Silicon Valley Bank Results Presentation Deck

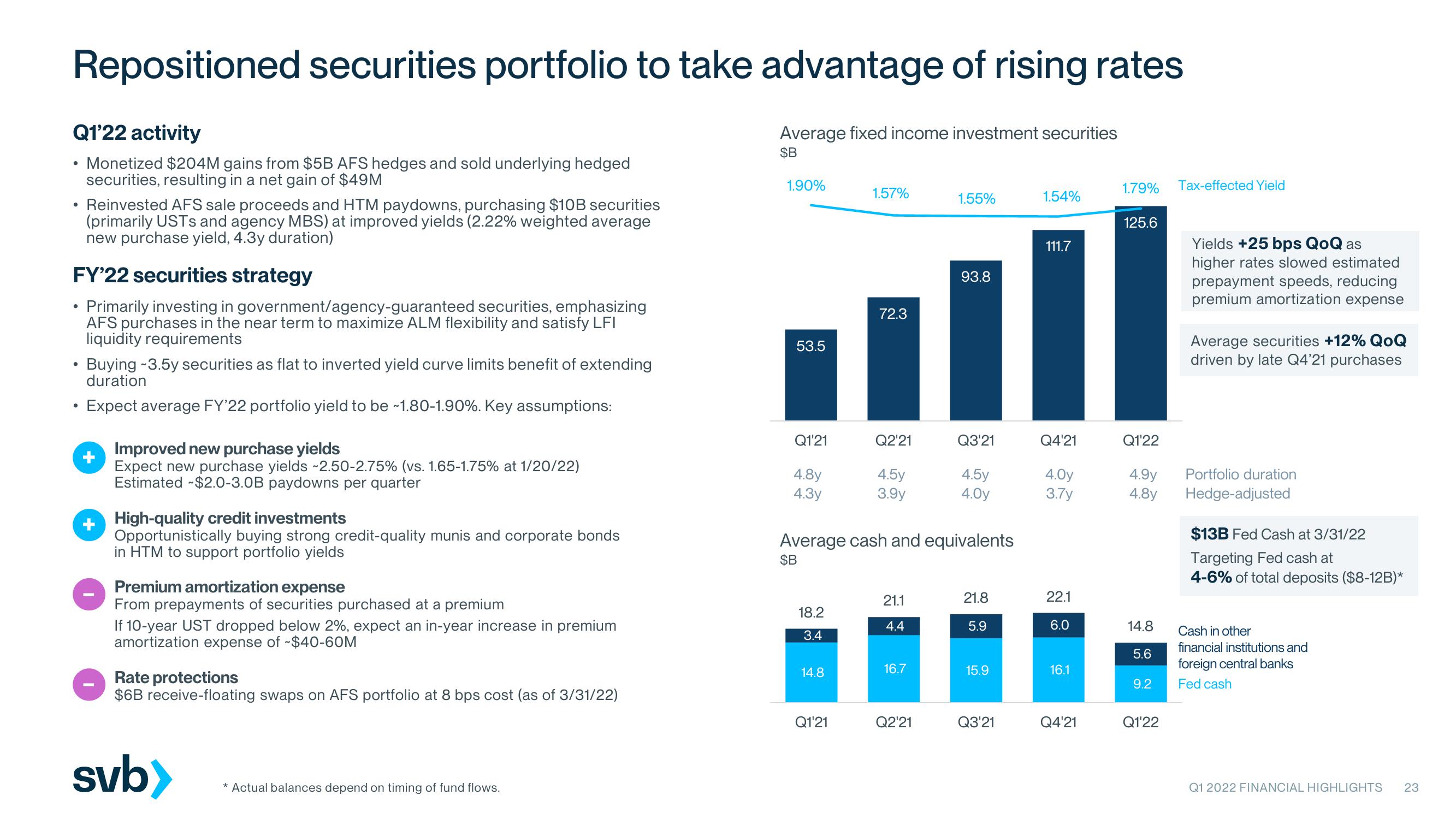

Repositioned securities portfolio to take advantage of rising rates

Q1'22 activity

Monetized $204M gains from $5B AFS hedges and sold underlying hedged

securities, resulting in a net gain of $49M

●

●

FY'22 securities strategy

Primarily investing in government/agency-guaranteed securities, emphasizing

AFS purchases in the near term to maximize ALM flexibility and satisfy LFI

liquidity requirements

●

Reinvested AFS sale proceeds and HTM paydowns, purchasing $10B securities

(primarily USTs and agency MBS) at improved yields (2.22% weighted average

new purchase yield, 4.3y duration)

●

Buying -3.5y securities as flat to inverted yield curve limits benefit of extending

duration

• Expect average FY'22 portfolio yield to be ~1.80-1.90%. Key assumptions:

Improved new purchase yields

Expect new purchase yields -2.50-2.75% (vs. 1.65-1.75% at 1/20/22)

Estimated $2.0-3.0B paydowns per quarter

High-quality credit investments

Opportunistically buying strong credit-quality munis and corporate bonds

in HTM to support portfolio yields

Premium amortization expense

From prepayments of securities purchased at a premium

If 10-year UST dropped below 2%, expect an in-year increase in premium

amortization expense of $40-60M

Rate protections

$6B receive-floating swaps on AFS portfolio at 8 bps cost (as of 3/31/22)

svb>

* Actual balances depend on timing of fund flows.

Average fixed income investment securities

$B

1.90%

53.5

Q1'21

4.8y

4.3y

18.2

3.4

14.8

1.57%

Q1'21

Q2'21

Average cash and equivalents

$B

1.55%

111.7

93.8

72.3

all

Q3'21

Q4'21

4.5y

3.9y

21.1

4.4

16.7

4.5y

4.0y

Q2'21

21.8

5.9

15.9

1.54%

Q3'21

4.0y

3.7y

22.1

6.0

16.1

1.79% Tax-effected Yield

Q4'21

125.6

Q1'22

4.9y

4.8y

14.8

5.6

9.2

Q1'22

Yields +25 bps QoQ as

higher rates slowed estimated

prepayment speeds, reducing

premium amortization expense

Average securities +12% QOQ

driven by late Q4'21 purchases

Portfolio duration

Hedge-adjusted

$13B Fed Cash at 3/31/22

Targeting Fed cash at

4-6% of total deposits ($8-12B)*

Cash in other

financial institutions and

foreign central banks

Fed cash

Q1 2022 FINANCIAL HIGHLIGHTS 23View entire presentation