Apollo Global Management Investor Presentation Deck

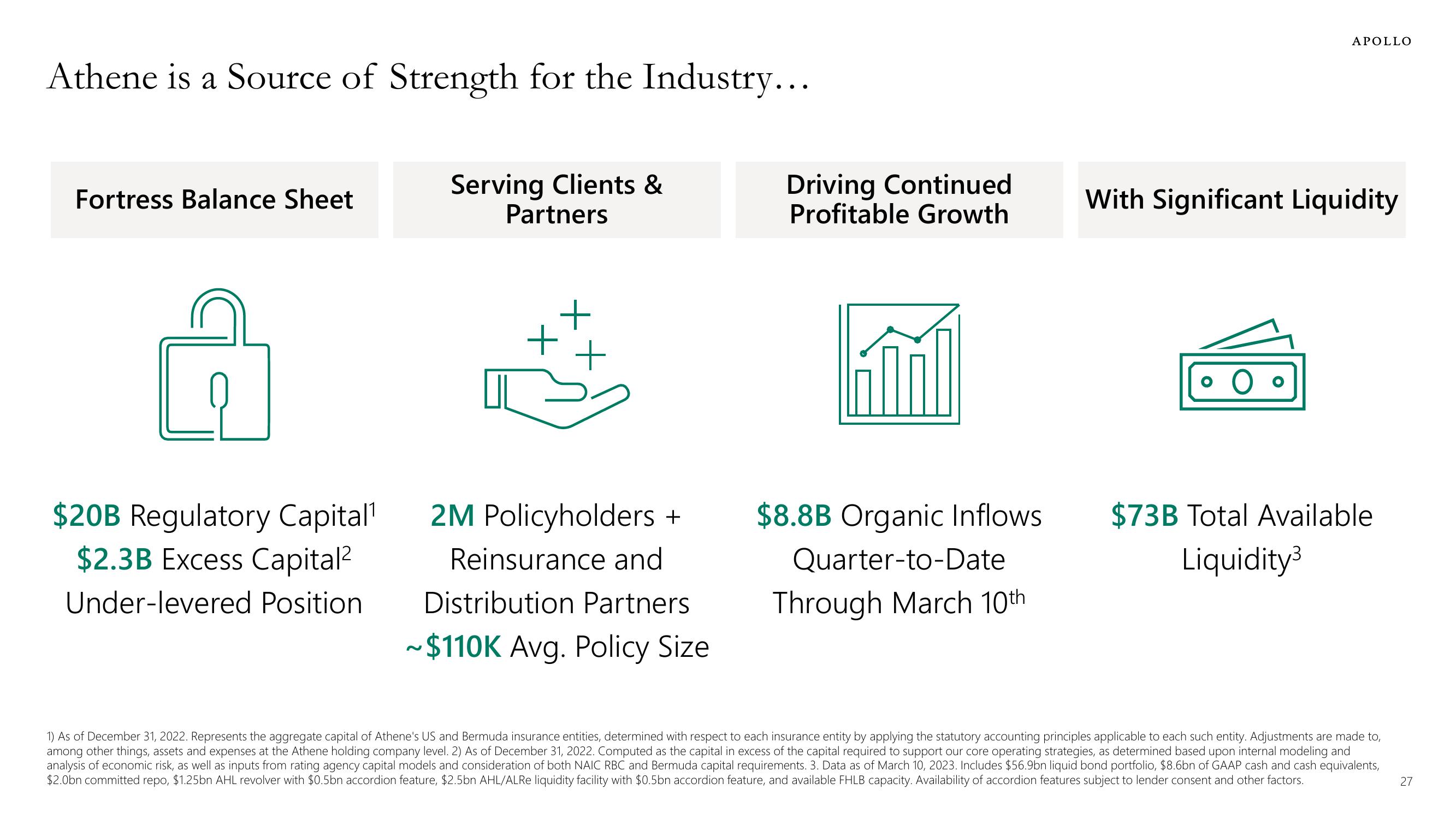

Athene is a Source of Strength for the Industry...

Fortress Balance Sheet

G

$20B Regulatory Capital¹

$2.3B Excess Capital²

Under-levered Position

Serving Clients &

Partners

2M Policyholders +

Reinsurance and

Distribution Partners

~$110K Avg. Policy Size

Driving Continued

Profitable Growth

$8.8B Organic Inflows

Quarter-to-Date

Through March 10th

APOLLO

With Significant Liquidity

$73B Total Available

Liquidity³

1) As of December 31, 2022. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to,

among other things, assets and expenses at the Athene holding company level. 2) As of December 31, 2022. Computed as the capital in excess of the capital required to support our core operating strategies, as determined based upon internal modeling and

analysis of economic risk, as well as inputs from rating agency capital models and consideration of both NAIC RBC and Bermuda capital requirements. 3. Data as of March 10, 2023. Includes $56.9bn liquid bond portfolio, $8.6bn of GAAP cash and cash equivalents,

$2.0bn committed repo, $1.25bn AHL revolver with $0.5bn accordion feature, $2.5bn AHL/ALRe liquidity facility with $0.5bn accordion feature, and available FHLB capacity. Availability of accordion features subject to lender consent and other factors.

27View entire presentation