Apollo Global Management Investor Presentation Deck

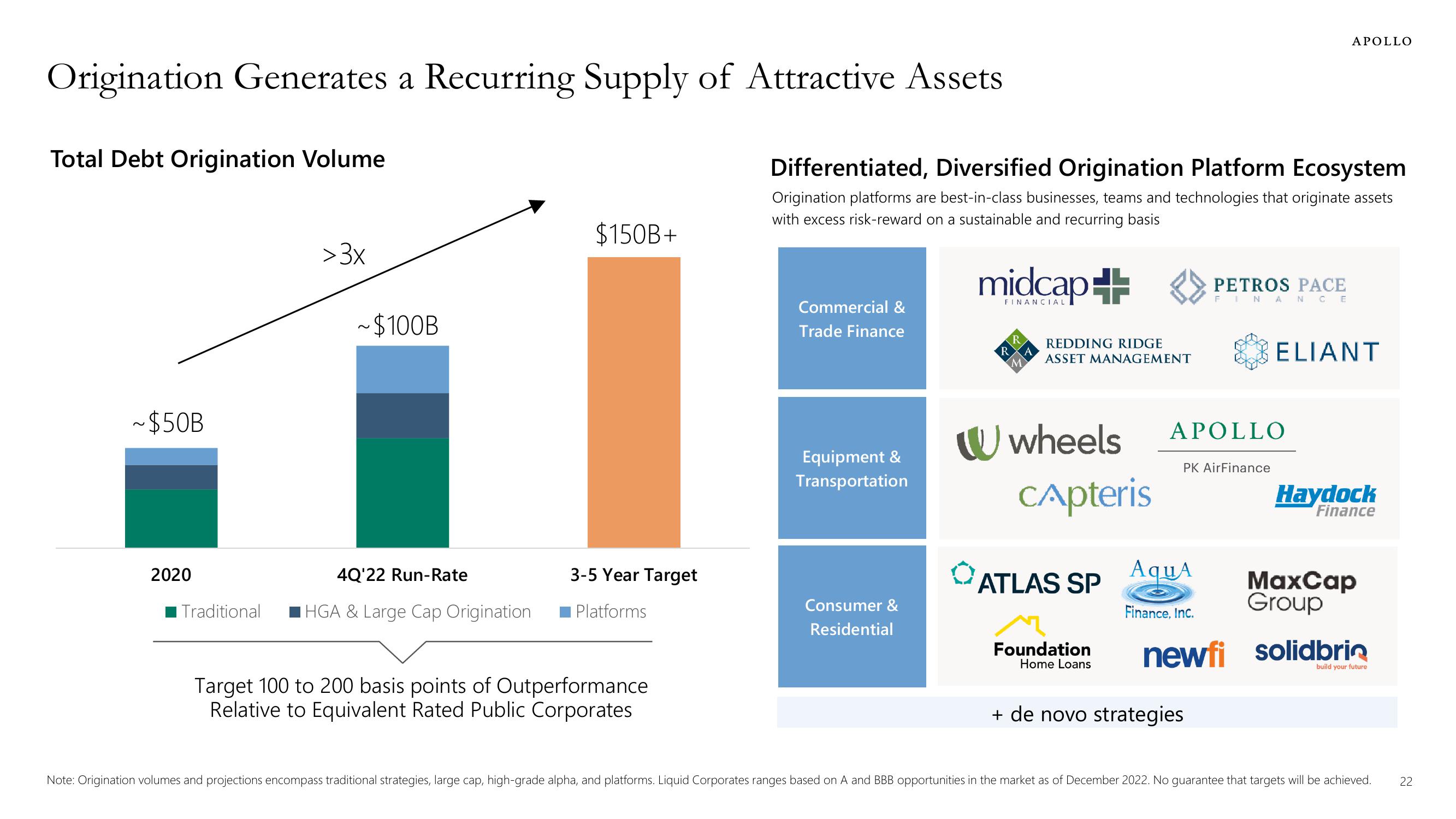

Origination Generates a Recurring Supply of Attractive Assets

Total Debt Origination Volume

~$50B

>3x

2020

~$100B

4Q'22 Run-Rate

Traditional HGA & Large Cap Origination

$150B+

3-5 Year Target

Platforms

Target 100 to 200 basis points of Outperformance

Relative to Equivalent Rated Public Corporates

Differentiated, Diversified Origination Platform Ecosystem

Origination platforms are best-in-class businesses, teams and technologies that originate assets

with excess risk-reward on a sustainable and recurring basis

Commercial &

Trade Finance

Equipment &

Transportation

Consumer &

Residential

midcap++

FINANCIAL

R

R

M1

A

REDDING RIDGE

ASSET MANAGEMENT

wheels

CApteris

Foundation

Home Loans

ATLAS SP AQUA

Finance, Inc.

PETROS PACE

FINANCE

APOLLO

PK AirFinance

+ de novo strategies

newfi

APOLLO

ELIANT

Haydock

Finance

MaxCap

Group

solidbrin

build your future

Note: Origination volumes and projections encompass traditional strategies, large cap, high-grade alpha, and platforms. Liquid Corporates ranges based on A and BBB opportunities in the market as of December 2022. No guarantee that targets will be achieved.

22View entire presentation