Silicon Valley Bank Results Presentation Deck

Glossary

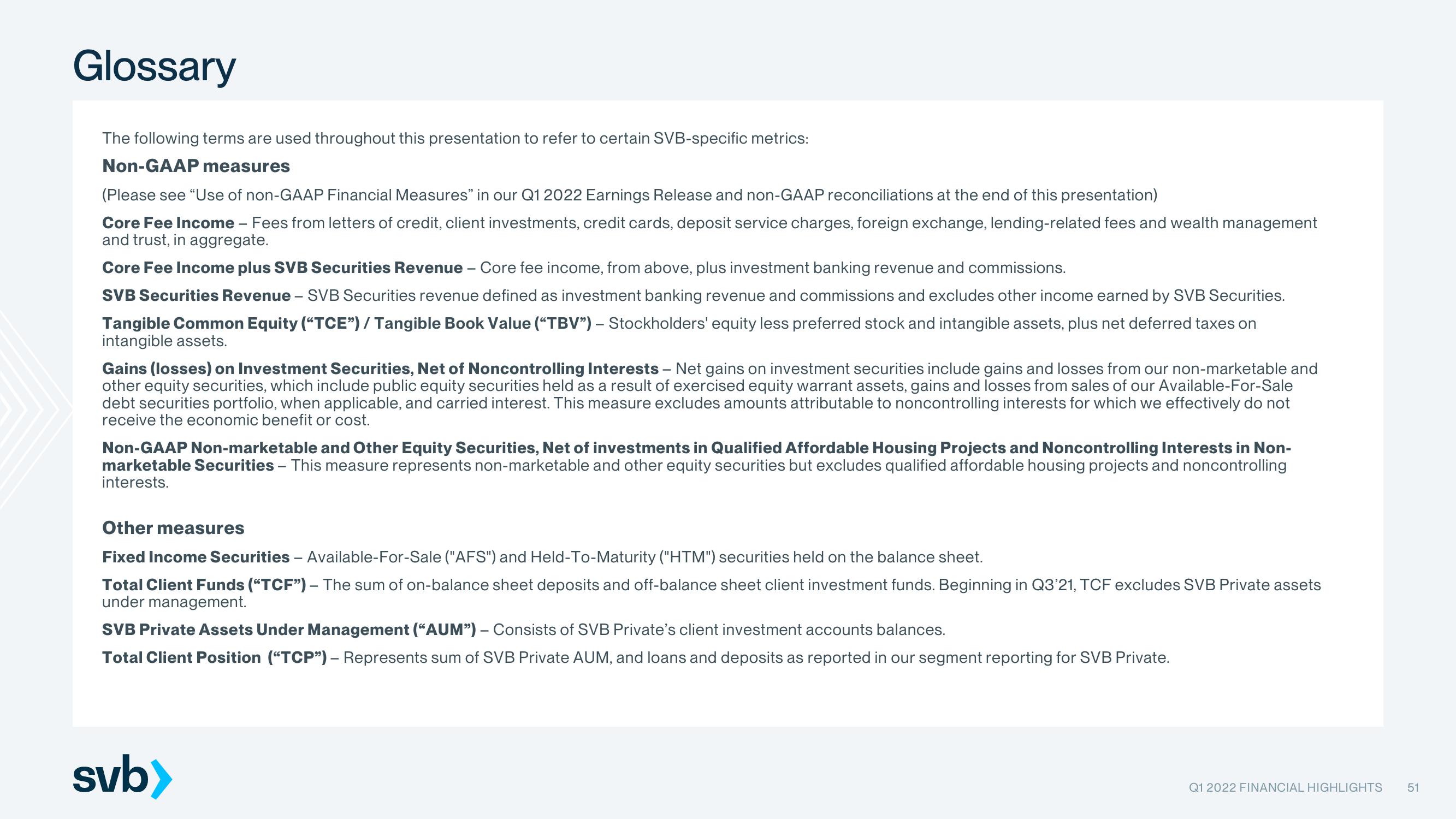

The following terms are used throughout this presentation to refer to certain SVB-specific metrics:

Non-GAAP measures

(Please see "Use of non-GAAP Financial Measures" in our Q1 2022 Earnings Release and non-GAAP reconciliations at the end of this presentation)

Core Fee Income - Fees from letters of credit, client investments, credit cards, deposit service charges, foreign exchange, lending-related fees and wealth management

and trust, in aggregate.

Core Fee Income plus SVB Securities Revenue - Core fee income, from above, plus investment banking revenue and commissions.

SVB Securities Revenue - SVB Securities revenue defined as investment banking revenue and commissions and excludes other income earned by SVB Securities.

Tangible Common Equity ("TCE") / Tangible Book Value ("TBV") - Stockholders' equity less preferred stock and intangible assets, plus net deferred taxes on

intangible assets.

Gains (losses) on Investment Securities, Net of Noncontrolling Interests - Net gains on investment securities include gains and losses from our non-marketable and

other equity securities, which include public equity securities held as a result of exercised equity warrant assets, gains and losses from sales of our Available-For-Sale

debt securities portfolio, when applicable, and carried interest. This measure excludes amounts attributable to noncontrolling interests for which we effectively do not

receive the economic benefit or cost.

Non-GAAP Non-marketable and Other Equity Securities, Net of investments in Qualified Affordable Housing Projects and Noncontrolling Interests in Non-

marketable Securities - This measure represents non-marketable and other equity securities but excludes qualified affordable housing projects and noncontrolling

interests.

Other measures

Fixed Income Securities - Available-For-Sale ("AFS") and Held-To-Maturity ("HTM") securities held on the balance sheet.

Total Client Funds ("TCF") - The sum of on-balance sheet deposits and off-balance sheet client investment funds. Beginning in Q3'21, TCF excludes SVB Private assets

under management.

SVB Private Assets Under Management ("AUM") - Consists of SVB Private's client investment accounts balances.

Total Client Position ("TCP") - Represents sum of SVB Private AUM, and loans and deposits as reported in our segment reporting for SVB Private.

svb>

Q1 2022 FINANCIAL HIGHLIGHTS

51View entire presentation