Silicon Valley Bank Results Presentation Deck

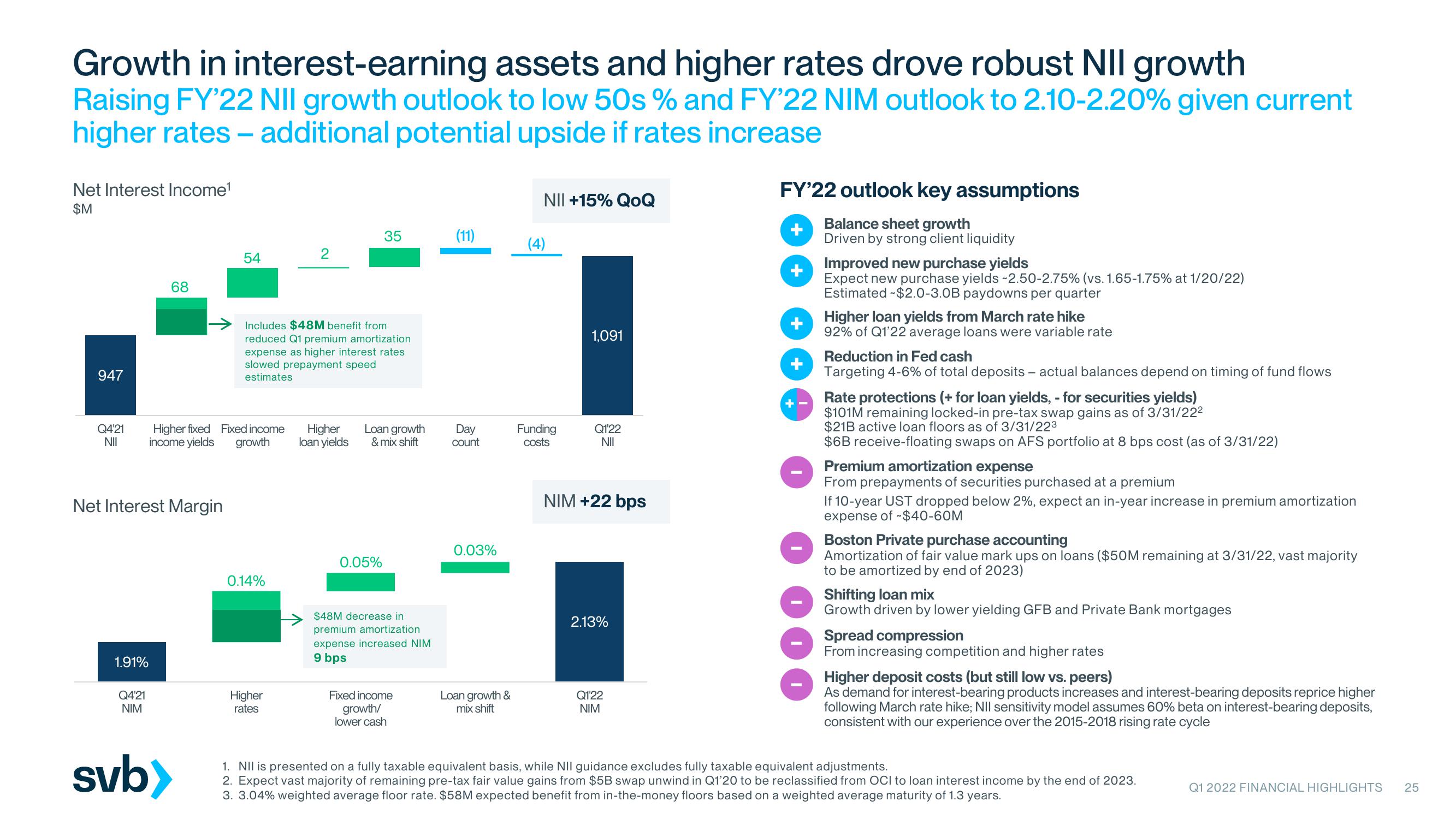

Growth in interest-earning assets and higher rates drove robust NII growth

Raising FY'22 NII growth outlook to low 50s % and FY'22 NIM outlook to 2.10-2.20% given current

higher rates - additional potential upside if rates increase

Net Interest Income¹

$M

947

Q4'21

NII

68

1.91%

Net Interest Margin

54

Higher fixed Fixed income

income yields growth

Q4'21

NIM

svb>

Includes $48M benefit from

reduced Q1 premium amortization

expense as higher interest rates

slowed prepayment speed

estimates

0.14%

2

Higher

rates

35

Higher Loan growth

loan yields

& mix shift

0.05%

$48M decrease in

premium amortization

expense increased NIM

9 bps

Fixed income

growth/

lower cash

(11)

Day

count

0.03%

Loan growth &

mix shift

NII +15% QOQ

(4)

Funding

costs

1,091

Q1'22

NII

NIM +22 bps

2.13%

Q1'22

NIM

FY'22 outlook key assumptions

Balance sheet growth

Driven by strong client liquidity

+

+

-

Improved new purchase yields

Expect new purchase yields -2.50-2.75% (vs. 1.65-1.75% at 1/20/22)

Estimated $2.0-3.0B paydowns per quarter

Higher loan yields from March rate hike

92% of Q1'22 average loans were variable rate

Reduction in Fed cash

Targeting 4-6% of total deposits - actual balances depend on timing of fund flows

Rate protections (+ for loan yields, - for securities yields)

$101M remaining locked-in pre-tax swap gains as of 3/31/22²

$21B active loan floors as of 3/31/223

$6B receive-floating swaps on AFS portfolio at 8 bps cost (as of 3/31/22)

Premium amortization expense

From prepayments of securities purchased at a premium

If 10-year UST dropped below 2%, expect an in-year increase in premium amortization

expense of -$40-60M

Boston Private purchase accounting

Amortization of fair value mark ups on loans ($50M remaining at 3/31/22, vast majority

to be amortized by end of 2023)

Shifting loan mix

Growth driven by lower yielding GFB and Private Bank mortgages

Spread compression

From increasing competition and higher rates

Higher deposit costs (but still low vs. peers)

As demand for interest-bearing products increases and interest-bearing deposits reprice higher

following March rate hike; NII sensitivity model assumes 60% beta on interest-bearing deposits,

consistent with our experience over the 2015-2018 rising rate cycle

1. NII is presented on a fully taxable equivalent basis, while NII guidance excludes fully taxable equivalent adjustments.

2. Expect vast majority of remaining pre-tax fair value gains from $5B swap unwind in Q1'20 to be reclassified from OCI to loan interest income by the end of 2023.

3. 3.04% weighted average floor rate. $58M expected benefit from in-the-money floors based on a weighted average maturity of 1.3 years.

Q1 2022 FINANCIAL HIGHLIGHTS 25View entire presentation