Silicon Valley Bank Results Presentation Deck

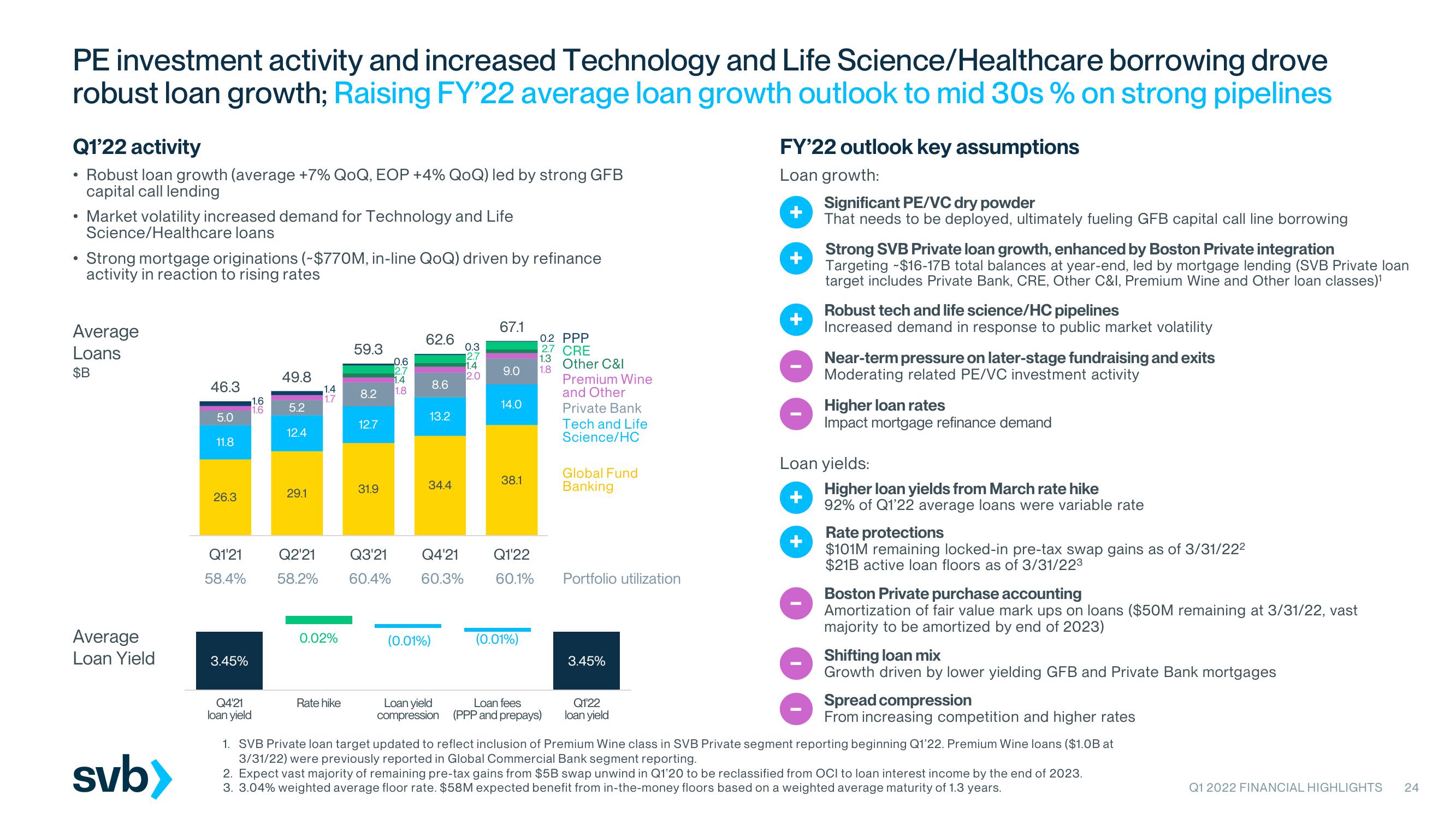

PE investment activity and increased Technology and Life Science/Healthcare borrowing drove

robust loan growth; Raising FY'22 average loan growth outlook to mid 30s % on strong pipelines

Q1'22 activity

Robust loan growth (average +7% QOQ, EOP +4% QoQ) led by strong GFB

capital call lending

●

• Market volatility increased demand for Technology and Life

Science/Healthcare loans

• Strong mortgage originations (~$770M, in-line QoQ) driven by refinance

activity in reaction to rising rates

Average

Loans

$B

Average

Loan Yield

svb>

46.3

5.0

11.8

26.3

Q1'21

58.4%

3.45%

Q4'21

loan yield

1.6

1.6

49.8

5.2

12.4

29.1

Q2¹21

58.2%

1.4

1.7

0.02%

Rate hike

59.3

0.6

2.7

1.4

8.2 1.8

12.7

31.9

Q3'21

60.4%

62.6

8.6

13.2

34.4

Q4'21

60.3%

(0.01%)

0.3

2.7

1.4

2.0

67.1

0.2 PPP

2.7 CRE

1.3

9.0 1.8

14.0

38.1

(0.01%)

Other C&I

Premium Wine

and Other

Private Bank

Tech and Life

Science/HC

Q1'22

60.1% Portfolio utilization

Loan yield

Loan fees

compression (PPP and prepays)

Global Fund

Banking

3.45%

Q1'22

loan yield

FY'22 outlook key assumptions

Loan growth:

+

+

Significant PE/VC dry powder

That needs to be deployed, ultimately fueling GFB capital call line borrowing

+

Strong SVB Private loan growth, enhanced by Boston Private integration

Targeting -$16-17B total balances at year-end, led by mortgage lending (SVB Private loan

target includes Private Bank, CRE, Other C&I, Premium Wine and Other loan classes)¹

Robust tech and life science/HC pipelines

Increased demand in response to public market volatility

Near-term pressure on later-stage fundraising and exits

Moderating related PE/VC investment activity

Higher loan rates

Impact mortgage refinance demand

Loan yields:

Higher loan yields from March rate hike

92% of Q1'22 average loans were variable rate

Rate protections

$101M remaining locked-in pre-tax swap gains as of 3/31/22²

$21B active loan floors as of 3/31/22³

Boston Private purchase accounting

Amortization of fair value mark ups on loans ($50M remaining at 3/31/22, vast

majority to be amortized by end of 2023)

Shifting loan mix

Growth driven by lower yielding GFB and Private Bank mortgages

Spread compression

From increasing competition and higher rates

1. SVB Private loan target updated to reflect inclusion of Premium Wine class in SVB Private segment reporting beginning Q1'22. Premium Wine loans ($1.0B at

3/31/22) were previously reported in Global Commercial Bank segment reporting.

2. Expect vast majority of remaining pre-tax gains from $5B swap unwind in Q1'20 to be reclassified from OCI to loan interest income by the end of 2023.

3. 3.04% weighted average floor rate. $58M expected benefit from in-the-money floors based on a weighted average maturity of 1.3 years.

Q1 2022 FINANCIAL HIGHLIGHTS 24View entire presentation