Silicon Valley Bank Results Presentation Deck

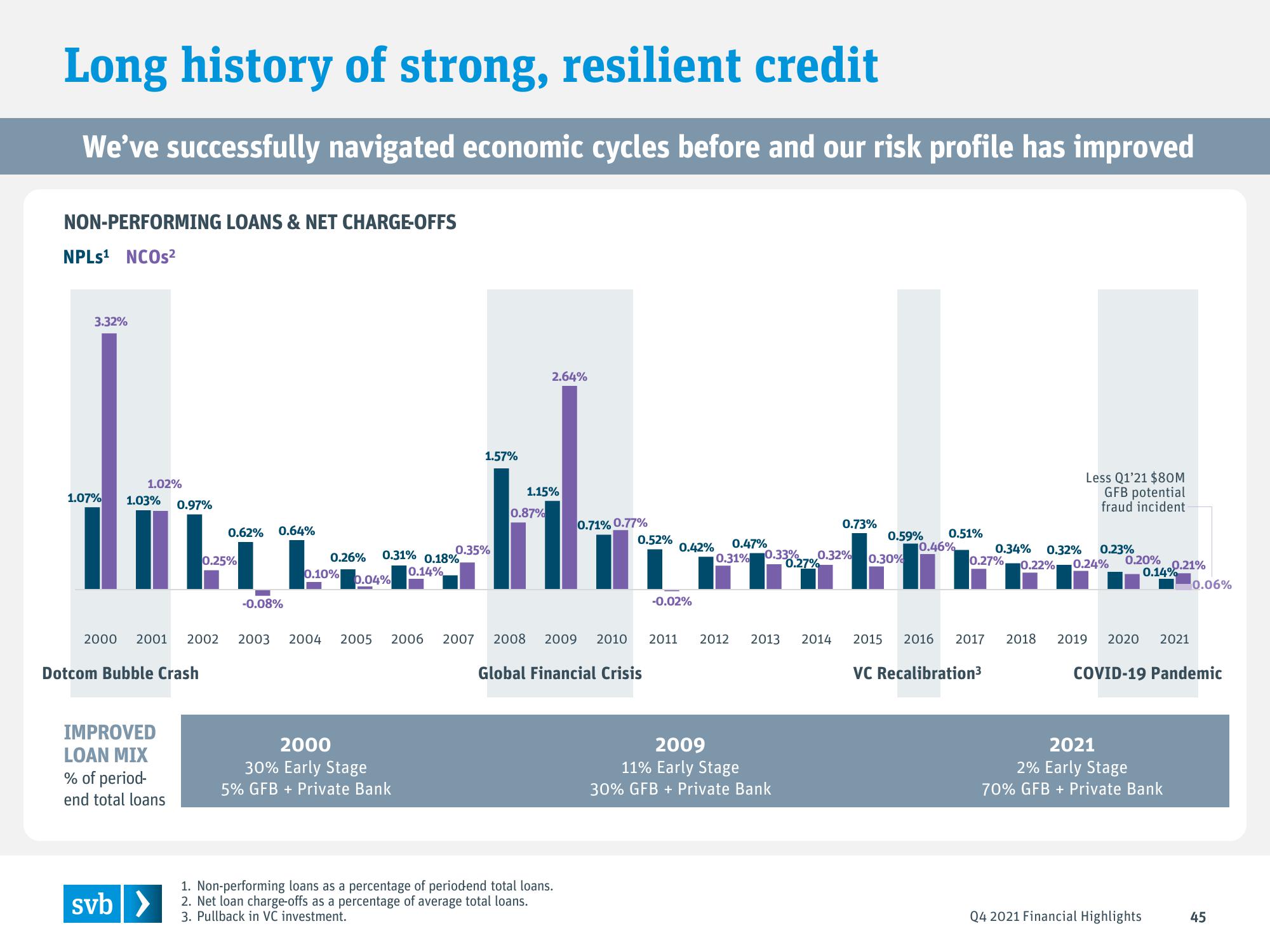

Long history of strong, resilient credit

We've successfully navigated economic cycles before and our risk profile has improved

NON-PERFORMING LOANS & NET CHARGE-OFFS

NPLs¹ NCOs²

3.32%

1.02%

1.07% 1.03% 0.97%

Dotcom Bubble Crash

IMPROVED

LOAN MIX

% of period-

end total loans

0.62%

svb >

0.25%

0.64%

-0.08%

0.26%

0.10%

2.64%

th

1.57%

1.15%

0.87%

0.71% 0.77%

0.31% 0.18%

0.14%

0.04%

0.35%

2000

30% Early Stage

5% GFB+ Private Bank

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Global Financial Crisis

0.52%

1. Non-performing loans as a percentage of periodend total loans.

2. Net loan charge-offs as a percentage of average total loans.

3. Pullback in VC investment.

0.47%

0.42%

-0.02%

0.32%

0.31% 0.33%

0.27%

0.73%

2009

11% Early Stage

30% GFB + Private Bank

0.59% 0.51%

0.30%

10.46%

0.34% 0.32%

0.27%

VC Recalibration³

2015 2016 2017 2018

Less Q1'21 $80M

GFB potential

fraud incident

0.23%

0.22% 0.24%

0.20%

0.14%

2019 2020 2021

0.21%

2021

2% Early Stage

70% GFB + Private Bank

COVID-19 Pandemic

Q4 2021 Financial Highlights

0.06%

45View entire presentation