Silicon Valley Bank Results Presentation Deck

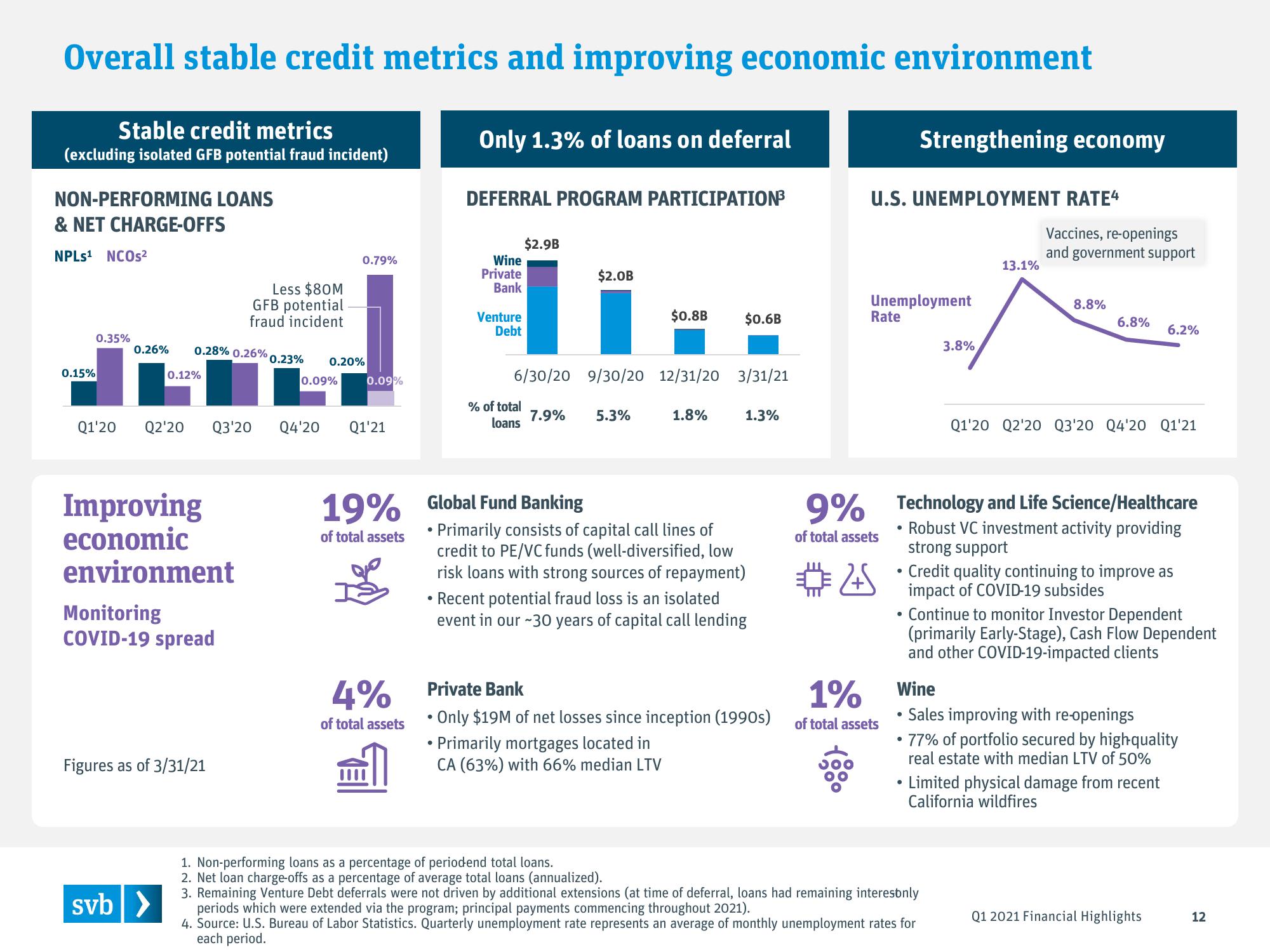

Overall stable credit metrics and improving economic environment

Stable credit metrics

(excluding isolated GFB potential fraud incident)

NON-PERFORMING LOANS

& NET CHARGE-OFFS

NPLs¹ NCOs²

0.15%

0.35%

Q1'20

0.26%

0.28% 0.26%

0.12%

Q2'20 Q3'20

Improving

economic

environment

Monitoring

COVID-19 spread

svb >

Less $80M

GFB potential

fraud incident

Figures as of 3/31/21

0.79%

0.23% 0.20%

0.09%

0.09%

Q4'20 Q1'21

Only 1.3% of loans on deferral

4%

of total assets

DEFERRAL PROGRAM PARTICIPATION³

Wine

Private

Bank

Venture

Debt

$2.9B

% of total

loans

7.9%

19% Global Fund Banking

of total assets

$2.0B

6/30/20 9/30/20 12/31/20 3/31/21

$0.8B

5.3%

$0.6B

1.8%

1.3%

•Primarily consists of capital call lines of

credit to PE/VC funds (well-diversified, low

risk loans with strong sources of repayment)

• Recent potential fraud loss is an isolated

event in our ~30 years of capital call lending

Private Bank

• Only $19M of net losses since inception (1990s)

• Primarily mortgages located in

CA (63%) with 66% median LTV

U.S. UNEMPLOYMENT RATE4

Unemployment

Rate

1%

of total assets

Strengthening economy

●

●

.

3.8%

13.1%

Vaccines, re-openings

and government support

9% Technology and Life Science/Healthcare

of total assets

• Robust VC investment activity providing

strong support

25

8.8%

6.8%

1. Non-performing loans as a percentage of periodend total loans.

2. Net loan charge-offs as a percentage of average total loans (annualized).

3. Remaining Venture Debt deferrals were not driven by additional extensions (at time of deferral, loans had remaining interesonly

periods which were extended via the program; principal payments commencing throughout 2021).

4. Source: U.S. Bureau of Labor Statistics. Quarterly unemployment rate represents an average of monthly unemployment rates for

each period.

Q1'20 Q2'20 Q3'20 Q4'20 Q1'21

6.2%

Credit quality continuing to improve as

impact of COVID-19 subsides

Wine

Sales improving with re-openings

• 77% of portfolio secured by high-quality

real estate with median LTV of 50%

Continue to monitor Investor Dependent

(primarily Early-Stage), Cash Flow Dependent

and other COVID-19-impacted clients

Limited physical damage from recent

California wildfires

Q1 2021 Financial Highlights

12View entire presentation