Silicon Valley Bank Results Presentation Deck

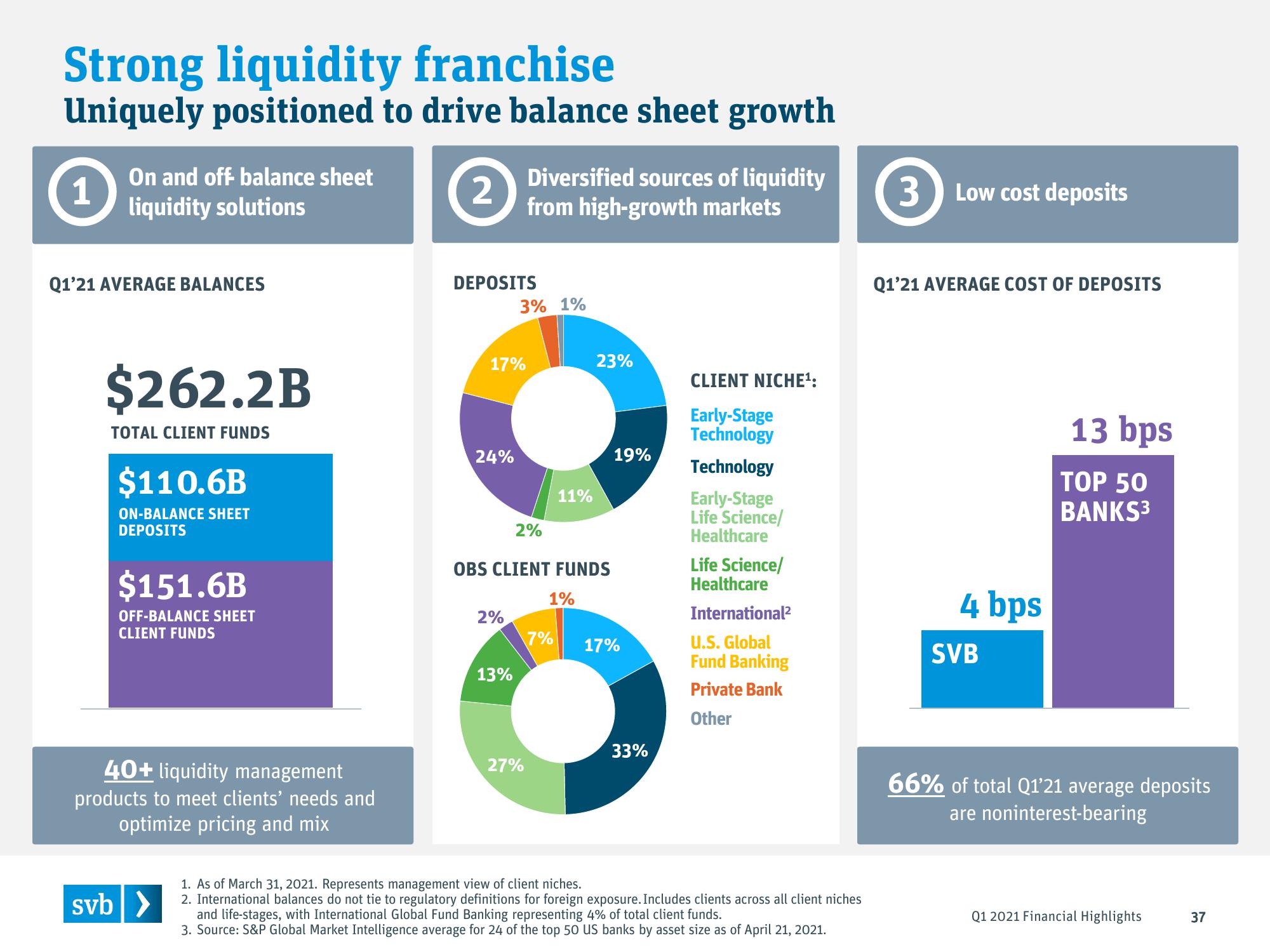

Strong liquidity franchise

Uniquely positioned to drive balance sheet growth

1

On and off balance sheet

liquidity solutions

Q1'21 AVERAGE BALANCES

$262.2B

TOTAL CLIENT FUNDS

$110.6B

ON-BALANCE SHEET

DEPOSITS

$151.6B

OFF-BALANCE SHEET

CLIENT FUNDS

40+ liquidity management

products to meet clients' needs and

optimize pricing and mix

svb >

2

DEPOSITS

17%

24%

2%

Diversified sources of liquidity

from high-growth markets

3% 1%

13%

2%

OBS CLIENT FUNDS

1%

27%

11%

7%

23%

19%

17%

33%

CLIENT NICHE¹:

Early-Stage

Technology

Technology

Early-Stage

Life Science/

Healthcare

Life Science/

Healthcare

International²

U.S. Global

Fund Banking

Private Bank

Other

1. As of March 31, 2021. Represents management view of client niches.

2. International balances do not tie to regulatory definitions for foreign exposure. Includes clients across all client niches

and life-stages, with International Global Fund Banking representing 4% of total client funds.

3. Source: S&P Global Market Intelligence average for 24 of the top 50 US banks by asset size as of April 21, 2021.

3 Low cost deposits

Q1'21 AVERAGE COST OF DEPOSITS

4 bps

SVB

13 bps

TOP 50

BANKS³

66% of total Q1'21 average deposits

are noninterest-bearing

Q1 2021 Financial Highlights

37View entire presentation