FL Entertaiment SPAC

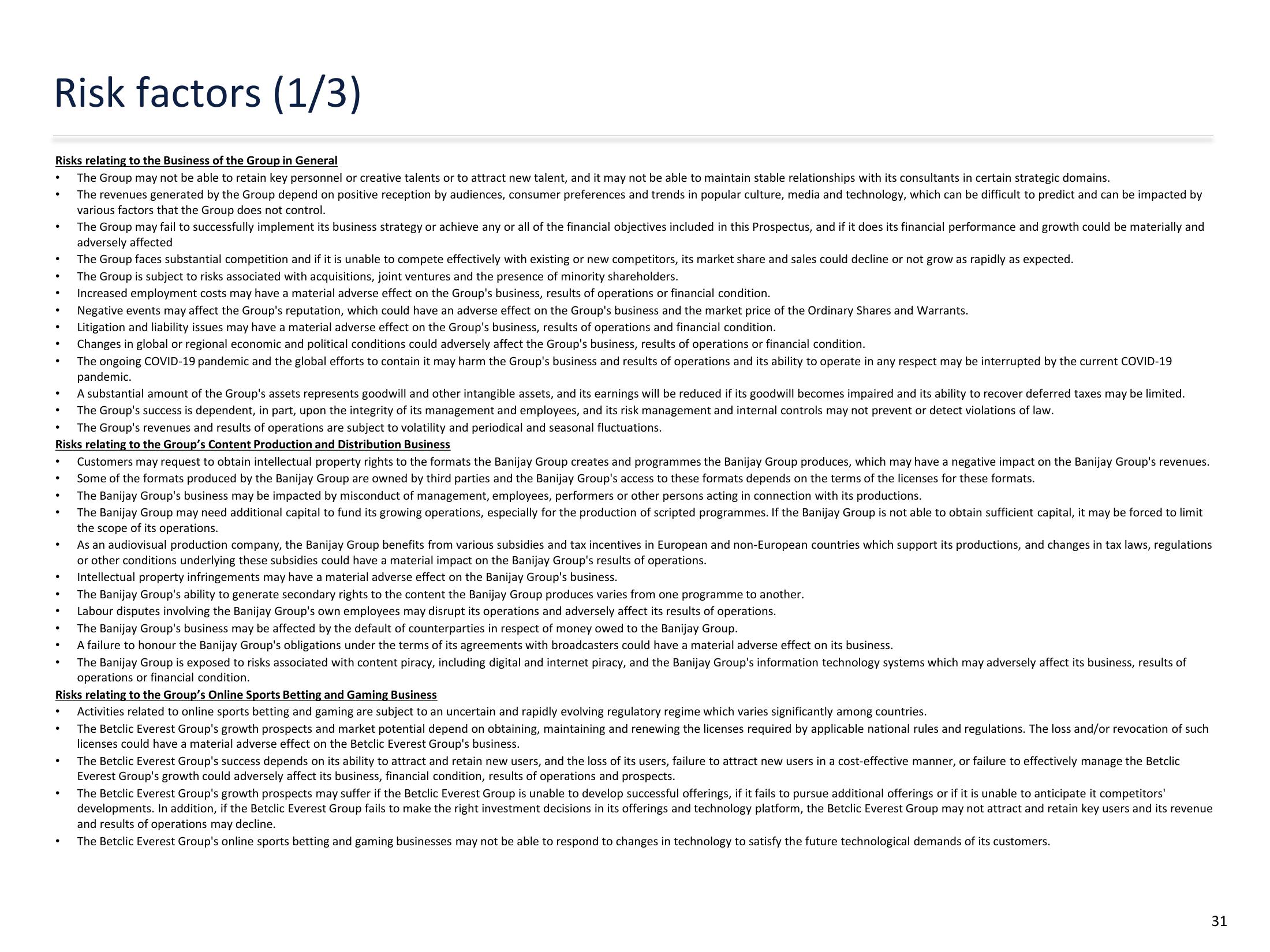

Risk factors (1/3)

Risks relating to the Business of the Group in General

The Group may not be able to retain key personnel or creative talents or to attract new talent, and it may not be able to maintain stable relationships with its consultants in certain strategic domains.

