Silicon Valley Bank Results Presentation Deck

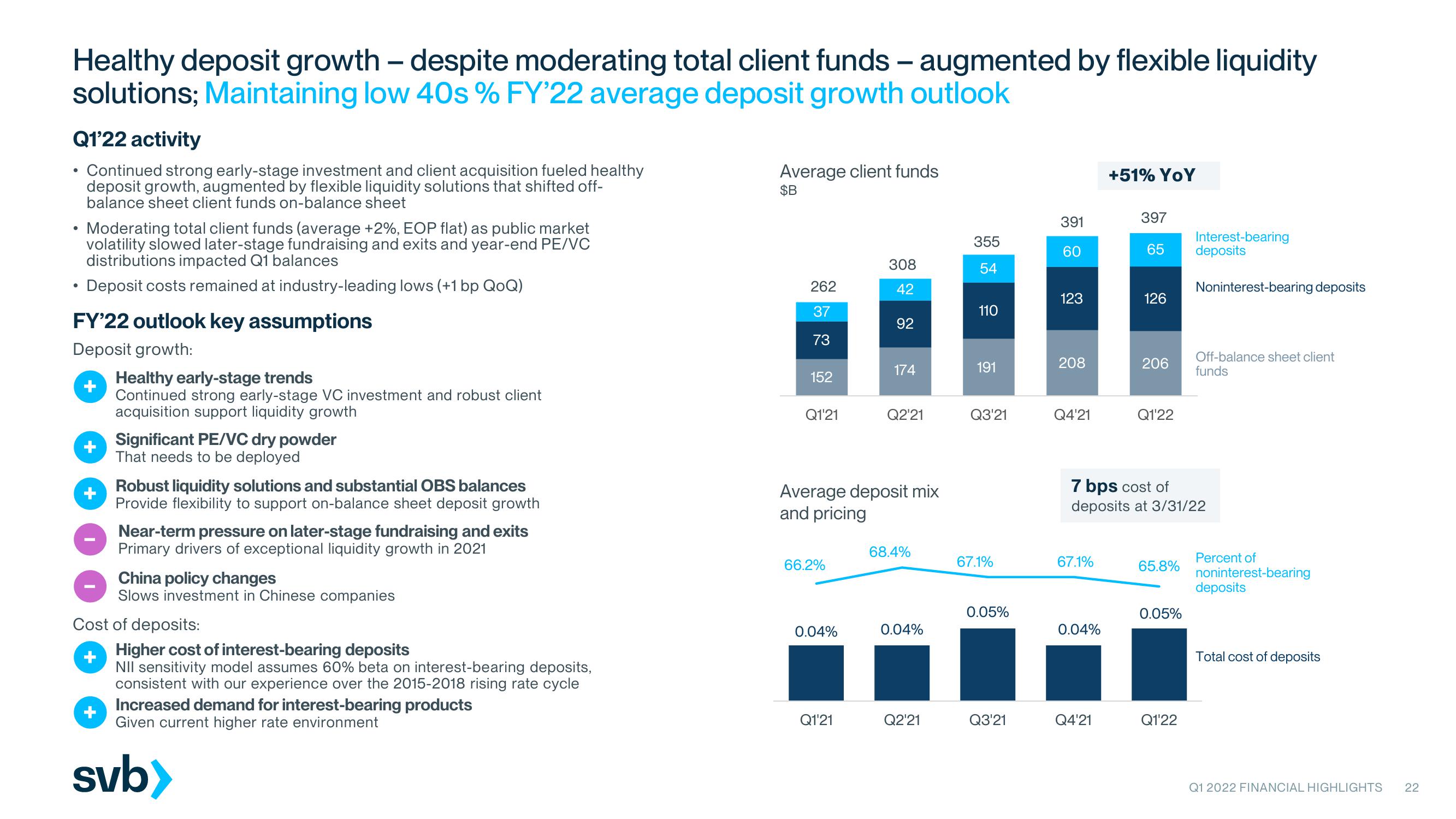

Healthy deposit growth - despite moderating total client funds - augmented by flexible liquidity

solutions; Maintaining low 40s % FY'22 average deposit growth outlook

Q1'22 activity

Continued strong early-stage investment and client acquisition fueled healthy

deposit growth, augmented by flexible liquidity solutions that shifted off-

balance sheet client funds on-balance sheet

• Moderating total client funds (average +2%, EOP flat) as public market

volatility slowed later-stage fundraising and exits and year-end PE/VC

distributions impacted Q1 balances

Deposit costs remained at industry-leading lows (+1 bp QoQ)

●

FY'22 outlook key assumptions

Deposit growth:

+

Healthy early-stage trends

Continued strong early-stage VC investment and robust client

acquisition support liquidity growth

Significant PE/VC dry powder

That needs to be deployed

Robust liquidity solutions and substantial OBS balances

Provide flexibility to support on-balance sheet deposit growth

Near-term pressure on later-stage fundraising and exits

Primary drivers of exceptional liquidity growth in 2021

China policy changes

Slows investment in Chinese companies

Cost of deposits:

+

Higher cost of interest-bearing deposits

NII sensitivity model assumes 60% beta on interest-bearing deposits,

consistent with our experience over the 2015-2018 rising rate cycle

Increased demand for interest-bearing products

Given current higher rate environment

svb>

Average client funds

$B

262

37

73

152

Q1'21

66.2%

0.04%

308

42

Q1'21

92

Average deposit mix

and pricing

174

Q2¹21

68.4%

0.04%

Q2'21

355

54

110

191

Q3'21

67.1%

0.05%

Q3'21

391

60

123

208

Q4'21

67.1%

0.04%

+51% YoY

Q4'21

397

65

126

206

Q1'22

7 bps cost of

deposits at 3/31/22

65.8%

0.05%

Interest-bearing

deposits

Q1'22

Noninterest-bearing deposits

Off-balance sheet client

funds

Percent of

noninterest-bearing

deposits

Total cost of deposits

Q1 2022 FINANCIAL HIGHLIGHTS

22View entire presentation