Rent The Runway Results Presentation Deck

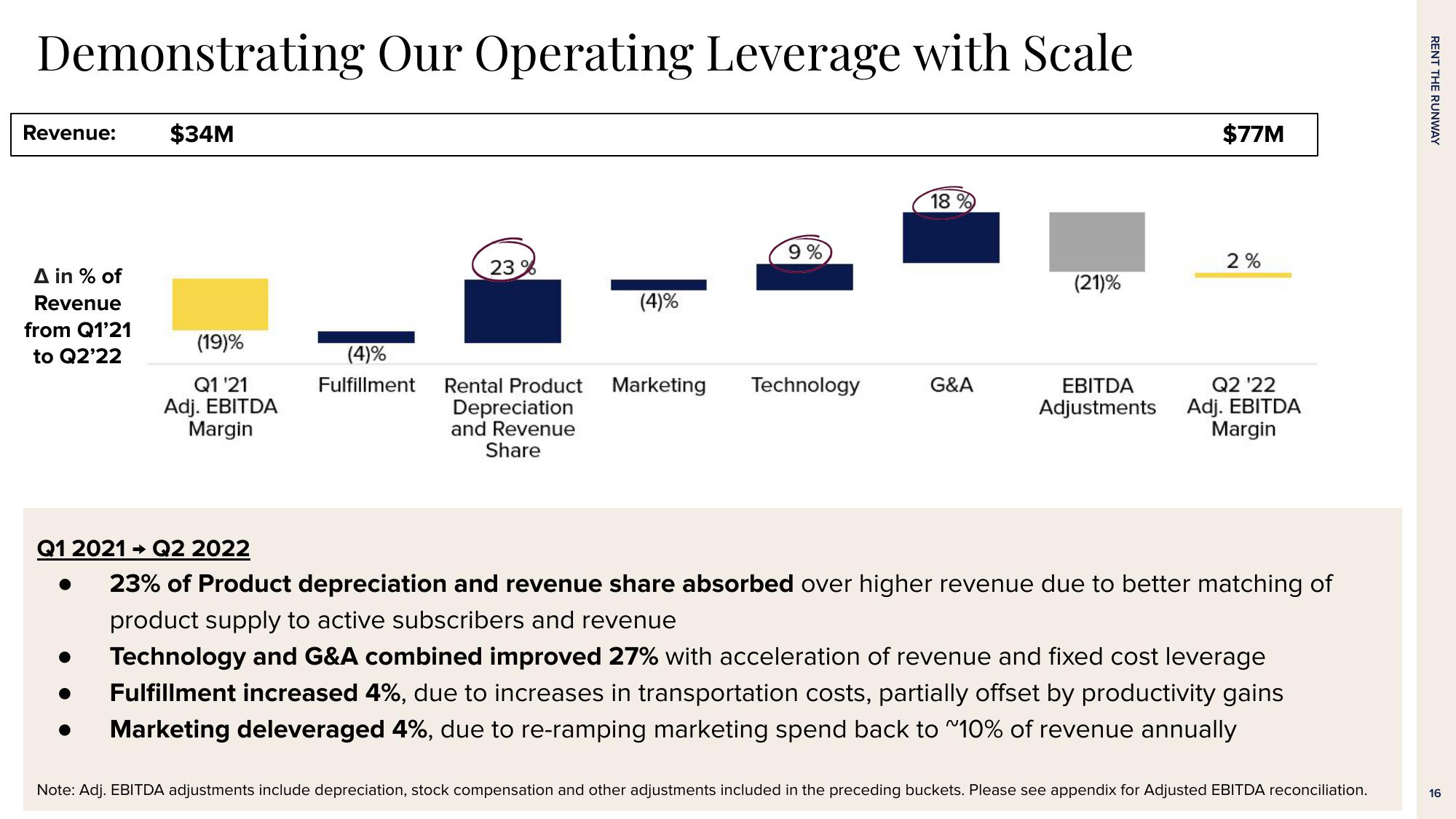

Demonstrating Our Operating Leverage with Scale

Revenue:

A in % of

Revenue

from Q1'21

to Q2'22

$34M

➡>>

(19)%

Q1 '21

Adj. EBITDA

Margin

Q1 2021 Q2 2022

(4)%

Fulfillment

23 %

Rental Product

Depreciation

and Revenue

Share

(4)%

9%

Marketing Technology

18%

G&A

(21)%

EBITDA

Adjustments

$77M

2%

Q2 '22

Adj. EBITDA

Margin

23% of Product depreciation and revenue share absorbed over higher revenue due to better matching of

product supply to active subscribers and revenue

Technology and G&A combined improved 27% with acceleration of revenue and fixed cost leverage

Fulfillment increased 4%, due to increases in transportation costs, partially offset by productivity gains

Marketing deleveraged 4%, due to re-ramping marketing spend back to ~10% of revenue annually

Note: Adj. EBITDA adjustments include depreciation, stock compensation and other adjustments included in the preceding buckets. Please see appendix for Adjusted EBITDA reconciliation.

RENT THE RUNWAY

16View entire presentation