Silicon Valley Bank Results Presentation Deck

Significant securities purchases as deposit inflows continued

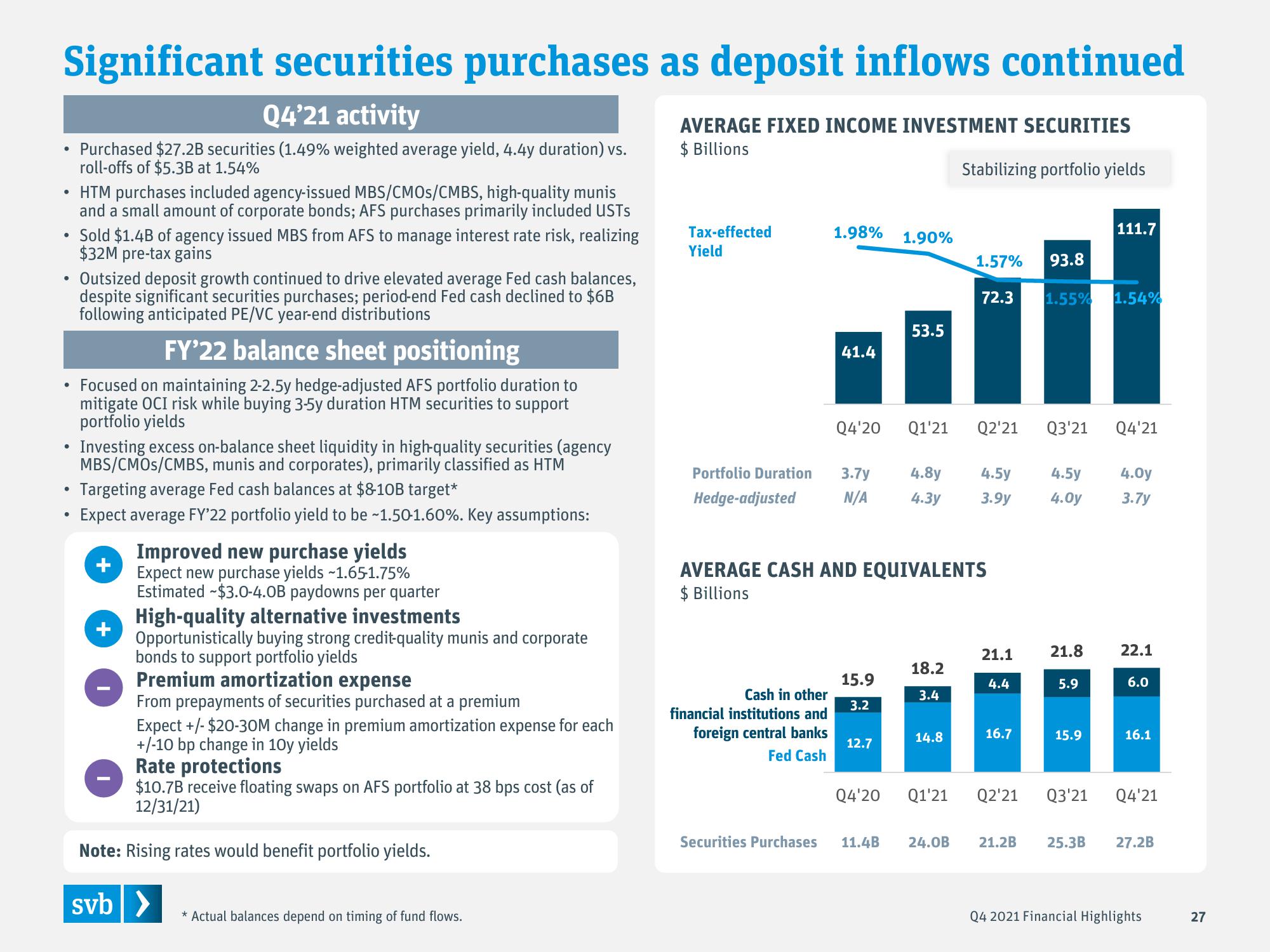

Q4'21 activity

Purchased $27.2B securities (1.49% weighted average yield, 4.4y duration) vs.

roll-offs of $5.3B at 1.54%

●

●

●

●

HTM purchases included agency-issued MBS/CMOS/CMBS, high-quality munis

and a small amount of corporate bonds; AFS purchases primarily included USTS

●

Sold $1.4B of agency issued MBS from AFS to manage interest rate risk, realizing

$32M pre-tax gains

Outsized deposit growth continued to drive elevated average Fed cash balances,

despite significant securities purchases; period-end Fed cash declined to $6B

following anticipated PE/VC year-end distributions

FY'22 balance sheet positioning

• Focused on maintaining 2-2.5y hedge-adjusted AFS portfolio duration to

mitigate OCI risk while buying 3-5y duration HTM securities to support

portfolio yields

Investing excess on-balance sheet liquidity in high-quality securities (agency

MBS/CMOS/CMBS, munis and corporates), primarily classified as HTM

Targeting average Fed cash balances at $8-10B target*

Expect average FY'22 portfolio yield to be ~1.50-1.60%. Key assumptions:

+

Improved new purchase yields

Expect new purchase yields ~1.65-1.75%

Estimated $3.0-4.0B paydowns per quarter

High-quality alternative investments

Opportunistically buying strong credit-quality munis and corporate

bonds to support portfolio yields

Premium amortization expense

From prepayments of securities purchased at a premium

Expect +/- $20-30M change in premium amortization expense for each

+/-10 bp change in 10y yields

Rate protections

$10.7B receive floating swaps on AFS portfolio at 38 bps cost (as of

12/31/21)

Note: Rising rates would benefit portfolio yields.

svb >

* Actual balances depend on timing of fund flows.

AVERAGE FIXED INCOME INVESTMENT SECURITIES

$ Billions

Stabilizing portfolio yields

Tax-effected

Yield

1.98%

Cash in other

financial institutions and

foreign central banks

Fed Cash

41.4

Securities Purchases

Q4'20

Portfolio Duration 3.7y 4.8y

Hedge-adjusted N/A

4.3y

15.9

3.2

1.90%

12.7

53.5

Q4'20

AVERAGE CASH AND EQUIVALENTS

$ Billions

Q1'21 Q2'21

18.2

3.4

14.8

1.57% 93.8

Q1'21

72.3

11.4B 24.0B

4.5y

4.5y

3.9y 4.0y

21.1

4.4

16.7

1.55%

Q2'21

Q3'21

21.8

5.9

15.9

111.7

1.54%

Q4'21

4.0y

3.7y

22.1

6.0

16.1

Q3'21 Q4'21

21.2B 25.3B 27.2B

Q4 2021 Financial Highlights

27View entire presentation