First Citizens BancShares Mergers and Acquisitions Presentation Deck

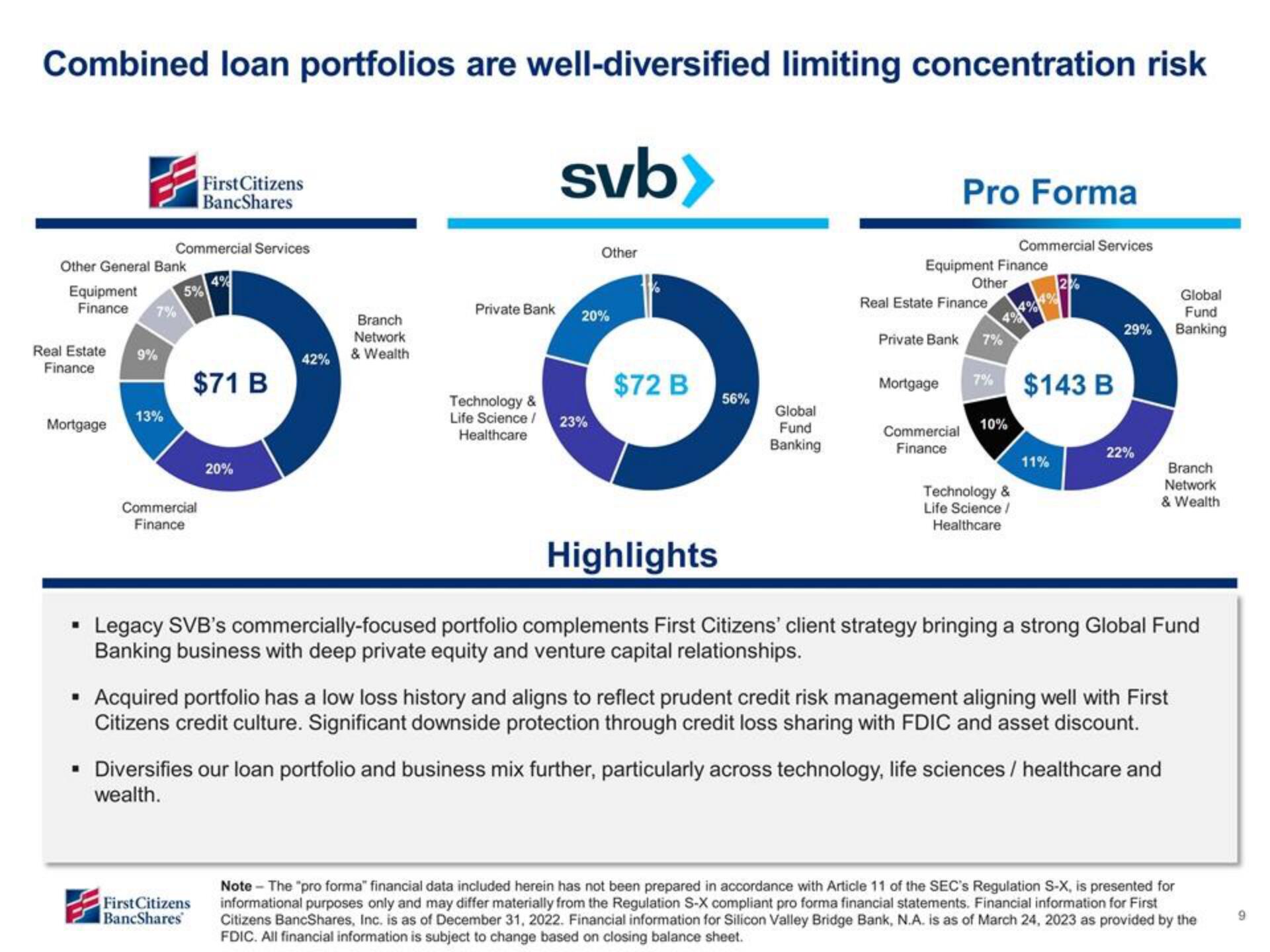

Combined loan portfolios are well-diversified limiting concentration risk

Other General Bank

Equipment

Finance 7%

Real Estate 9%

Finance

Mortgage

13%

Commercial Services

4%

First Citizens

BancShares

Commercial

Finance

$71 B

20%

First Citizens

BancShares

42%

Branch

Network

& Wealth

Private Bank

svb>

Other

20%

Technology &

Life Science/ 23%

Healthcare

$72 B

56%

Global

Fund

Banking

Pro Forma

Equipment Finance

Other

Real Estate Finance

Private Bank 7%

Commercial

Finance

Mortgage 7% $143 B

Commercial Services

2%

10%

Technology &

Life Science /

Healthcare

11%

29%

22%

Branch

Network

& Wealth

Highlights

Legacy SVB's commercially-focused portfolio complements First Citizens' client strategy bringing a strong Global Fund

Banking business with deep private equity and venture capital relationships.

▪ Acquired portfolio has a low loss history and aligns to reflect prudent credit risk management aligning well with First

Citizens credit culture. Significant downside protection through credit loss sharing with FDIC and asset discount.

Global

Fund

Banking

▪ Diversifies our loan portfolio and business mix further, particularly across technology, life sciences / healthcare and

wealth.

Note - The "pro forma financial data included herein has not been prepared in accordance with Article 11 of the SEC's Regulation S-X, is presented for

informational purposes only and may differ materially from the Regulation S-X compliant pro forma financial statements. Financial information for First

Citizens BancShares, Inc. is as of December 31, 2022. Financial information for Silicon Valley Bridge Bank, N.A. is as of March 24, 2023 as provided by the

FDIC. All financial information is subject to change based on closing balance sheet.

9View entire presentation