT FUNDS

+$45.OB PERIOD-END GROWTH

$159M

+1.9%

CORE FEE INCOME²

svb >

Net Income:

$532M

$167 M

+10.5%

SVB LEERINK REVENUE², 3

$665 M

+11.5%

NET INTEREST INCOME¹

ROE:

27.04%

$364M $19M

PROVISION FOR

CREDIT LOSSES

(primarily driven by $80M charge-off

related to potential GFB capital call line

fraud", partially offset by improved

model economic scenarios)

WARRANT AND

INVESTMENT GAINS

NET OF NCI²

1. SBA Paycheck Protection Program ("PPP") contributed $1.6B to average loan balances and $14.1M to net interest income, includig

$10.1M of loan fees. Net interest income presented on a fully taxable equivalent basis.

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q1 2021 Earnings Release and our

non-GAAP reconciliations at the end of this presentation.

3. Represents investment banking revenue and commissions.

4. Reflects potentially fraudulent client activity in connection with a GFB capital call line of credit resulting in a preax charge-off of $80M

($59M net of tax). We continue to pursue all available sources of recovery, and based on our review of the GFB loan portfoliowe

currently believe this incident is an isolated occurrence. See our Q1 2021 Earnings Release for more information.

Q1 2021 Financial Highlights

4View entire presentation