Silicon Valley Bank Mergers and Acquisitions Presentation Deck

Boston Private loan portfolio

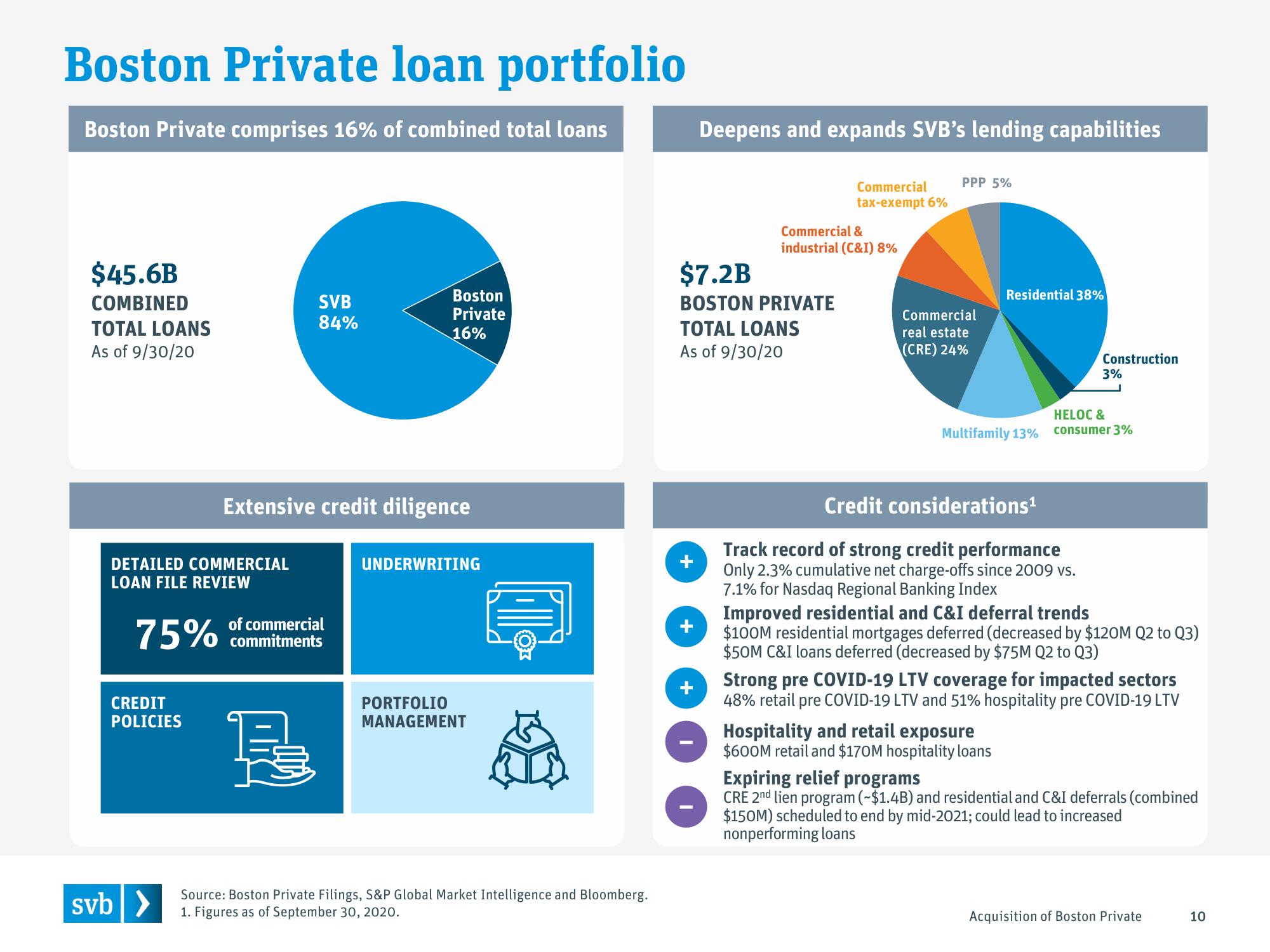

Boston Private comprises 16% of combined total loans

$45.6B

COMBINED

TOTAL LOANS

As of 9/30/20

DETAILED COMMERCIAL

LOAN FILE REVIEW

75%

CREDIT

POLICIES

svb >

SVB

84%

Extensive credit diligence

of commercial

commitments

是

Boston

Private

16%

UNDERWRITING

PORTFOLIO

MANAGEMENT

T

Source: Boston Private Filings, S&P Global Market Intelligence and Bloomberg.

1. Figures as of September 30, 2020.

Deepens and expands SVB's lending capabilities

Commercial &

industrial (C&I) 8%

$7.2B

BOSTON PRIVATE

Commercial

tax-exempt 6%

TOTAL LOANS

As of 9/30/20

PPP 5%

Commercial

real estate

(CRE) 24%

Residential 38%

Multifamily 13%

Credit considerations¹

Track record of strong credit performance

Only 2.3% cumulative net charge-offs since 2009 vs.

7.1% for Nasdaq Regional Banking Index

Construction

Hospitality and retail exposure

$600M retail and $170M hospitality loans

3%

HELOC &

consumer 3%

Improved residential and C&I deferral trends

$100M residential mortgages deferred (decreased by $120M Q2 to Q3)

$50M C&I loans deferred (decreased by $75M Q2 to Q3)

Strong pre COVID-19 LTV coverage for impacted sectors

48% retail pre COVID-19 LTV and 51% hospitality pre COVID-19 LTV

Expiring relief programs

CRE 2nd lien program (~$1.4B) and residential and C&I deferrals (combined

$150M) scheduled to end by mid-2021; could lead to increased

nonperforming loans

Acquisition of Boston Private

10View entire presentation