Silicon Valley Bank Results Presentation Deck

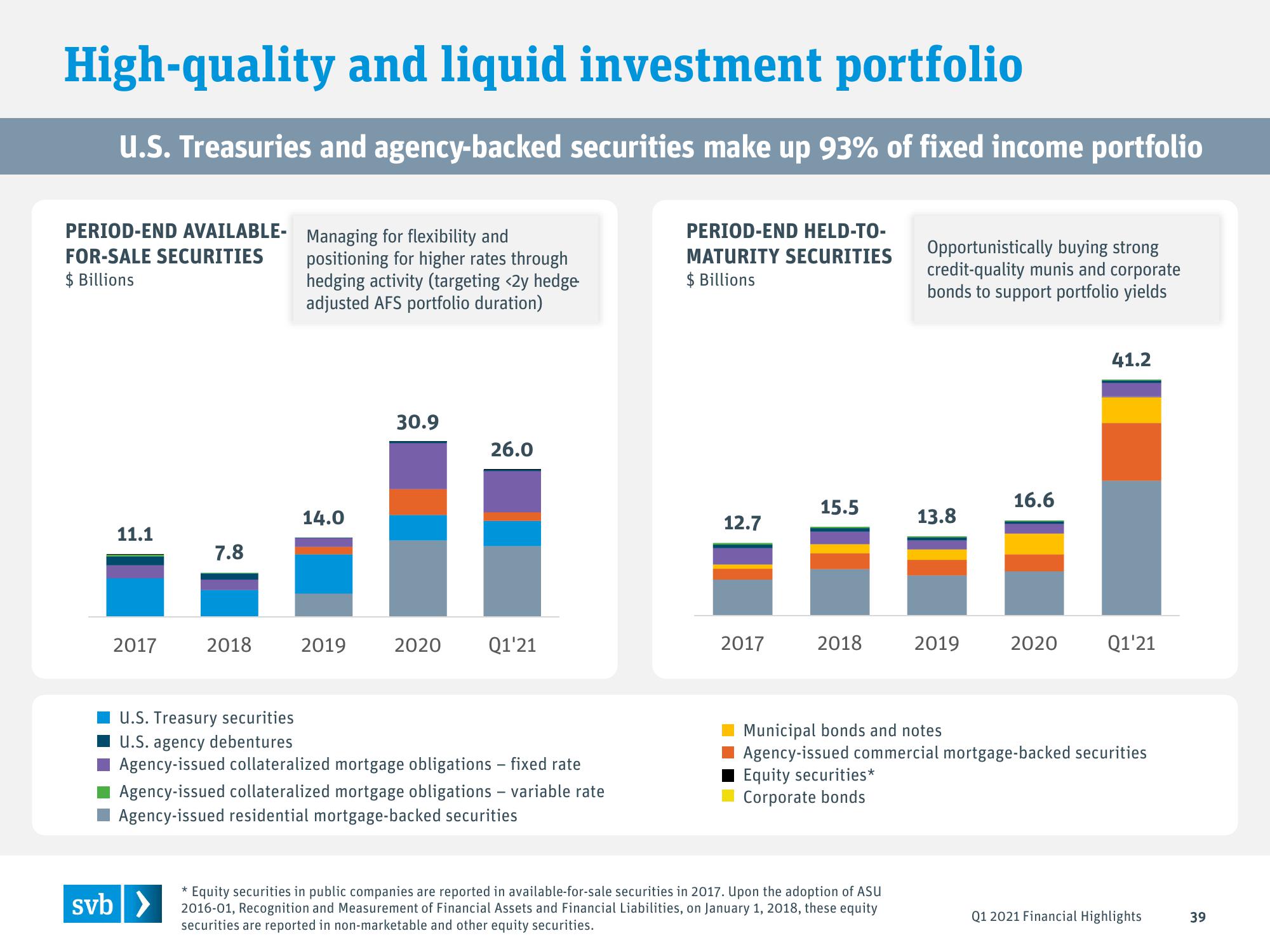

High-quality and liquid investment portfolio

U.S. Treasuries and agency-backed securities make up 93% of fixed income portfolio

PERIOD-END AVAILABLE- Managing for flexibility and

FOR-SALE SECURITIES

$ Billions

11.1

2017

7.8

svb >

2018

positioning for higher rates through

hedging activity (targeting <2y hedge

adjusted AFS portfolio duration)

14.0

2019

30.9

26.0

2020 Q1¹21

U.S. Treasury securities

U.S. agency debentures

Agency-issued collateralized mortgage obligations - fixed rate

Agency-issued collateralized mortgage obligations - variable rate

Agency-issued residential mortgage-backed securities

PERIOD-END HELD-TO-

MATURITY SECURITIES

$ Billions

12.7

2017

15.5

2018

Opportunistically buying strong

credit-quality munis and corporate

bonds to support portfolio yields

* Equity securities in public companies are reported in available-for-sale securities in 2017. Upon the adoption of ASU

2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities, on January 1, 2018, these equity

securities are reported in non-marketable and other equity securities.

13.8

2019

16.6

2020

41.2

Q1'21

Municipal bonds and notes

Agency-issued commercial mortgage-backed securities

Equity securities*

Corporate bonds

Q1 2021 Financial Highlights

39View entire presentation