Apollo Global Management Investor Presentation Deck

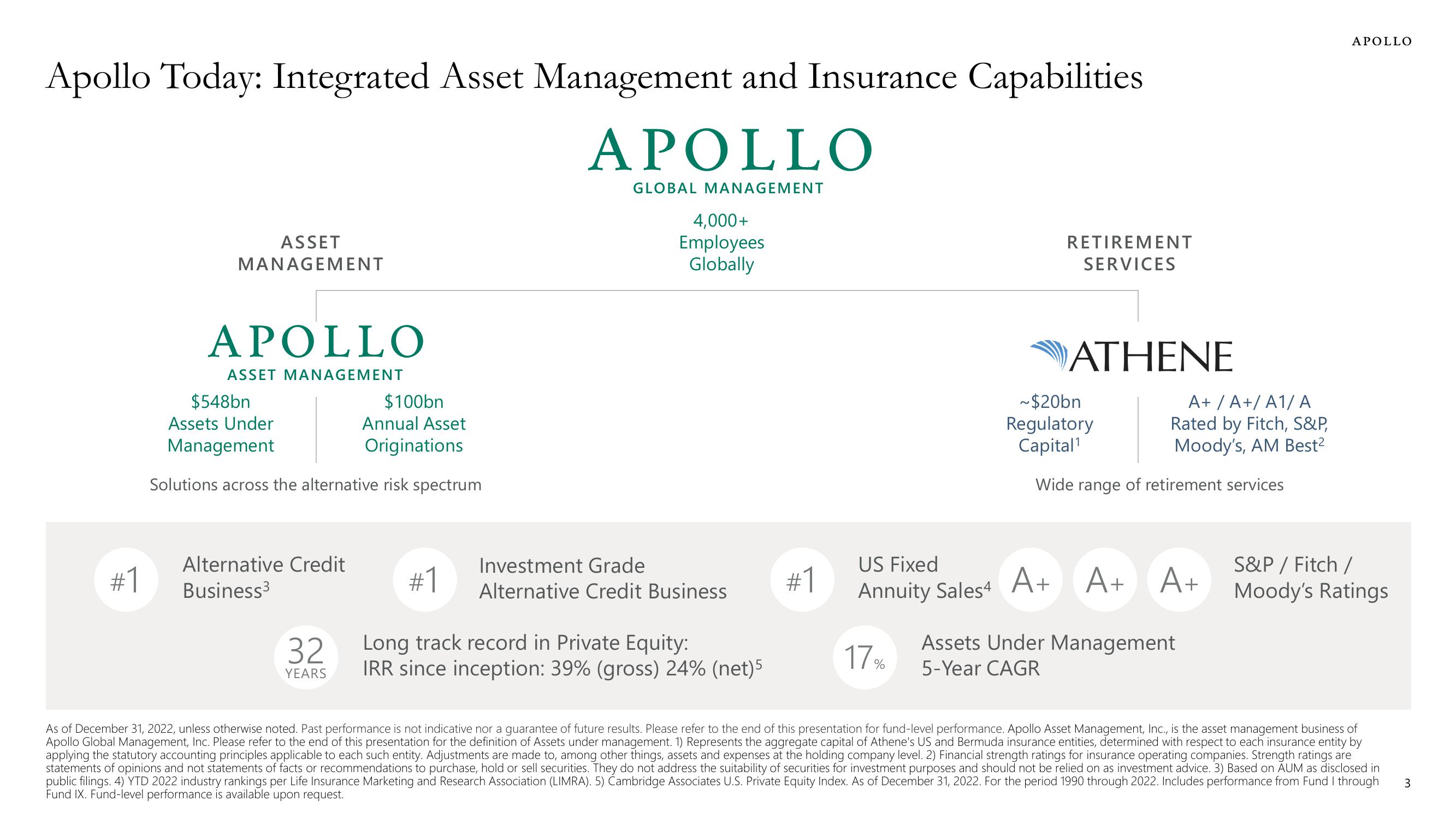

Apollo Today: Integrated Asset Management and Insurance Capabilities

APOLLO

#1

ASSET

MANAGEMENT

APOLLO

ASSET MANAGEMENT

$548bn

$100bn

Assets Under

Annual Asset

Management

Originations

Solutions across the alternative risk spectrum

Alternative Credit

Business³

32

YEARS

#1

GLOBAL MANAGEMENT

4,000+

Employees

Globally

Investment Grade

Alternative Credit Business

Long track record in Private Equity:

IRR since inception: 39% (gross) 24% (net)5

#1

RETIREMENT

SERVICES

ATHENE

~$20bn

Regulatory

Capital ¹

US Fixed

Annuity Sales4 A+

17%

A+/A+/A1/A

Rated by Fitch, S&P,

Moody's, AM Best²

Wide range of retirement services

A+ A+

Assets Under Management

5-Year CAGR

APOLLO

S&P / Fitch /

Moody's Ratings

As of December 31, 2022, unless otherwise noted. Past performance is not indicative nor a guarantee of future results. Please refer to the end of this presentation for fund-level performance. Apollo Asset Management, Inc., is the asset management business of

Apollo Global Management, Inc. Please refer to the end of this presentation for the definition of Assets under management. 1) Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by

applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. 2) Financial strength ratings for insurance operating companies. Strength ratings are

statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. 3) Based on AUM as disclosed in

public filings. 4) YTD 2022 industry rankings per Life Insurance Marketing and Research Association (LIMRA). 5) Cambridge Associates U.S. Private Equity Index. As of December 31, 2022. For the period 1990 through 2022. Includes performance from Fund I through

Fund IX. Fund-level performance is available upon request.

3View entire presentation