First Citizens BancShares Results Presentation Deck

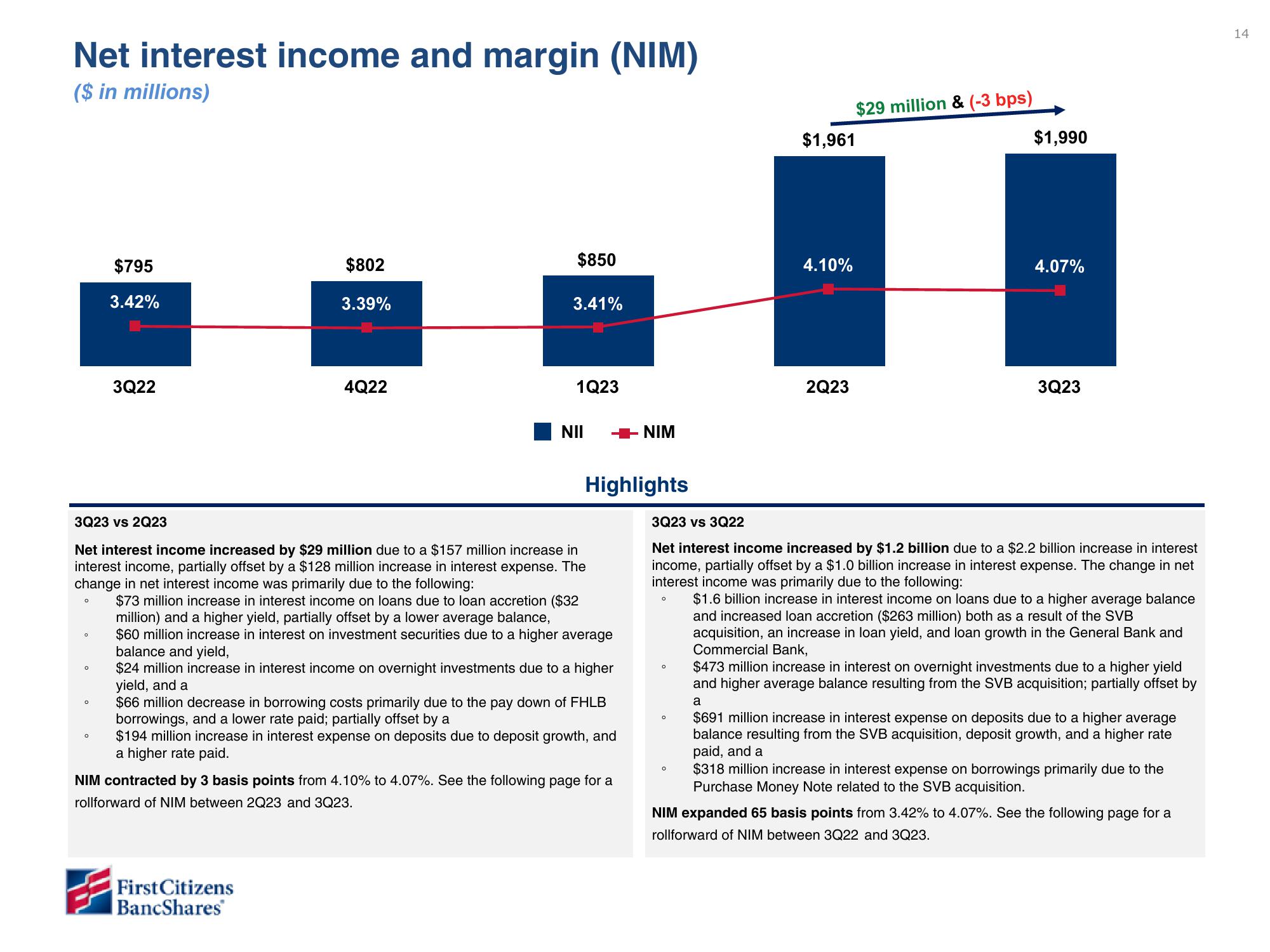

Net interest income and margin (NIM)

($ in millions)

$795

3.42%

3Q22

$802

3.39%

4Q22

$850

First Citizens

BancShares

3.41%

1Q23

NII

3Q23 vs 2Q23

Net interest income increased by $29 million due to a $157 million increase in

interest income, partially offset by a $128 million increase in interest expense. The

change in net interest income was primarily due to the following:

$73 million increase in interest income on loans due to loan accretion ($32

million) and a higher yield, partially offset by a lower average balance,

$60 million increase in interest on investment securities due to a higher average

balance and yield,

$24 million increase in interest income on overnight investments due to a higher

yield, and a

Highlights

$66 million decrease in borrowing costs primarily due to the pay down of FHLB

borrowings, and a lower rate paid; partially offset by a

$194 million increase in interest expense on deposits due to deposit growth, and

a higher rate paid.

NIM contracted by 3 basis points from 4.10% to 4.07%. See the following page for a

rollforward of NIM between 2Q23 and 3Q23.

NIM

$1,961

4.10%

2Q23

$29 million & (-3 bps)

$1,990

4.07%

3Q23

3Q23 vs 3Q22

Net interest income increased by $1.2 billion due to a $2.2 billion increase in interest

income, partially offset by a $1.0 billion increase in interest expense. The change in net

interest income was primarily due to the following:

$1.6 billion increase in interest income on loans due to a higher average balance

and increased loan accretion ($263 million) both as a result of the SVB

acquisition, an increase in loan yield, and loan growth in the General Bank and

Commercial Bank,

$473 million increase in interest on overnight investments due to a higher yield

and higher average balance resulting from the SVB acquisition; partially offset by

a

$691 million increase in interest expense on deposits due to a higher average

balance resulting from the SVB acquisition, deposit growth, and a higher rate

paid, and a

$318 million increase in interest expense on borrowings primarily due to the

Purchase Money Note related to the SVB acquisition.

NIM expanded 65 basis points from 3.42% to 4.07%. See the following page for a

rollforward of NIM between 3Q22 and 3Q23.

14View entire presentation