Apollo Global Management Investor Presentation Deck

Risk Management is Embedded in Everything We Do

Managing Risk Such That Athene Can Grow Profitably Across Market Environments

Duration-Matched Portfolio with Quarterly Cash Flow Monitoring & Stress Testing

Robust risk management framework and procedures underpin

focus on protecting capital and aligning risks with stakeholder

expectations

Risk strategy, investment, credit, asset-liability management ("ALM")

and liquidity risk policies, amongst others, at the board and

management levels to ensure full duration and convexity matching

Stress testing plays a key role in defining risk appetite, with tests

performed on both sides of the balance sheet

CLICK HERE

TO VIEW ATHENE'S ASSET STRESS TEST ANALYSIS

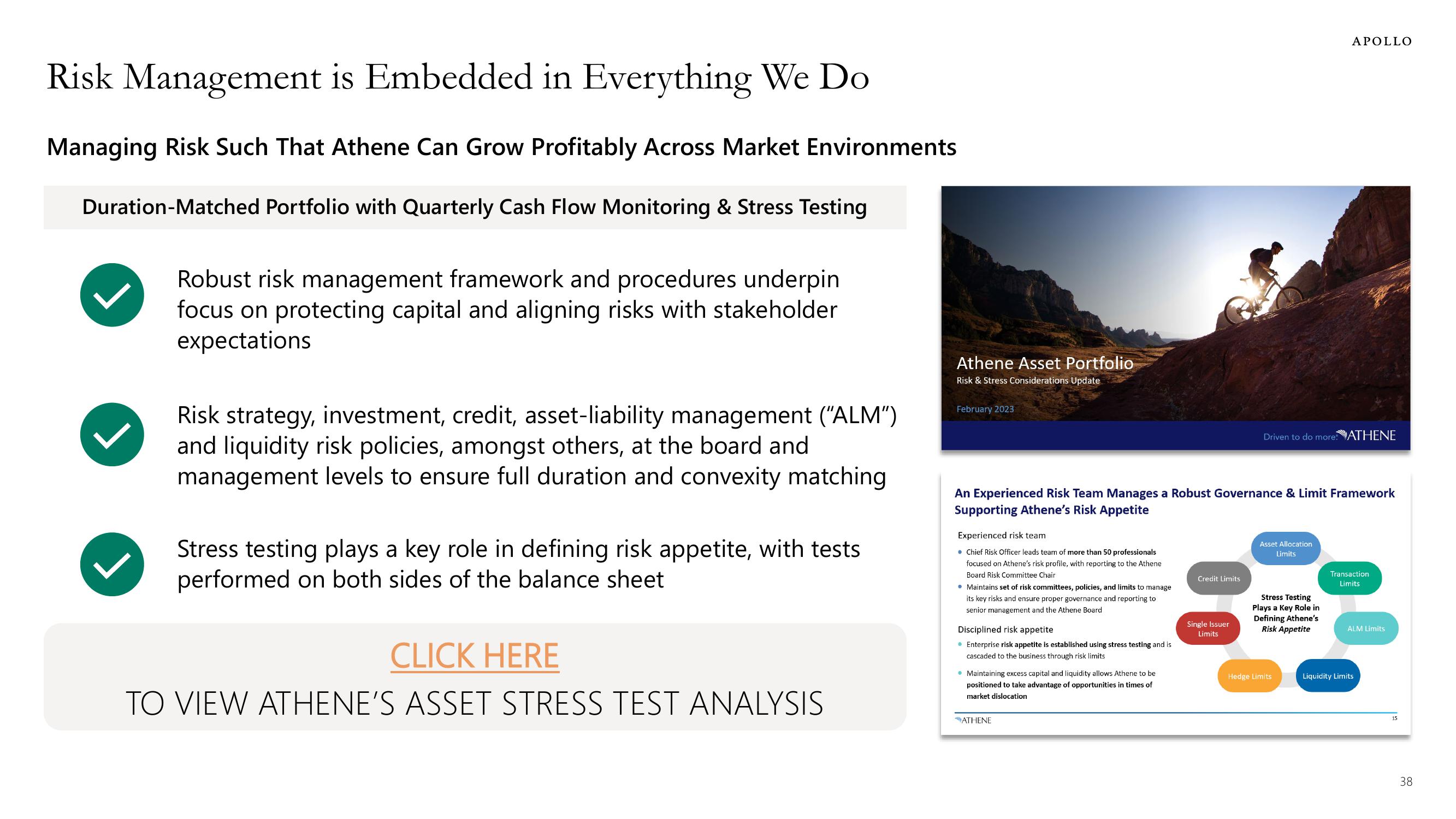

Athene Asset Portfolio

Risk & Stress Considerations Update

February 2023

Experienced risk team

• Chief Risk Officer leads team of more than 50 professionals

focused on Athene's risk profile, with reporting to the Athene

Board Risk Committee Chair

An Experienced Risk Team Manages a Robust Governance & Limit Framework

Supporting Athene's Risk Appetite

• Maintains set of risk committees, policies, and limits to manage

its key risks and ensure proper governance and reporting to

senior management and the Athene Board

Disciplined risk appetite

• Enterprise risk appetite is established using stress testing and is

cascaded to the business through risk limits

• Maintaining excess capital and liquidity allows Athene to be

positioned to take advantage of opportunities in times of

market dislocation

ATHENE

Credit Limits

Single Issuer

Limits

Driven to do more: ATHENE

Asset Allocation

Limits

APOLLO

Stress Testing

Plays a Key Role in

Defining Athene's

Risk Appetite

Hedge Limits

Transaction

Limits

ALM Limits

Liquidity Limits

15

38View entire presentation