Silicon Valley Bank Results Presentation Deck

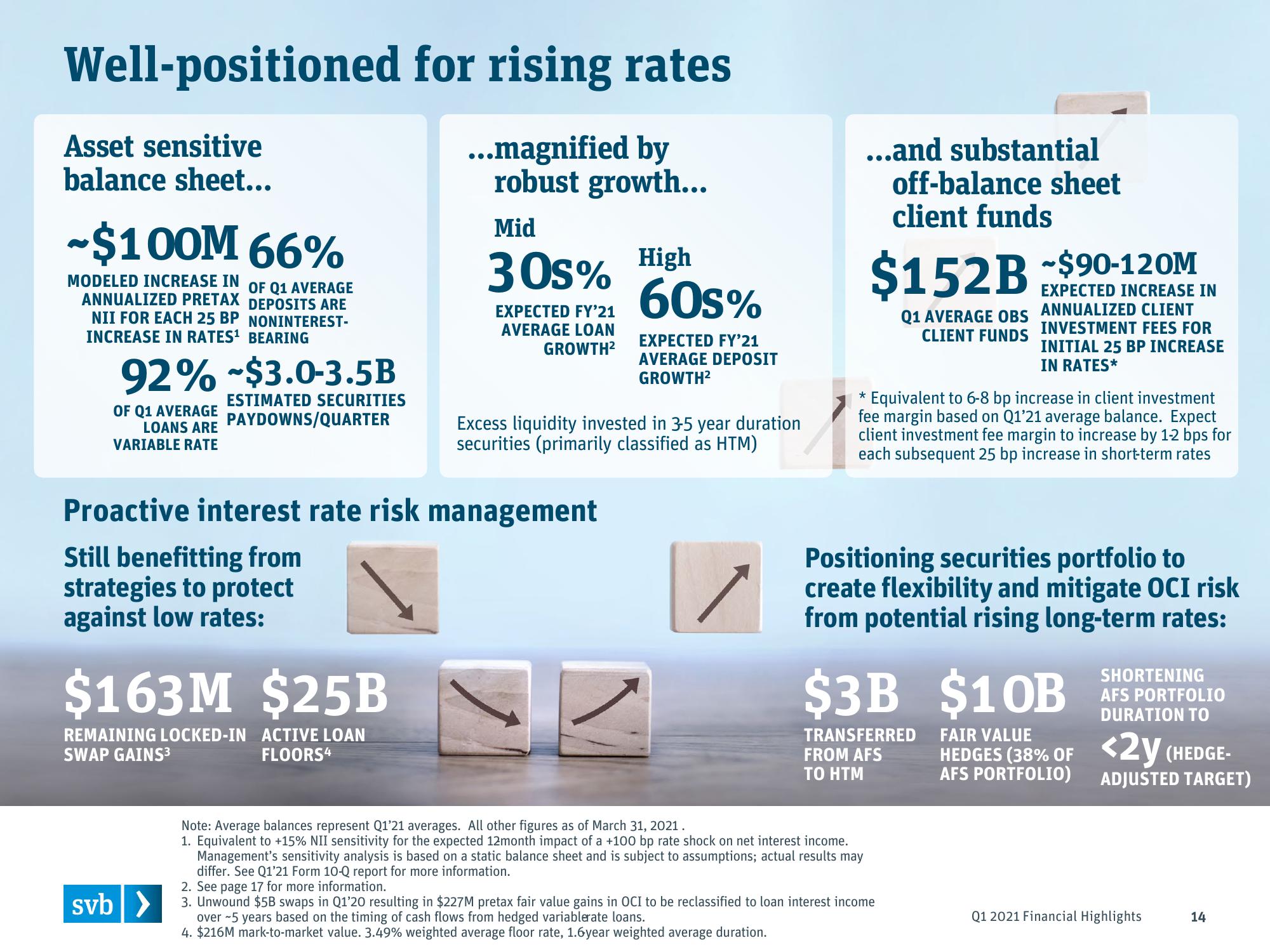

Well-positioned for rising rates

Asset sensitive

balance sheet...

...magnified by

robust growth...

-$100M 66%

MODELED INCREASE IN OF Q1 AVERAGE

ANNUALIZED PRETAX DEPOSITS ARE

NII FOR EACH 25 BP NONINTEREST-

INCREASE IN RATES¹ BEARING

92% $3.0-3.5B

OF Q1 AVERAGE

LOANS ARE

VARIABLE RATE

ESTIMATED SECURITIES

PAYDOWNS/QUARTER

svb >

$163M $25B

REMAINING LOCKED-IN ACTIVE LOAN

SWAP GAINS³

FLOORS4

Mid

30s% High

60s%

EXPECTED FY'21

AVERAGE LOAN

GROWTH²

Proactive interest rate risk management

Still benefitting from

strategies to protect

against low rates:

EXPECTED FY'21

AVERAGE DEPOSIT

GROWTH²

Excess liquidity invested in 3-5 year duration

securities (primarily classified as HTM)

Z

...and substantial

off-balance sheet

client funds

$152B -$90-120M

Q1 AVERAGE OBS

CLIENT FUNDS

* Equivalent to 6-8 bp increase in client investment

fee margin based on Q1'21 average balance. Expect

client investment fee margin to increase by 1-2 bps for

each subsequent 25 bp increase in short-term rates

EXPECTED INCREASE IN

ANNUALIZED CLIENT

INVESTMENT FEES FOR

INITIAL 25 BP INCREASE

IN RATES*

Positioning securities portfolio to

create flexibility and mitigate OCI risk

from potential rising long-term rates:

Note: Average balances represent Q1'21 averages. All other figures as of March 31, 2021.

1. Equivalent to +15% NII sensitivity for the expected 12month impact of a +100 bp rate shock on net interest income.

Management's sensitivity analysis is based on a static balance sheet and is subject to assumptions; actual results may

differ. See Q1'21 Form 10-Q report for more information.

$3B $10B

TRANSFERRED

FROM AFS

TO HTM

FAIR VALUE

HEDGES (38% OF

AFS PORTFOLIO)

2. See page 17 for more information.

3. Unwound $5B swaps in Q1'20 resulting in $227M pretax fair value gains in OCI to be reclassified to loan interest income

over 5 years based on the timing of cash flows from hedged variablerate loans.

4. $216M mark-to-market value. 3.49% weighted average floor rate, 1.6year weighted average duration.

SHORTENING

AFS PORTFOLIO

DURATION TO

<2y (HEDGE-

ADJUSTED TARGET)

Q1 2021 Financial Highlights

14View entire presentation