Apollo Global Management Investor Presentation Deck

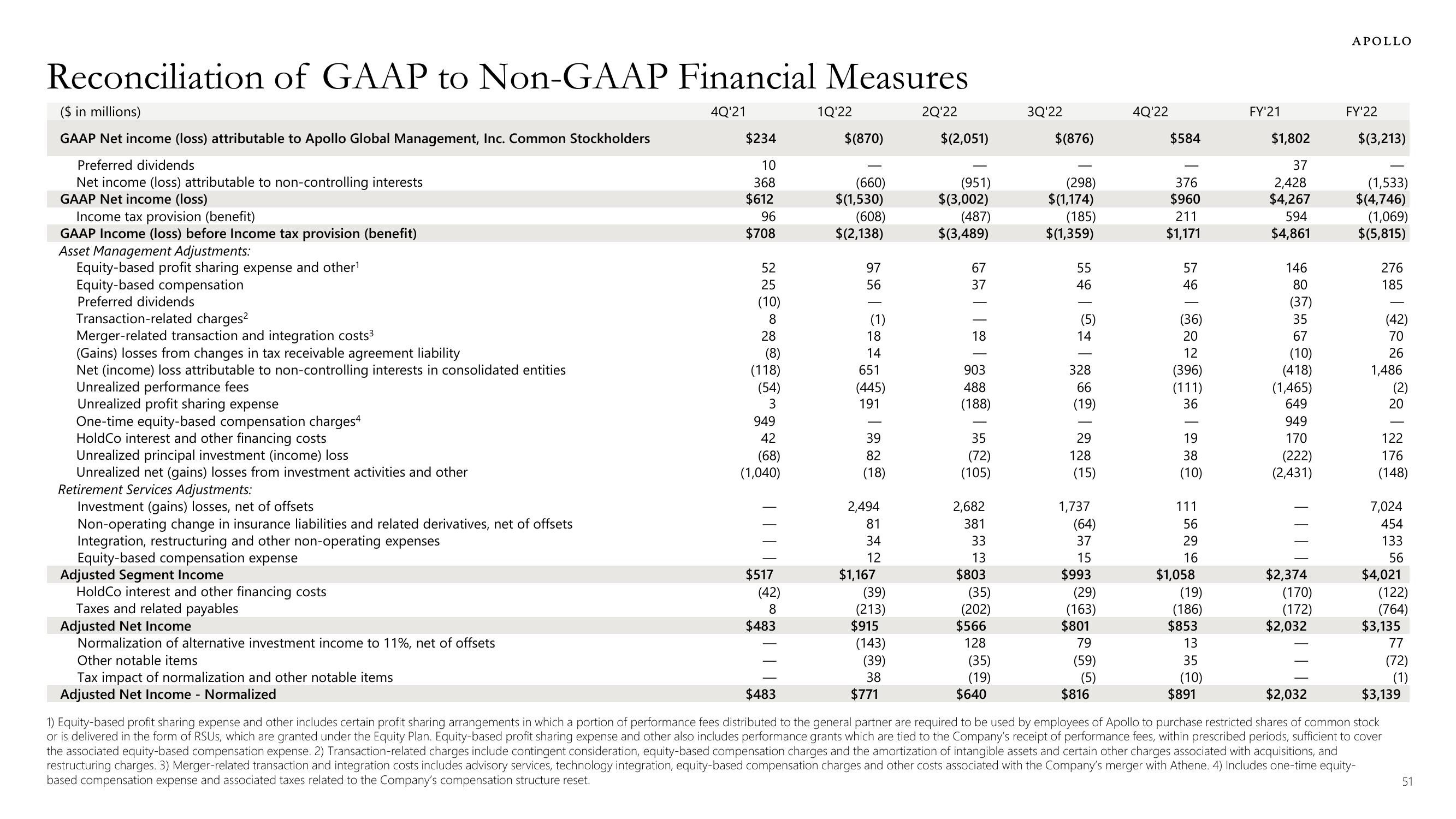

Reconciliation of GAAP to Non-GAAP Financial Measures

($ in millions)

GAAP Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders

Preferred dividends

Net income (loss) attributable to non-controlling interests

GAAP Net income (loss)

Income tax provision (benefit)

GAAP Income (loss) before Income tax provision (benefit)

Asset anagement Adjustments:

Equity-based profit sharing expense and other¹

Equity-based compensation

Preferred dividends

Transaction-related charges²

Merger-related transaction and integration costs³

(Gains) losses from changes in tax receivable agreement liability

Net (income) loss attributable to non-controlling interests in consolidated entities

Unrealized performance fees

Unrealized profit sharing expense

One-time equity-based compensation charges4

HoldCo interest and other financing costs

Unrealized principal investment (income) loss

Unrealized net (gains) losses from investment activities and other

Retirement Services Adjustments:

Investment (gains) losses, net of offsets

Non-operating change in insurance liabilities and related derivatives, net of offsets

Integration, restructuring and other non-operating expenses

Equity-based compensation expense

Adjusted Segment Income

HoldCo interest and other financing costs

Taxes and related payables

Adjusted Net Income

Normalization of alternative investment income to 11%, net of offsets

Other notable items

Tax impact of normalization and other notable items

Adjusted Net Income - Normalized

4Q'21

$234

10

368

$612

96

$708

52

25

(10)

8

28

(8)

(118)

(54)

3

949

42

(68)

(1,040)

$517

(42)

8

$483

1Q'22

$(870)

(660)

$(1,530)

(608)

$(2,138)

97

56

(1)

18

14

651

(445)

191

39

82

(18)

2,494

81

34

12

$1,167

(39)

(213)

$915

(143)

(39)

38

$771

2Q'22

$(2,051)

(951)

$ (3,002)

(487)

$(3,489)

\ \ ៩ \ \ ||

T

903

488

(188)

(72)

(105)

2,682

381

33

13

$803

(35)

(202)

$566

128

(35)

(19)

3Q'22

$640

$(876)

(298)

$(1,174)

(185)

$(1,359)

55

46

(5)

14

328

66

(19)

29

128

(15)

1,737

(64)

37

15

$993

(29)

(163)

$801

79

(59)

(5)

4Q'22

$816

$584

376

$960

211

$1,171

57

46

(36)

20

12

(396)

(111)

36

19

38

(10)

111

56

29

16

$1,058

(19)

(186)

$853

13

35

(10)

FY'21

$891

$1,802

37

2,428

$4,267

594

$4,861

146

80

(37)

35

67

(10)

(418)

(1,465)

649

949

170

(222)

(2,431)

||||||

$2,374

(170)

(172)

$2,032

APOLLO

FY'22

$ (3,213)

(1,533)

$(4,746)

(1,069)

$(5,815)

*B| @R*y@8 | 229 2³

$483

$2,032

1) Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are required to be used by employees of Apollo to purchase restricted shares of common stock

or is delivered in the form of RSUS, which are granted under the Equity Plan. Equity-based profit sharing expense and other also includes performance grants which are tied to the Company's receipt of performance fees, within prescribed periods, sufficient to cover

the associated equity-based compensation expense. 2) Transaction-related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions, and

restructuring charges. 3) Merger-related transaction and integration costs includes advisory services, technology integration, equity-based compensation charges and other costs associated with the Company's merger with Athene. 4) Includes one-time equity-

based compensation expense and associated taxes related to the Company's compensation structure reset.

$4,021

(764)

$3,135

77

(72)

(1)

$3,139

51View entire presentation