First Citizens BancShares Mergers and Acquisitions Presentation Deck

Expanding First Citizens' deposit base

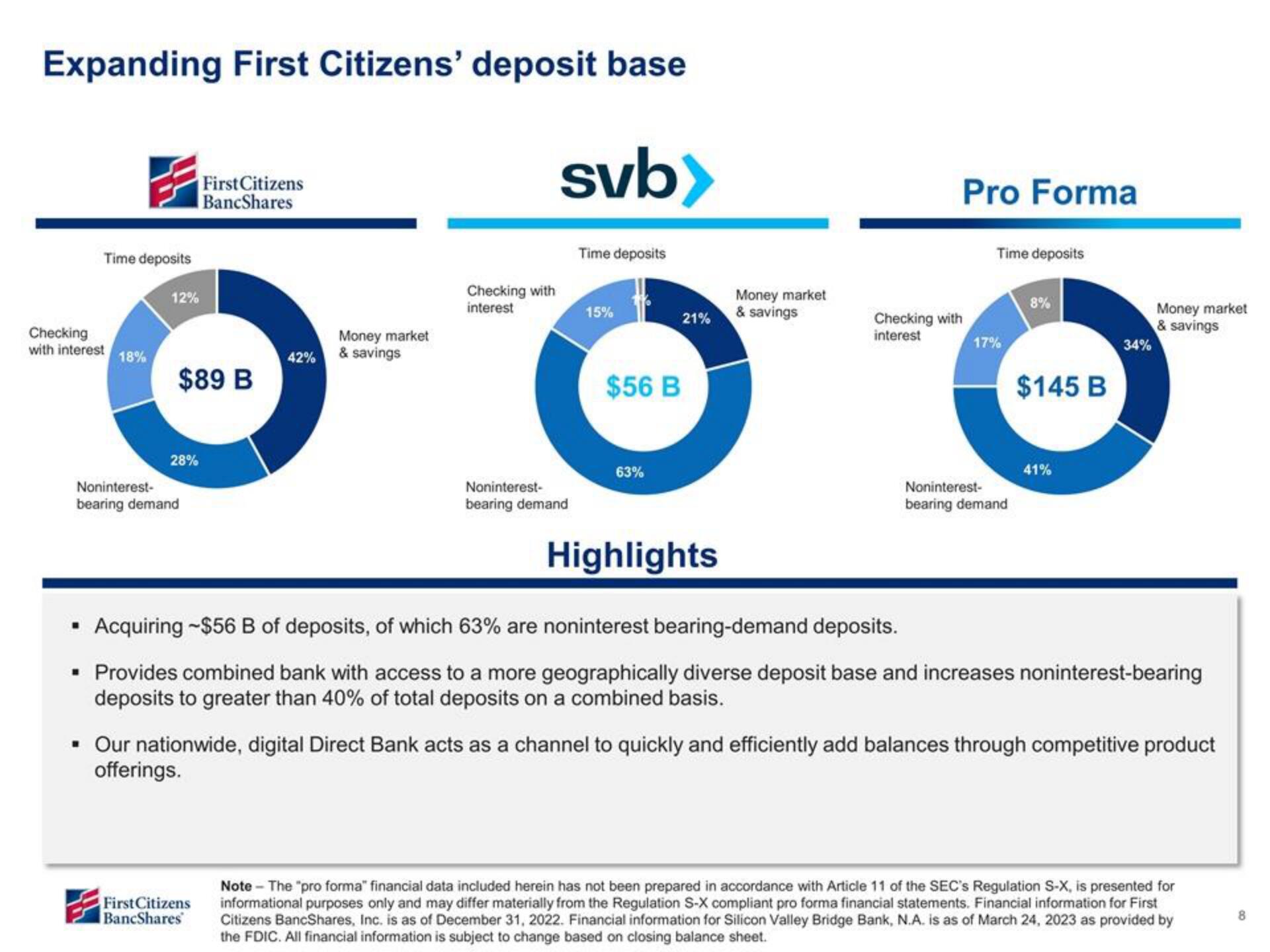

Time deposits

Checking

with interest 18%

12%

$89 B

28%

Noninterest-

bearing demand

First Citizens

BancShares

Money market

42% & savings

First Citizens

BancShares

Checking with

interest

svb>

Noninterest-

bearing demand

Time deposits

15%

$56 B

63%

Money market

21% & savings

Highlights

Checking with

interest

Pro Forma

Time deposits

17%

Noninterest-

bearing demand

8%

$145 B

41%

34%

Money market

& savings

▪ Acquiring -$56 B of deposits, of which 63% are noninterest bearing-demand deposits.

Provides combined bank with access to a more geographically diverse deposit base and increases noninterest-bearing

deposits to greater than 40% of total deposits on a combined basis.

▪ Our nationwide, digital Direct Bank acts as a channel to quickly and efficiently add balances through competitive product

offerings.

Note - The "pro forma" financial data included herein has not been prepared in accordance with Article 11 of the SEC's Regulation S-X, is presented for

informational purposes only and may differ materially from the Regulation S-X compliant pro forma financial statements. Financial information for First

Citizens BancShares, Inc. is as of December 31, 2022. Financial information for Silicon Valley Bridge Bank, N.A. is as of March 24, 2023 as provided by

the FDIC. All financial information is subject to change based on closing balance sheet.

8View entire presentation