The revenues generated by the Group depend on positive reception by audiences, consumer preferences and trends in popular culture, media and technology, which can be difficult to predict and can be impacted by

various factors that the Group does not control.

The Group may fail to successfully implement its business strategy or achieve any or all of the financial objectives included in this Prospectus, and if it does its financial performance and growth could be materially and

adversely affected

●

.

●

●

Negative events may affect the Group's reputation, which could have an adverse effect on the Group's business and the market price of the Ordinary Shares and Warrants.

Litigation and liability issues may have a material adverse effect on the Group's business, results of operations and financial condition.

Changes in global or regional economic and political conditions could adversely affect the Group's business, results of operations or financial condition.

The ongoing COVID-19 pandemic and the global efforts to contain it may harm the Group's business and results of operations and its ability to operate in any respect may be interrupted by the current COVID-19

pandemic.

A substantial amount of the Group's assets represents goodwill and other intangible assets, and its earnings will be reduced if its goodwill becomes impaired and its ability to recover deferred taxes may be limited.

The Group's success is dependent, in part, upon the integrity of its management and employees, and its risk management and internal controls may not prevent or detect violations of law.

The Group's revenues and results of operations are subject to volatility and periodical and seasonal fluctuations.

Risks relating to the Group's Content Production and Distribution Business

Customers may request to obtain intellectual property rights to the formats the Banijay Group creates and programmes the Banijay Group produces, which may have a negative impact on the Banijay Group's revenues.

Some of the formats produced by the Banijay Group are owned by third parties and the Banijay Group's access to these formats depends on the terms of the licenses for these formats.

●

●

.

●

.

●

●

●

As an audiovisual production company, the Banijay Group benefits from various subsidies and tax incentives in European and non-European countries which support its productions, and changes in tax laws, regulations

or other conditions underlying these subsidies could have a material impact on the Banijay Group's results of operations.

Intellectual property infringements may have a material adverse effect on the Banijay Group's business.

The Banijay Group's ability to generate secondary rights to the content the Banijay Group produces varies from one programme to another.

Labour disputes involving the Banijay Group's own employees may disrupt its operations and adversely affect its results of operations.

The Banijay Group's business may be affected by the default of counterparties in respect of money owed to the Banijay Group.

A failure to honour the Banijay Group's obligations under the terms of its agreements with broadcasters could have a material adverse effect on its business.

The Banijay Group is exposed to risks associated with content piracy, including digital and internet piracy, and the Banijay Group's information technology systems which may adversely affect its business, results of

operations or financial condition.

Risks relating to the Group's Online Sports Betting and Gaming Business

Activities related to online sports betting and gaming are subject to an uncertain and rapidly evolving regulatory regime which varies significantly among countries.

The Betclic Everest Group's growth prospects and market potential depend on obtaining, maintaining and renewing the licenses required by applicable national rules and regulations. The loss and/or revocation of such

licenses could have a material adverse effect on the Betclic Everest Group's business.

●

●

●

.

.

The Group faces substantial competition and if it is unable to compete effectively with existing or new competitors, its market share and sales could decline or not grow as rapidly as expected.

The Group is subject to risks associated with acquisitions, joint ventures and the presence of minority shareholders.

Increased employment costs may have a material adverse effect on the Group's business, results of operations or financial condition.

●

●

The Banijay Group's business may be impacted by misconduct of management, employees, performers or other persons acting in connection with its productions.

The Banijay Group may need additional capital to fund its growing operations, especially for the production of scripted programmes. If the Banijay Group is not able to obtain sufficient capital, it may be forced to limit

the scope of its operations.

The Betclic Everest Group's success depends on its ability to attract and retain new users, and the loss of its users, failure to attract new users in a cost-effective manner, or failure to effectively manage the Betclic

Everest Group's growth could adversely affect its business, financial condition, results of operations and prospects.

The Betclic Everest Group's growth prospects may suffer if the Betclic Everest Group is unable to develop successful offerings, if it fails to pursue additional offerings or if it is unable to anticipate it competitors'

developments. In addition, if the Betclic Everest Group fails to make the right investment decisions in its offerings and technology platform, the Betclic Everest Group may not attract and retain key users and its revenue

and results of operations may decline.

The Betclic Everest Group's online sports betting and gaming businesses may not be able to respond to changes in technology to satisfy the future technological demands of its customers.

31View entire presentation