AstraZeneca Results Presentation Deck

Tagrisso and Imfinzi

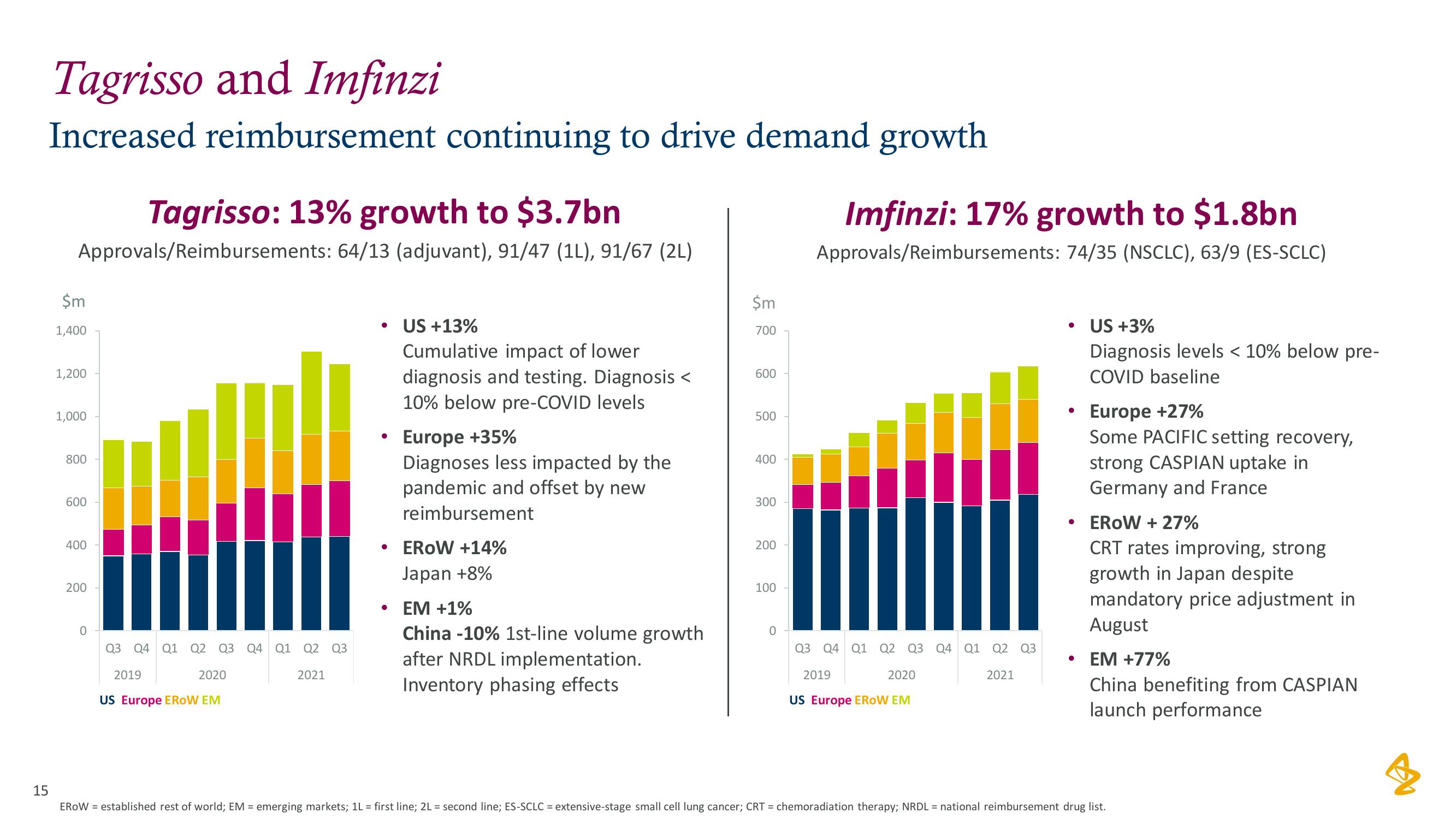

Increased reimbursement continuing to drive demand growth

15

Tagrisso: 13% growth to $3.7bn

Approvals/Reimbursements: 64/13 (adjuvant), 91/47 (1L), 91/67 (2L)

$m

1,400

1,200

1,000

800

600

400

200

0

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2021

2019

2020

US Europe EROW EM

●

●

●

●

US +13%

Cumulative impact of lower

diagnosis and testing. Diagnosis <

10% below pre-COVID levels

Europe +35%

Diagnoses less impacted by the

pandemic and offset by new

reimbursement

EROW +14%

Japan +8%

EM +1%

China -10% 1st-line volume growth

after NRDL implementation.

Inventory phasing effects

$m

700

600

500

400

300

200

100

0

Imfinzi: 17% growth to $1.8bn

Approvals/Reimbursements: 74/35 (NSCLC), 63/9 (ES-SCLC)

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2021

2019

2020

US Europe EROW EM

●

US +3%

Diagnosis levels < 10% below pre-

COVID baseline

Europe +27%

Some PACIFIC setting recovery,

strong CASPIAN uptake in

Germany and France

• EROW + 27%

CRT rates improving, strong

growth in Japan despite

mandatory price adjustment in

August

• EM +77%

China benefiting from CASPIAN

launch performance

EROW= established rest of world; EM = emerging markets; 1L = first line; 2L = second line; ES-SCLC = extensive-stage small cell lung cancer; CRT = chemoradiation therapy; NRDL= national reimbursement drug list.

BView entire presentation