Silicon Valley Bank Results Presentation Deck

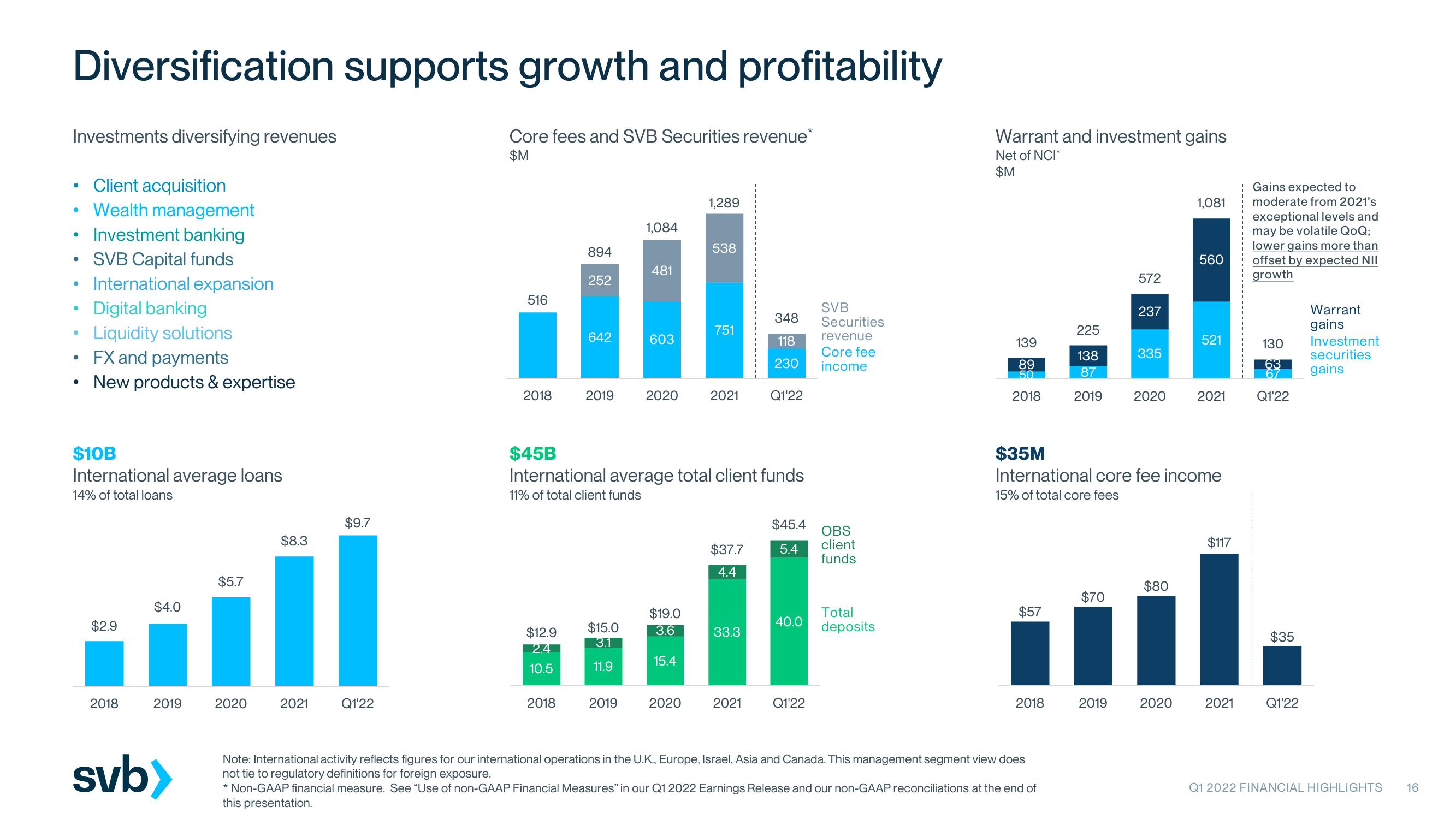

Diversification supports growth and profitability

Investments diversifying revenues

●

●

●

●

e

●

Client acquisition

Wealth management

Investment banking

SVB Capital funds

International expansion

Digital banking

Liquidity solutions

FX and payments

New products & expertise

$10B

International average loans

14% of total loans

$2.9

2018

$4.0

2019

svb>

$5.7

2020

$8.3

2021

$9.7

Q1'22

Core fees and SVB Securities revenue*

$M

516

2018

$12.9

2.4

10.5

894

2018

252

642

2019

$15.0

3.1

11.9

1,084

2019

481

603

2020

$19.0

3.6

$45B

International average total client funds

11% of total client funds

15.4

1,289

2020

538

751

2021

$37.7

4.4

33.3

348

118

230

2021

Q1'22

$45.4

OBS

5.4 client

funds

40.0

SVB

Securities

revenue

Core fee

income

Q1'22

Total

deposits

Warrant and investment gains

Net of NCI*

$M

139

89

50

2018

$57

2018

225

138

87

2019

Note: International activity reflects figures for our international operations in the U.K., Europe, Israel, Asia and Canada. This management segment view does

not tie to regulatory definitions for foreign exposure.

* Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q1 2022 Earnings Release and our non-GAAP reconciliations at the end of

this presentation.

$70

572

2019

237

335

2020

$35M

International core fee income

15% of total core fees

$80

1,081

2020

560

521

2021

$117

2021

Gains expected to

moderate from 2021's

exceptional levels and

may be volatile QoQ;

lower gains more than

offset by expected NII

growth

130

63

67

Q1'22

$35

Q1'22

Warrant

gains

Investment

securities

gains

Q1 2022 FINANCIAL HIGHLIGHTS 16View entire presentation